RBC Wealth Management Services

Estate Planning for Individuals

with Disability

Halifax Estate Planning Council

September 29, 2014

Sharon Avery

*http://disability.novascotia.ca/sites/default/files/StatisticalReport_2010.pdf

Disability Statistics*

In 2006, an estimated 4.4 million Canadians living in households reported

having a disability, an increase of over 3/4 of a million in five years.

In 2001, 12.4 percent of the Canadian population reported a disability, by

2006 this rate had increased to 14.3 percent.

Disability rate in Nova Scotia increased from 17.1 percent to 20 percent.

There were 179,100 individuals in the province who reported some form of

disability.

Provinces in the East had, on average, higher disability rates than those in

the West.

*http://disability.novascotia.ca/sites/default/files/StatisticalReport_2010.pdf

Financial & Estate Planning for Disabled Individuals

There is no universal definition of disability. Each government department or

agency (federal, provincial, territorial, and municipal) has its own definition,

based on applicable legislation and the purpose of a given program.

Caring for an individual with disability and planning for their financial support

can be a significant responsibility. There are financial and estate planning

options available:

•Disability Tax Credit

•Child Disability Benefit

•Henson Trusts

•RDSP

•Lifetime Benefits Trust

•Qualified Trust Annuity

Disability Tax Credit

The disability tax credit (DTC) is a non-refundable tax credit used to reduce

income tax payable on the income tax and benefit return. A person with a

severe and prolonged impairment in physical or mental functions may claim

the disability amount once they are eligible for the DTC.

The purpose of the DTC is to provide for greater tax equity by allowing some

relief for disability costs, since these are unavoidable additional expenses

that other taxpayers don’t have to face. Being eligible for the DTC can open

the door to other federal, provincial, or territorial programs such as the

registered disability savings plan, the working income tax benefit, and the

child disability benefit.

Disability Tax Credit

For income tax purposes, an individual is

considered disabled if they are eligible for

the Disability Tax Credit (DTC).

A physician must certify that the individual

suffers from a severe and prolonged

mental or physical impairment that

markedly restricts his or her basic activity

of daily living (almost) all of the time.

The impairment must have lasted (or is

reasonably expected to last) for at least 12

consecutive months – prolonged disability.

Maximum Disability Tax Credit Amount for

2013 is $7,697

The Disability Tax Credit and Promoters

The Disability Tax Credit Promoters Restrictions Act received Royal Assent on

May 29, 2014. The Act limits fees that can be charged for helping to

complete a disability tax credit request, and ensure that more money stays

in the pockets of persons with disabilities and their caregivers who need it

most.

The Canada Revenue Agency will hold public consultations in the coming

months. You can request to be informed when the consultations will be

scheduled.

http://www.parl.gc.ca/LEGISinfo/BillDetails.aspx?Mode=1&billId=5814389&Language=E

Child Disability Benefit

The Child Disability Benefit (CDB) is a tax-free benefit for families who care

for a child under age 18 who is eligible for the disability amount.

A child is eligible for the disability amount when a qualified practitioner

certifies, on Form T2201, Disability Tax Credit Certificate, that the child has a

severe and prolonged impairment in physical or mental functions, and the

Canada Revenue Agency (CRA) approves the form.

The Child Disability Benefit (CDB) is a tax-free benefit of up to $2,650 per

year ($220.83 per month) for families who care for a child under age 18 with

a severe and prolonged impairment in physical or mental functions.

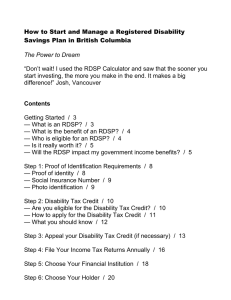

Registered Disability Savings Plan

A registered disability savings plan (RDSP) is a savings plan

that is intended to help parents and others save for the

long term financial security of a person who is eligible for

the disability tax credit.

Incentives to save for disabled individuals

Canada Disability Savings Grant (based on family income

and matching or surpassing contributions up to certain

amounts – max grant is $70k)

Canada Disability Savings Bond

(grant for low income individuals

maximum is 20K)

RDSP

Contributions to an RDSP are not tax deductible and can be made until the

end of the year in which the beneficiary turns 59.

Contributions that are withdrawn are not included in income for the

beneficiary when they are paid out of an RDSP.

However,

•

•

•

•

the Canada disability savings grant,

the Canada disability savings bond,

investment income earned in the plan, and

rollover amounts

are included in the beneficiary's income for tax purposes when they are paid

out of the RDSP.

•

Who can become a beneficiary of an RDSP?

You can designate an individual as beneficiary of an RDSP if the individual:

•

•

•

•

is eligible for the disability tax credit (DTC);

has a valid social insurance number (SIN);

is a resident in Canada when the plan is entered into; and

is under the age of 60 (a plan can be opened for an individual until the end of

the year in which they turn 59). The age limit does not apply when a

beneficiary's RDSP is opened as a result of a transfer from the beneficiary's

former RDSP.

A beneficiary can only have one RDSP at any given time, although this RDSP

can have several plan holders throughout its existence, and it can have more

than one plan holder at any given time.

RDSP – Some important facts

So Only one RDSP per individual

Must qualify for DTC

the overall lifetime limit for a particular

beneficiary is $200,000 (all contributions

and rollover transfers that have

previously been made to any RDSP will

reduce this amount).

There is no annual limit on amounts that

can be contributed to an RDSP of a

particular beneficiary in a given year.

However, Contributions are permitted

until the end of the year in which the

beneficiary turns 59.

To open an RDSP, a person who qualifies to be a holder of the plan must

contact a participating financial institution that offers RDSPs.

These financial institutions are known as issuers.

.

Who can open an RDSP

Under 19 (age of majority)

– a parent of the beneficiary;

– a guardian, tutor, or curator of the beneficiary, or another legally authorized to act; or

– a public department, agency, or institution legally authorized to act for the beneficiary.

Over age of majority & legally able to enter into a contract

– RDSP can be established for such a beneficiary by the beneficiary.

– If a legal parent is, at the time the plan is established, a holder of a pre–existing RDSP for the

adult beneficiary, the legal parent may become the sole holder of the plan or a joint holder

of the plan with the beneficiary.

Over the age of majority but legal ability to enter into a contract in doubt

– a "qualifying family member" may open a plan under

– Only June 29, 2012 to December 31, 2016.

– These rules will not apply if an RDSP has already been opened

– A "qualifying family member" if after reasonable inquiry, it is the opinion of a financial

institution that offers RDSPs (RDSP issuer), that an adult individual’s ability to enter into a

contract is in doubt.

– A "qualifying family member" includes a spouse, common-law partner, or parent of an

individual

Two types of withdrawals: flexible payments (payments which can be

requested anytime for example a wheelchair) or lifetime disability

assistance (payments which are regularly scheduled payments based on a

formula – begin at age 60)

Deceased may rollover RRSP or RRIF to financially dependent infirm child or

grandchild to maximum contribution level on a tax deferred basis.

This option is discussed more later…..

Henson Trust

Is an absolute discretionary trust

Only amounts vesting are payments made to

disabled person

No right to income of capital in trust by disabled

person

Protects provincial benefits in provinces that allow

such trust

Trustees may withhold income and assets from

disabled beneficiary

May be testamentary or inter vivos

Not all provinces recognize Henson Trusts (such as

Alberta) – some only allow with maximum amounts

being held in the trust (such as New Brunswick)

Does not require that the disabled person qualifies

for DTC

No maximum contribution limit

Residual beneficiaries can be named

RRSP or RRIF Rollovers

Ordinary rules say tax on death for full market

value

Some limited exceptions (rollover or deferrals)

– Spouse

– Financially dependent child or grandchild

• If healthy children

– Roll to annuity fixed until 18 years of age

• If disabled physically or mentally

– Could rollover to RRSP or fixed term annuity

– But a problem – if mentally disabled problems

establishing or administering the RRSP or

annuity where the prime beneficiary (the

disabled person) lacked capacity to direct the

RRSP

Transferring RRSP/RRIF on a rollover to an RDSP

The maximum rollover amount into an RDSP is $200,000. All contributions and

rollover amounts made to any RDSP will reduce this amount. Grants will not be paid

into the RDSP on the money you rollover.

Since July 1, 2011 , for deaths occurring after March 3, 2010, the RDSP rules allow

for a rollover of a deceased individual's registered retirement savings plan (RRSP)

proceeds to the registered disability savings plan (RDSP) of the deceased

individual's financially dependent child or grandchild with an impairment in

physical or mental functions. A qualifying beneficiary is referred to as an eligible

individual. These rollover rules also apply to registered retirement income

fund(RRIF) proceeds, to certain lump-sum amounts paid from registered pension

plans (RPPs), to the specified pension plans (SPP), or to pooled registered pension

plans (PRPPs).

As of June 28, 2012, upon the death of an annuitant of a pooled registered pension

plan (PRPP), the amounts from a PRPP can be transferred into an RDSP of an infirm

dependent child/grandchild or an infirm dependent child/grandchild who has

attained the age of majority but is not considered contractually competent to enter

into a disability savings plan. The amount of the transfer is not reported as income

nor deducted by either the annuitant or the beneficiary.

RRSP or RRIF Rollovers for Mentally Disabled Dependent

Financially dependent child or grandchild

• If Mentally disabled and unable to administer RRSP on rollover

– 60.011 ITA

– Lifetime Benefit Trust (effective June 2013 retroactive to 1989)

» Personal trust where mentally disabled spouse or dependent child or

grandchild is the sole beneficiary of any income or capital of the trust.

» Trustees may pay income or capital to the beneficiary but are not required to

pay out all the income of the LBT to the beneficiary

» Trustees are required to consider the needs of the beneficiary including

comfort, care and maintenance.

RRSP or RRIF Rollovers for Mentally Disabled Dependent

Financially dependent children

– Qualifying Trust Annuity – must be purchased by the

LBT with the RRSP/RRIF proceeds coming from the

deceased parent or spouse (to benefit the disabled

spouse or child)

– Must be for the life of the taxpayer (disabled person)

with or without a guaranteed person or for a fixed

term equal to 90 years minus the age of the taxpayer

– If death occurs during the fixed term or guaranteed

period amounts otherwise payable after the death of

the taxpayer must be commuted to a single payment.

– Any amounts paid out of QTA to the beneficiary of

the LBT will be fully taxed to the beneficiary

56(1)(d.2) and 75.2

RRSP or RRIF Rollovers

Financially dependent children

– Tax at death of beneficiary is at FMV of

annuity at time of death and is fully taxable to

the beneficiary in the year of his or her death.

– Any amount remaining of the QTA after death

of beneficiary (and taxes paid) is available to

other beneficiaries named in LBT

– In regular RRSP rollover to physically or

mentally disabled person potential that no

ability to bequeath the remaining proceeds on

death of the disabled person if individual does

not have capacity to give Will instructions

(thus resulting in devolution based on

intestate succession rules).

Example

My son Ricky…

• Has Spina Bifida & Hydrocephalus

• Physically and mentally disabled

• Mentally capable in certain areas

• Neuropsychology test says his

developmental age is 8 in some areas

• Not able to manage money

• Could be victimized

• Works fulltime as a Walmart greeter

• Diehard country music fan

• Is absolutely magnificent

Example

My son Ricky…

• Qualifies for DTC

• Plan calls for RDSP, Henson & LBT

• Rollover as much as possible to RDSP –

why? May look at more than “comfort,

care and maintenance” also perhaps

education, travel, housing (may

collapse if his health changes)

• Still possible to rollover RRSPs to an

RRSP for Ricky (previous LBT option)

and Ricky MAY be able to give

directions to administer the RRSP fund

in his name but maybe not….so….

• Rollover to LBT and QTA

The strategies, advice and technical content in this presentation are provided for the general guidance and benefit of the presentation

participants, based on information that we believe to be accurate, but we cannot guarantee its accuracy or completeness. This presentation is

not intended as nor does it constitute legal or tax advice. Participants should consult their own lawyer, accountant or other professional

advisor when planning to implement a strategy. This will ensure that the particular client circumstances have been considered properly and

that action is taken on the latest available information.

This presentation has been prepared for use by Royal Bank of Canada, RBC Dominion Securities*, RBC Phillips, Hager & North Investment

Counsel Inc. and RBC Global Asset Management Inc. Royal Bank of Canada, RBC Phillips, Hager & North Investment Counsel Inc., RBC

Global Asset Management Inc., Royal Mutual Funds Inc., and RBC Dominion Securities Inc. are separate corporate entities that are affiliated.

RBC Phillips, Hager & North Investment Counsel Inc., RBC Global Asset Management Inc., RBC Dominion Securities Inc., and the Private

Banking division of Royal Bank of Canada are member companies under RBC Wealth Management. *Member – Canadian Investor Protection

Fund. ®Registered trademark of Royal Bank of Canada. RBC Wealth Management is a registered trademark of Royal Bank of Canada, a

business segment of Royal Bank of Canada. Used under licence. ©2014 Royal Bank of Canada. All rights reserved.