The Hidden Cost of Being African American

advertisement

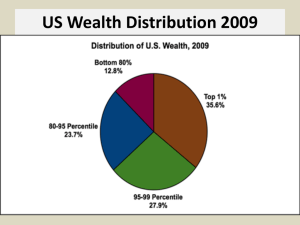

The Hidden Cost of Being African American The Hidden Cost of Being African American by: Thomas M. Shapiro Examining racial inequality as expressed through wealth Amy Shier Andrew Fitts Jessika Allen Methodology • 2 types of data – Quantitative – Qualitative • 3 Cities – Boston – Los Angeles – St. Louis • 180 families interviewed – ½ from the suburbs and ½ from the city – ¾ middle class and ¼ working class and poor Chain of wealth reinforcement Wealth Location Education Wealth • Wealth - the total value of things families own minus their debts. • Wealth is an integral part of racial inequality due to the benefits of having them and consequences of not having them. • Wealth represents the inequality of the past and predicts the inequalities of the future. • Wealth discloses the consequences of the racial patterning of opportunities. The Importance of Income • Income – earnings from work, interest and dividends, pensions, and transfer payments. • The difference of income and wealth are insurmountable. Wealth refers to ownership and control resources and income refers to salary or its replacement. • Income is seen as a tool to support basic life. • Income is a indicator of the current status of racial inequality. Asset Poverty Line Poverty- lacking adequate income and the basic capacities for building and sustaining a better life. The APL determines the asset conditions of American families. The asset poverty rate for a black families is double that of white ones. Baseline Racial Wealth Gap • Net worth – all assets minus all debts, specifically home equity. A family’s total asset balance, indicating all of its financial resources. • Net financial assets – assets that are immediately available, excluding cars and home equity. • Black families only posses 10 cents to every white families dollar in wealth. • The gap between white and black families grew by $16,000 between 1988-1999. Baseline Racial Wealth Gap cont. • To analyze this racial wealth gap we must – 1. indentify the most important factors in the creation of it – 2. explore how much of the wealth gap is made out of a combination of them – 3. assess the contribution of merit and nonmerit factors in the creation of it. Baseline Racial Wealth Gap cont. • Inheritance and having one full time job is the most significant predictors of differences in net worth. • Income is the most important factor in net financial assets, and is the most important variable in determining net worth. • Blacks only accrue $1.98 in wealth for each additional dollar earned while whites accrue $3.25. The Middle Class • Income: between $17,000 and $79,000 • Job ranking: professionals, technical workers, administrators, managers, supervisors, clerical workers, and sales workers. • Education: at least one adult with a bachelor’s degree Middle Class in Black and White • Conways • • Income: $70,000 Suzanne (45) – operations supervisor at a capital management company Frank (38) – worked at a communications-marketing firm but was laid off, now going to school Children: 1 daughter in private school House: Frank’s mom gave $10,000 for the down payment. Debt: none because their parents paid for school Inheritance: $95,000 and expect to get more Retirement: $53,000 Additional assets: worth $125,000 Neighborhood: mostly black • • • • • • • • Barzaks Income: $84,000 Richard (41) – consultant with his own telecommunications and real estate business Kim – screen writer Children: 2 children in private school House: paid for their down payment with Richard’s 401k, because they had no other assets or ways to pay. Debt: both have students loans = $30,000 Neighborhood: predominantly black Financial Help • • • • • • • Assistance from family. Whites parents help their children financially more than black parents. Blacks financially assist their friends and family, all around, more than whites. A little over half (54%) of whites paid the down payment from their own savings, the other 46% received help outside themselves. 9 out of 10 blacks down payment was from their own savings. Black parents help their children in other ways. Prospects of houses are different. Inheritance • Net worth is the most important factor in determining the prospects of the capacity of parents to assist their adult children. • Transformative assets – resources that have the potential to advance a family economically and socially beyond the means provided to them by their salaries. • Head-start assets – assets given to adult children to help improve their class standing. • Inheritance – wealth given between living people, typically from parent to adult child. – Types of inheritances – financial, cultural, social, and human capitol. The Black and White Inheritance Gap • Median inheritance figures showed that while a white families inheritance amounts to approximately $10,000 a black families average inheritance is $798. • Blacks inherit 8 cents to every white inherited dollar. • Typically, whites receive inheritances that are at least three times larger than blacks. • Inheritances are actually reversing gains earned through the decreasing income gap. Possessive Advantage • Whites may see black disadvantage, but they often do no see their advantage. • Stereotyping • Seeing the poverty of African-Americans as their own fault. • Choosing to see black’s status and problems as a value judgment on them and not a disadvantage placed upon them Homeownership • • • • • • • The percentage of blacks to whites who own homes is 25% less. “Racial redlining” is a factor in the amount of blacks who own homes. Mortgage companies often do not go out of their way to get mortgages and in fact sometimes discourage, deny, and avoid lending altogether to minorities. Three stages in the process that work to the disadvantage of blacks. ~ Access to credit ~ Price of credit or interest rates on loans ~ Inequality in the increase of housing values Homeownership: Access to Credit • Racial discrimination still persists – Counterparts but not equal • The Federal Reserve Board Study showed blacks were denied loans 80% more than whites who were the same in their applications. – Banks self-conscious – Predatory lending Homeownership: Price of Credit or interest rates on loans • Middle class whites generally have good income and wealth in terms of assets, while most blacks have only income to fall back on. – African-Americans often must pay a slightly higher interest rate than whites because they do not have as many assets. • Among all families whose assets are not enough to make the down payment, whites own houses 59% more than minorities. Inequality in the increase of housing. • • • • • The value of a house owned by an average white family increases $28,605 more than a house owned by a black family. “…homes lose at least 16% of their value when located in neighborhoods that are more than 10% black.” “A 2001 Brookings study reported that home values for black homeowners were 18% less than values for white homeowners.” Increased segregation = higher discrepancy between white and black values of homes. In essence, segregation is more profitable for whites and less for blacks. White Flight • Reasons given are not racial • Concerns racist and unfounded even when seemingly legitimate the reasoning is selfcentered. • Believe and it will happen. • Fear of declining property value Moving Up or Falling Behind • Homeownership in wealthier communities also is the way families gain access to important civic services like public schools. Example Harvard, Massachusetts’s, public schools had the best test scores in the state in 2000. To go to Harvard’s public schools on must be a resident and a homeowner. The typical home price in 1999 was $377,000. To qualify for a home loan to get one of these houses a family must have an annual income of at least $120,000. Tax Breaks for the More Wealthy • • • • • Homeowners get five different tax breaks that renters do not. In the best known of these breaks, the IRS allows homeowners to deduct interest paid on mortgages. The higher the families tax bracket, the bigger the deduction. A solidly middle class family that falls into the 28% tax bracket would be able to deduct $3,236 on a $161,000 home with a 30 year mortgage at 6.5%. A upper class family that falls into the 39.6% tax rate would be able to deduct $4,576 on a $161,000 home with a 30 year mortgage at 6.5%. Bias in Picking Schools • The most important indicators in picking a school are according to the U.S. Department of Education: school leadership, school goals, professional community, discipline, academic environment, class size, teacher experience, and technology. • However, repeatedly when asked, parents identified school reputation as the most important factor in where they send their kids. Where People Choose to Live • 984 of 1000 whites stay in predominantly white areas or move to them each year. • Of the young whites that live in racially mixed areas in 1984, 59% remained in integrated areas 10 years later. However the other 41% all moved to predominantly white areas. • In contrast to this over ¾ of blacks living in racially mixed areas in 1984 remained in similar communities 10 years later. Education and Segregation • Segregation at schools was declining in the 80s, but do to rising residential segregation and lack of judicial interest it has risen again. • White students are by far the most segregated in schools dominated by their own group. Whites on average go to schools where 80% of the students are white. • In comparison blacks and Latinos attend schools where a little over half of the students are black or Latino. Inequalities Between Schools • Research has suggested that smaller class size in the first few years of primary education is critical for student achievement. • The best class size is in the range of 13 – 20 students. • In 1997 nearly 47% of elementary classes had 25 students or more. • The distribution of the higher class sizes is not equal. It has been shown that black, Hispanic and Asian children are enrolled in schools with larger class sizes then white children. Overall Lessons From The Hidden Cost of Being African American • Racial inequalities stem from a difference in assets. • Whites start out ahead due to inheritances • Racially segregated housing boosts whites’ home equity, while depressing blacks’. • Parents are willing to pay a premium to live in a “good” school district. However, few parents can judge schools objectively and instead use easily observable markers like the racial makeup and the relative affluence of the area. • Through this unconscious racism, blacks are forced to go to poor schools and racial inequalities become larger and larger. So what is the hidden cost of being African American? The typical white family’s net worth is $247,730 if you swap white functions for black ones that family’s net worth decreases to $111,556. So… the cost of being African American is $136,174 overall and in net financial assets it’s $94,426.