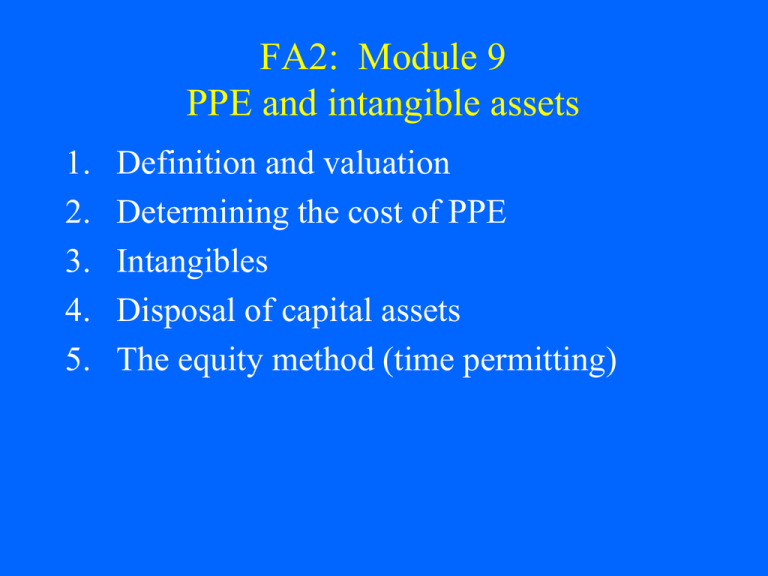

FA2: Module 9 Tangible and intangible capital assets

advertisement

FA2: Module 9 PPE and intangible assets 1. 2. 3. 4. 5. Definition and valuation Determining the cost of PPE Intangibles Disposal of capital assets The equity method (time permitting) 1. Definitions – Long-lived assets Property, plant and equipment (PPE) are tangible items, acquired for use in the revenue-producing activities of the enterprise and expected to be used for more than one period. Investment property: land/buildings held for rent or capital appreciation Biological assets: living plants and animals Intangible assets: legal/contractual rights Goodwill: unidentifiable asset 1. Valuation Cost model: Long-lived assets are valued at cost of acquisition, development, betterments, etc., less accumulated depreciation and accumulated impairment losses. Revaluation model: Asset is periodically revalued to its fair value and carried at revalued amount less accumulated depreciation and impairment. Fair value model: Asset revalued to fair value every year; no depreciation 2. Determining the cost of PPE Capital assets are measured at historical cost, the cash or cash equivalent price of obtaining the asset and bringing it to the location and condition necessary for its intended use. Costs included in historical cost include all costs reasonable and necessary to prepare the asset for its intended use. Historical cost is a reliable measure of the fair value of the asset at the date of acquisition. 2. Valuation at initial acquisition a. b. c. d. Basic examples Lump sum purchases Decommissioning cost obligations Subsequent expenditures a. Basic examples: Cost of land The cost of land includes: • The purchase cost of the land • Legal and registration fees associated with closing the transaction • Cost of preparing the land for intended use (landscaping, clearing, etc.) • Assumption of taxes in arrears or other encumbrances • Land improvements that have indefinite life a. Basics: Buildings and equipment The cost of buildings include all costs related to acquisition (as with land) or construction (direct materials, direct labour, overhead). This also includes interest costs incurred during construction. The cost of equipment includes purchase price (less any discounts), taxes, tariffs, freight charges, assembly and installation costs, costs of conducting trial runs. Example: Slavin Company Machine 101 was purchased and put into operation on July 31. The following items and expenditures were noted: Invoice cost $19,000 Cash discount received (2%) 380 Transportation charges 570 Operator wages (August) 975 Installation/testing costs 950 Insurance premium (1 yr) 450 Damage from dropping 200 What was the cost of Machine 101? b. Lump sum purchases (basket purchases) When several assets are purchased for a single lump sum, the purchase cost must be allocated to the individual assets acquired. This is typically done on the basis of relative fair market value of each asset as at the date of acquisition. Accountants might use: •Appraisal (for insurance or other purposes) •Assessed valuation for property taxes Lump sum purchases: Example The firm purchases land and a building for $100,000. According to the city assessors, the land’s appraised value is $60,000, and the building’s appraised value is $20,000. The entry to record the acquisition is: c. Decommissioning obligations Definition: Legal or constructive (expectation by outsiders) obligation associated with the retirement of a tangible long-lived asset that the entity is required to settle. The PV of obligation (using pre-tax riskadjusted rate) is estimated, if it can be done with reasonable precision, and charged (debited) to cost of asset, with an offsetting credit to a liability account. Every year, interest (accretion) expense is computed on, and added to, the liability. DCO example Acme Incorporated has a management practice of dismantling its equipment at the end of their useful life and selling them for scrap. For new equipment purchased in 20x1 for a cost of $70,000, the anticipated net costs (cost less scrap revenue) are $10,000. The equipment has an estimated useful life of 20 years. The pre-tax risk-adjusted rate is 8%. Required: Prepare journal entries to record acquisition of equipment and adjusting entries at the end of 20x1 and 20x2. d. Subsequent costs These are costs incurred after acquisition for ordinary maintenance, major inspections, overhauls, . . . Maintenance and ordinary repair costs (costs incurred to keep asset in normal working order) are expensed as incurred. Subsequent costs should be capitalized if: 1. They enhance the service potential or useful life of the asset; and 2. The costs involved are material Subsequent costs to capitalize 1. Additions: extensions, expansions or enlargements. The cost can be added to carrying value of original asset, or can be treated as new component. 2. Replacement of major part (Betterment): derecognize replaced part (with any gain or loss on disposal) and capitalize cost of new part 3. Major inspection (major overhaul): Capitalized; any remaining costs related to previous inspections are derecognized Subsequent costs example 1. Regular machine maintenance was carried out for $22,000. 2. A major overhaul was carried out on some equipment at a cost of $65,000. A major overhaul is expected every five years. 3. The building roof was replaced at a cost of $25,000. The old roof had a cost of $18,000 and was two-thirds depreciated. 4. A new wing was added to the building at a cost of $175,000. 3. Intangible assets Intangible assets are characterized by a lack of physical substance. Their value typically derives from some form of legal or contractual right they confer upon the holder. For many firms, their most important intangibles are not reported on the balance sheet. Intangible capital assets Internally developed Identifiable Development costs, patents,etc. Sometimes capitalized Externally acquired Patents, trademarks, copyrights, licenses, franchises Capitalized Purchased goodwill NonInternally identifiable developed goodwill Capitalized Never capitalized Internally developed intangibles Can capitalized as long as: 1. The asset in question is identifiable, i. e., asset is separable from entity or asset derives from some contractual or legal rights; 2. Asset recognition criteria are met: 1. Entity has control 2. Future economic benefits 3. Cost is reliably measurable Research and development Research is original and planned investigations undertaken in the hope of gaining new scientific or technical knowledge. Research is expensed as incurred. Development is application of research findings or other knowledge to design or plan for production of new or improved products, done before commercial production begins. Development costs can be capitalized if certain criteria are met. Development capitalization criteria 1. Asset proven to be technologically feasible 2. Management intends to complete and market or use asset 3. Entity is able to use asset 4. Probable future economic benefits clearly established 5. Adequate resources to complete project 6. Costs can be reliably measured A9-16 Amortization of intangibles Intangible assets are amortized over their useful lives. Generally, they are amortized on a straight-line basis, although other amortization methods could be used. If useful life is considered to be indefinite, there is no amortization. Indefinite life intangibles need to tested periodically for impairment. Goodwill Goodwill is the difference between the market value of the entity as a going concern and the sum of the fair values of the entity’s identifiable net assets (assets – liabilities). Goodwill arises from such things as: -effective advertising -employee training -entity’s reputation in the marketplace -strategic location, etc. Calculating Goodwill Goodwill is recorded only when an entire business is purchased, and is recorded as the excess of the cost of the business over the fair value of net assets acquired. 1. Establish cost of acquisition of entity: cash payment plus other consideration 2. Establish fair value of all identifiable assets and liabilities. Fair value of net assets acquired is fair value of assets less fair value of liabilities. 3. Goodwill = 1 – 2 Accounting for goodwill Internally generated goodwill is not capitalized because it is impossible to identify and measure with any reliability. Goodwill is not amortized, but is subject to impairment tests. Example: A9-26 5. Disposal of PPE Two principal steps: 1. Record depreciation or amortization expense up to date of disposal of asset, if applicable. 2. Remove historical cost of asset and its associated depreciation. Record cash received. Gain or loss is difference between cash received and book value of asset at date of disposal. Example: A9-22 4. Equity method (mod. 8, time permitting) a. Equity method basics Basics: Investor records its proportionate share of investee income as its own income (debit to investment account), and reduces the investment account by its share of investee dividends received. e. g., Big buys 25% of voting shares of Small for $100 on January 1. At year end, Small reports net income of $40 and declares and pays a cash dividend of $20. 4.b. Acquisition cost greater than book value The purchase discrepancy is the difference between the cost of investment acquired and the book value of investor share of investee net assets on acquisition date. This difference arises from under- or overstated assets and/or liabilities on the investee balance sheet; or unrecorded goodwill. The investor must attribute the purchase discrepancy to depreciable assets (and then amortize it), non-depreciable identifiable assets/liabilities, or goodwill. Example: A11-23 4.c. Investee discontinued operations Investor company must record separately its share of investee income attributable to discontinued operations. If these items are material from the investor’s point of view, they must be presented separately on investor’s income statement. In practice, this is rare. 4.d. Intercompany transactions Principle: An economic entity cannot earn a profit by selling to itself. From an economic point of view, affiliated companies are (at least partly) a single entity. Investor company cannot earn a profit simply by transferring assets to or from investee. Profits are earned only by selling to an external party. Intercompany sales cause no problems as long as the asset in question is ultimately sold to an external party. Adjustments must be made if a “profitable” intercompany sale occurs and the asset remains “inside” the investor-investee entity.