PowerPointSlides-Ch015 - Management and Marketing

advertisement

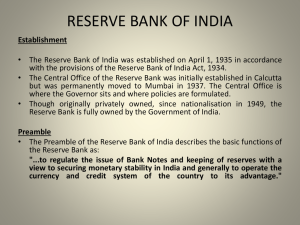

Part 6 Financing the Enterprise © 2015 McGraw-Hill Education. 15-2 CHAPTER 14 Accounting and Financial Statements CHAPTER 15 Money and the Financial System CHAPTER 16 Financial Management and Securities Markets 15-3 Learning Objectives LO 15-1 Define money, its functions, and its characteristics. LO 15-2 Describe various types of money. LO 15-3 Specify how the Federal Reserve Board manages the money supply and regulates the American banking system. LO 15-4 Compare and contrast commercial banks, savings and loan associations, credit unions, and mutual savings banks. LO 15-5 Distinguish among nonbanking institutions such as insurance companies, pension funds, mutual funds, and finance companies. LO 15-6 Investigate the challenges ahead for the banking industry. 15-4 Money in the Financial System Finance • The study of money; how it’s made, how it’s lost, and how it’s managed Money (Currency) • Anything generally accepted in exchange for goods and services Fiat money is a paper money not readily convertible to a precious metal such as gold Gained full acceptance during the Great Depression in the 1930s In the U.S., paper money is really a government “note” or promise, worth the value specified on the note 15-5 Functions of Money • Medium of exchange Before fiat money, the trade of goods and services was accomplished through bartering • Trading one good or service for another of similar value • Inefficient because not always divisible and can be complicated in multipleparty transactions 15-6 Functions of Money Measure of Value • Money serves as a common standard or yardstick of the value of goods and services Store of Value • Money serves as a way to accumulate wealth (buying power) until it is needed • The value of stored money is directly dependent on the health of the economy 15-7 Characteristics of Money To be used as a medium of exchange, money must have: • Acceptability • Divisibility • Portability • Stability • Durability • Difficult to counterfeit 15-8 • The U.S. government redesigns currency in order to stay ahead of counterfeiters and protect the public • DID YOU KNOW? Around 75 percent of counterfeit currency is found and destroyed before it ever reaches the public 15-9 Costs to Produce Pennies and Nickels 15-10 Types of Money Paper Money and Coins Checking Account (Demand Deposit) • Money stored in an account at a bank or other institution that can be withdrawn without advance notice Savings Accounts (Time Deposits) • Accounts with funds that usually cannot be withdrawn without advance notice 15-11 A Check 15-12 Types of Money Money Market Accounts • Accounts that offer higher interest rates than standard bank rates but with greater restrictions Certificates of Deposit (CDs) • Savings accounts that guarantee a depositor a set interest rate over a specified interval as long as the funds are not withdrawn before the end of the period—six months or one year for example 15-13 Types of Money Credit Cards • Means of access to preapproved lines of credit granted by a bank or finance company Popular substitute for cash payments because of their convenience, easy access to credit, and acceptance by merchants around the world Credit CARD (Card Accountability Responsibility and Disclosure) Act was passed into law in 2009 To regulate the practices of credit card companies that were coming under attack by consumers Important to all companies and cardholders 15-14 Types of Money Debit Card • A card that looks like a credit card but works like a check • Using it results in a direct, immediate, electronic payment from the cardholder’s checking account to a merchant or third party Traveler’s Checks, Money Orders, and Cashier’s Checks • Common forms of “near” money • Guaranteed as cash 15-15 The American Financial System Federal Reserve Board (The Fed) • Guardian of the American financial system • Independent agency of the federal government • Established in 1913 to regulate the nation’s banking and financial industry 15-16 The Federal Reserve System • Controls the money supply with monetary policy • Regulates financial institutions Four • Manages regional and national Major check-clearing procedures Function • Supervises the federal deposit s insurance of commercial banks in the Federal Reserve system 15-17 Monetary Policy • The means by which the Fed controls the amount of money Monetary available in the economy Policy • Aims to keep supply and demand in balance to avoid inflation/deflation 15-18 Mobile Money Transfer (M-PESA) In developing economies, the financial infrastructure is not well supported. Many people in these areas have had to travel many hours by foot or train to retrieve their money for everyday purchases such as food. M-PESA was created to alleviate this problem. It uses mobile phones, which have become widespread in developing economies, to make money transfers. All that is required of the user is their national ID or passport information, and they can send or receive money within a matter of minutes. 15-19 Fed Tools for Regulating the Money Supply 15-20 Federal Reserve • One of the roles of the Federal Reserve is to use its policies to keep money flowing • Money is the lifeblood of the economy • If banks become too protective of their funds and stop lending money, the economy can grind to a halt 15-21 Four Main Monetary Policy Tools 1. Open Market Operations • Decisions to buy or sell U.S. Treasury bill in the open market • Buying securities increases money in supply and vice versa 2. Reserve Requirements • Percentage of deposits a bank must hold in reserve • Has a strong effect on the economy and not used often 3. Discount Rates • Rate of interest the Fed charges to loan money to banking institutions • Lowering discount rate encourages borrowing and expands money supply and vice versa 4. Credit Controls • Authority to establish and enforce credit rules 15-22 Other Regulatory Functions of the Fed Regulating Member Banks • Establishes and enforces banking rules that affect monetary policy and competition • Has authority to approve bank mergers Check Clearing • National check processing through check clearinghouses Depository Insurance • Supervises the federal insurance funds that protect the deposits in member banking institutions 15-23 Banking Institutions Commercial Banks • Largest and oldest of all financial institutions, relying mainly on checking and savings accounts • Loan to businesses and individuals Savings and Loan Associations (S&Ls—also called “thrifts”) • Primarily offer savings accounts and make long-term loans for residential mortgages • Most have merged with commercial banks 15-24 Banking Institutions New hybrid bank institutions perform multiple functions Credit Unions • Financial institutions owned and controlled by depositors • Usually having a common employer, profession, trade group, or religion Mutual Savings Banks • Similar to S&Ls, but owned by depositors • Found mostly in New England 15-25 Insurance for Banks Federal Deposit Insurance Corporation (FDIC) • Insures personal accounts up to $250,000 National Credit Union Association (NCUA) • Regulates and charters credit unions • Insures deposits through its National Credit Union Insurance Fund • Similar to the FDIC 15-26 Bank Failures • More than 380 banks have failed between 2009 - 2011 Bank Failures • Consumers’ money protected by FDIC 15-27 JPMorgan Chase is the second largest commercial bank in the United States behind Bank of America 15-28 Is the World Bank Serious about Sustainability? • • • • • The World Bank raises money through donations, bond sales, and shareholder support The money is used to provide loans and other financial assistance to developing countries Realizing that funding certain projects could negatively affect the environment the World Bank adopted policies to assess the sustainability of proposed projects The World Bank must juggle both the human and environmental impacts when determining which projects to fund The World Bank has taken steps to curb climate change and support renewable energy 15-29 Nonbanking Institutions Diversified Firms • Traditionally non-financial firms that have expanded into the financial field Insurance Companies • Businesses that protect their clients against losses from specified risks Pension Funds • Managed investment pools to provide retirement income for members 15-30 Nonbanking Institutions Mutual Fund • Investment company that pools investor money and invests in large numbers of diversified securities Brokerage Firm • Buy and sell securities for clients and provide other services Investment Bank • Underwrites new issues of securities for corporations, states and municipalities needed to raise money in capital markets Finance Companies • Businesses that offer short-term loans at substantially higher interest rates than banks 15-31 Hedge Funds Hedge funds are large pools of money that are managed and used to invest in activities that promise a high return on investment High minimum initial investment requirement Only the wealthy are able to be involved Similar to mutual funds except hedge fund investments can be high risk Increases the chances of a higher return on investment Main point of contributing to a hedge fund 15-32 State Farm Insurance allows users to input their information on its website to receive an auto insurance quote quickly and conveniently 15-33 Electronic Banking Electronic Funds Transfer (EFT) • Any movement of funds by means of an electronic terminal, telephone, computer, or magnetic tape Automated Teller Machines (ATM) • The most familiar form of electronic banking, which dispenses cash, accepts deposits, and allows balance inquiries and cash transfers from one account to another 15-34 Electronic Banking Automated Clearinghouses (ACHs) • A system that permits payments such as deposits or withdrawals to be made to and from a bank account by magnetic computer tape Online Banking • Bank at home or anywhere/anytime • 62% of adults list Internet banking as their preferred banking method 15-35 Cost of Borrowing Poses a Threat to Brazilian Consumers The Brazilian economy has been booming in recent years, creating a growing middle class and consumers are spending and using credit like never before The central bank of Brazil has increased interest rates Credit cards have an annual interest rate of 238% on average, whereas the cost of borrowing for personal loans is 85% for retailers and 47% for banks Higher interest rate tend to deter spending Inflation in Brazil has risen significantly, which in turn increases the cost of borrowing 15-36 • Computers and handheld devices have made online banking extremely convenient • However, hackers have stolen millions from banking customers by tricking them into visiting websites and downloading malicious software that gives the hackers access to their passwords 15-37 Future of Banking Advances in technology are challenging and changing the banking industry During 2007-2008, the financial markets collapsed under the weight of declining housing prices, subprime mortgages (mortgages with low-quality borrowers) and risky securities backed by these subprime mortgages Future of the structure of the banking system is in the hands of the U.S. Congress Dodd-Frank Wall Street Reform and Consumer Protection Act – Intent of the act is to eliminate the ability of banks to create this type of problem in the future 15-38 Mobile Money Transfer (M-PESA) In developing economies, the financial infrastructure is not well supported. Many people in these areas have had to travel many hours by foot or train to retrieve their money for everyday purchases such as food. M-PESA was created to alleviate this problem. It uses mobile phones, which have become widespread in developing economies, to make money transfers. All that is required of the user is their national ID or passport information, and they can send or receive money within a matter of minutes. 15-39 Discussion ? ? What are the six characteristics of money? Explain how the U.S. dollar has those six characteristics. Discuss the four economic goals the Federal Reserve must try to achieve with its monetary policy.