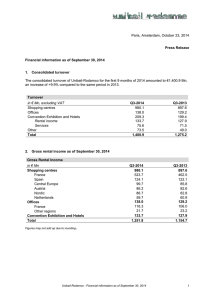

2014 Half-year results - Unibail

advertisement