ARRA Overview - National Association for the Education of Young

advertisement

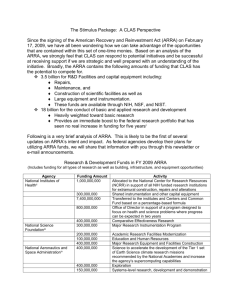

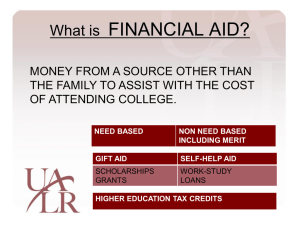

American Recovery & Reinvestment Act NAEYC Webinar March 2, 2009 Purpose President Obama statement February 14, 2009 It will save or create more than 3.5 million jobs over the next two years, ignite spending by business and consumers alike, and lay a new foundation for our lasting economic growth and prosperity. Timeline Enacted February 17, 2009 Governors have up to 45 days after date of enactment to “certify” that they will take the ARRA funds -- State Legislature may certify the state's intention to use any funds in ARRA not accepted for use by the Governor Unless otherwise specified, all funds appropriated under ARRA remain available for obligation until September 30, 2010 CCDBG $2 billion dollars – states have 2 years to spend the funds Discretionary funds = no state match required on these funds Goes through the normal CCDBG formula, including the minimum set aside of 4% for quality “shall be used to supplement, not supplant State general revenue” CCDBG Set Asides Above the statutory requirement that states use at least 4% of grant for quality, set asides of $255 million, of which $93.5 million for activities that improve the quality of infant/toddler care CCDBG While expected to serve many more children, opportunities with the quality funds and subsidy system improvements Quality set aside examples using quality dollars to support grants to programs to improve along the QRIS with grants expanding scholarships and compensation awards hire infant/toddler specialists to work with programs CCDBG Improve subsidy policy – a- year eligibility determination Lower family co-pay Lower eligibility threshold Job search as families become unemployed Education as families lose jobs and go back to school Once Head Start/Early Head Start Separates funding – both spend out over 2 years $1 billion for Head Start $1.1. billion for Early Head Start – up to 10% reserved for training and technical assistance and up to 3% reserved for monitoring COLA, set asides for quality, migrant and seasonal, tribal, early learning advisory councils come out of the $1 billion for Head Start Expansion funds left over from the $1 billion split between Head Start and Early Head Start Head Start/Early Head Start Application Expansion funds New Early Head Start Asking for time for start up of new Early Head Start to recruit teachers, etc. as in the first year of the authorized program Encouraging Head Start programs to serve 3 years old Title I $13 billion $3 billion for school improvement grants (state grants, SEA holds 5% and remainder goes to low performing school districts for improvement efforts) $10 billion to local school districts along a formula that is more heavily weighted for poverty: targeted assistance grants and education finance incentive grants Other Education Funds and Individual Aid State stabilization – restoration, incentive grants, innovation grants IDEA Part B IDEA Part C IDEA section 619 Title II Higher Education Act Part A Pell Grants, Work Study Higher education tax credit ARRA funds for Education and MOE Maintenance of effort provisions in underlying statutes – ESEA/NCLB and IDEA -- continue to apply to new funds. With prior approval from the Secretary of Education, a State Education Agency or local education agency that receives funds under the State Fiscal Stabilization Fund can treat any portion of such state fiscal stabilization funds that is used for elementary and secondary education or postsecondary education as non-Federal funds for the purpose of any requirement to maintain fiscal effort under any other program, including Part C of the Individuals with Disabilities in Education Act. For state fiscal stabilization funds, Governor shall ensure that the State will in each of fiscal years 2009, 2010, and 2011, maintain State support for elementary, secondary, and public postsecondary education at least at the levels in fiscal year 2006 Title I birth through K-12 US Dept of Ed guidance Can use for children below compulsory school age Can use with other funds for full day/full year programs District can directly provide 0-5 or contract with a Head Start, Even Start, Early Reading First, or “comparable public early childhood program” When using Title I for children below K, must follow the Head Start standards Teacher qualifications with Title I – Preschool teachers working in Title I preschool programs, in States that consider preschool as part of public elementary education, must meet the applicable Title I teacher qualification requirements Title I Teacher Qualifications According to 2004 guidance by US Dept of ED “Preschool teachers working in Title I preschool programs, in States that consider preschool as part of public elementary education, must meet the applicable Title I [NCLB] teacher qualification requirements “ http://www.ed.gov/policy/elsec/guid/preschoolguidance.doc -- pages 19-20 Title I and Professional Development Title I funds may be used to provide professional development for any teacher or paraprofessional working in a Title I preschool program supported partly by Title I funding even if their salary is not paid for with Title I funds if the training is related to the Title I program and is designed to meet the educational needs of Title I children. For example, Title I funds may be used for professional development for a Head Start teacher working in a preschool program jointly funded by Title I and Head Start if the training is related to the Title I program or is designed to help the Head Start teachers meet the educational needs of Title I children. Title I funds may also be used for joint professional development for non-Title I preschool teachers and paraprofessionals working in programs with no Title I funds, such as Head Start staff, and for Title I elementary school teachers and paraprofessionals. For example, Title I funds may be used for such joint professional development if the children served in the non-Title I preschool are likely to be attending a Title I school when they enter kindergarten, and if the purpose of the professional development is to improve coordination between the non-Title I preschool and the Title I school or to facilitate children’s transition from preschool into the Title I elementary school. IDEA Part C and 619 Additional $500 million for Part C Additional $400 million for 619 preschool Part C – new policy triggered by appropriation beyond $460 million Education Stabilization 3 parts in Title XIV of the ARRA Funds to states to restore cuts in state funds to K-12 and postsecondary education, “and as applicable, early childhood education programs and services” By governor application, Incentive Grants to improve school achievement By local school district or LEA/nonprofit partnership application, Innovation Funds to scale up effective models, public/private partnerships Education Stabilization – Assurances and Maintenance of Effort Governor shall ensure that the State will in each of fiscal years 2009, 2010, and 2011, maintain State support for elementary, secondary, and public postsecondary education at least at the levels in fiscal year 2006, and achieve equity in teacher distribution in low income school districts, establish a longitudinal data system that includes the elements described in the America COMPETES Act, enhance the quality of academic assessments relating to English language learners and students with disabilities, and improve State academic content standards and student academic achievement standards, and ensure compliance with corrective actions required for low-performing schools Restoration For K-12, determines how to spread those funds under its state aid formula For public higher education institutions to restore state support to the greater of fiscal year 2008 o4 2009 For early childhood, no formula suggested in the statute Remaining funds after restoring shortfall are distributed to local educational agencies according to Title I formula Incentive Grants Governor submits an application (50% of grant will go to local educational agencies based on their Title I share) that describes the State's progress in each of the following as well as achievement and graduation rates, and how the State will use the grant to continue making progress toward the state’s academic achievement standards achieve equity in teacher distribution in low income school districts, establish a longitudinal data system that includes the elements described in the America COMPETES Act, enhance the quality of academic assessments relating to English language learners and students with disabilities, and improve State academic content standards and student academic achievement standards, and ensure compliance with corrective actions required for low-performing schools Innovation Grants $650 million as “reward” for having made significant gains in closing achievement gap Uses of funds: expand and serve as model of best practice; work in partnership with private sector and philanthropic community; identify and document best practices to share and that can be taken to scale Eligible applicants: Local educational agency Partnership of a nonprofit organization and one or more local educational agencies or a consortium of schools US Dept of Education expects to release guidance the end of March Public Safety, Government Services, Education $8.7 billion in this grant fund that can be used on any activity authorized by ESEA/NCLB, IDEA and for school and higher education “modernization, renovation and repair” Higher Ed Title II PART A Teacher Quality Partnerships Pell Grants Work-Study Expansion of Hope tax credit now called American Opportunity tax credit for higher education Teacher Quality Partnerships Application from federal level to local partnership Required partners Baccalaureate teacher preparation institutions High need local school district Allowable partners: early childhood education program (child care, Head Start, state preK) See summary at www.naeyc.org/policy/federal/pdf/SummaryEcProvisionsHeoa.pd f New American Opportunity Credit New name for Hope tax credit for higher education $2500 a year for the first 4 years of college Covers tuition and fees, books, materials for coursework Credit is 100% of the first $2,000, then 25% of the next 2,000 Partially refundable: low income student who does not owe taxes can receive up to 40% of qualifying expenses which is a maximum of $1,000 This expansion applies to 2009 and 2010 – President’s budget requests making expansion permanent TANF $3 billion for Emergency Contingency Fund to states to serve increase in families due to economic downturn $319 million supplemental funds for states with high population growth and/or increased poverty Data Keeping track of Jobs/work created with the funds Quality uses and how to collect information on use and impact Children served and where (may be multiple settings) Coordination of funds under ARRA and other funds Continued unmet need of access, quality, workforce Transparency Rules Details at www.recovery.gov Federal agency websites will report grants, contracts, and how spent Federal recipients’ use of funds will be publicly reported What to do now Meet with state child care administrator on subsidy and quality funds Set up meetings with governors’ aides and legislature leadership regarding which funds governors will certify acceptance and what legislature will request Talk to you state superintendents and state school boards associations Talk to the State Title I director in the State Educational Agency Meet with local school districts receiving the Title I funds for discussions of use on preschool programs in schools and contracts with Head Start, high quality child care – summer extension, September expanded enrollment and hiring teachers and staff, joint professional development of communitybased and school based preschool, k and 1st grade teachers Meet with Governor on stabilization funds to discuss birth to age 8 restoration, innovation funds What to do now Talk to colleges of education that prepare early childhood educators about the Title II Partnership Grants to be partner applicants Get the word out to colleges, program directors, staff on the New American Opportunity tax credit for higher education Resources Chart of various funds under ARRA www.naeyc.org/policy/federal/pdf/FinalAgreementChart.pdf State by state allocations of CCDBG, including the allocation of the $255 million set aside, and other CCDBG recommendations under the ARRA http://childcareandearlyed.clasp.org/reinvestinginchildcare.html State allocations for Title I and IDEA Parts B, C and section 619 grants www.ed.gov/about/overview/budget/statetables/09arrastatetables.pdf Within-state allocations of Title I – www.ed.gov/about/overview/budget/titlei/fy09recovery/index.html State allocations for other programs in ARRA http://www.cbpp.org/1-2209bud.htm Using the ARRA for QRIS development and implementation www.buildinitiative.org/content/whats-new State ARRA websites www.recovery.gov/?q=content/state-recovery-page