Introduction to State Aid (PowerPoint 205 KB)

advertisement

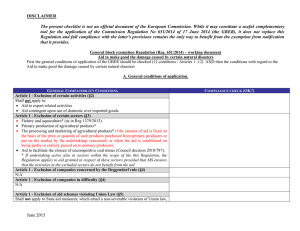

INTRODUCTION TO STATE AID Stephen Moore European Support Unit Objectives 1. Key State aid concepts and terms 2. How to undertake a State aid assessment 3. Outline options if State aid is present 4. Explain roles and responsibilities 5. Think State aid first What is State aid? Treaty on the Functioning of the European Union Article 107(1) “Save as otherwise provided in this Treaty, any aid granted by a Member State, or through State resources in any form whatsoever, which distorts, or threatens to distort competition, by favouring certain undertakings or production of certain goods, shall, in so far as it affects trade between Member States, be incompatible with the common market.” Obvious State aid • Grants • Loans below market rate of interest • Interest rate subsidies • Loan guarantees • Tax exemptions Less Obvious State aid • Sale of land below market prices • Subsidised rents • Investments on terms private sector would not replicate • Secondment of Civil Servants • Services provided by the State at a reduced or zero cost Structural Funds and State aid Northern Ireland EU Structural Funds – Guidance note 7 (http://www.eucompni.gov.uk/uploads/resource_guidance/guidance_note_7_-_state_aid.pdf) “Council Regulation (EC) 1083/2006 stipulates that projects must be fully compliant with State aid rules. It is therefore important that all projects are initially screened and regularly reviewed to ensure they comply with State aid rules.” Is the recipient an undertaking? • State aid is only present when it is provided to undertakings. • The Court of Justice has defined undertakings as entities that are engaged in an economic activity, regardless of their legal status and the way in which they are financed. Is the recipient an undertaking? • The status of an entity under national law is not material. • Entities do not have to be set up to generate profits. • The classification of an entity as an undertaking is always relative to a specific activity. Is State aid present? 1. Is there an intervention by the State or through State resources? 2. Does the intervention give the recipient an advantage on a selective basis? 3. Is competition distorted or potentially distorted? 4. Is there any potential to affect trade between Member States? Think State aid first If State aid is present – Next steps • Redesign scheme or project so State aid isn’t present • Would the aid scheme or project fit into one of the GBER exemptions? i.e. Try to avoid a full notification • Is the amount of State aid small enough that the de minimis regulation is an option? • If a full notification has to be submitted – don’t waste time • Seek advice from DETI or DSO or your legal advisors • Don’t ignore it What is the GBER? • GBER – General Block Exemption Regulation • GBER exempts State aid from the full notification procedure • GBER aid still has to be notified, but the process is straightforward and quick • The GBER is the main exemption regulation • 2013, 60% of NI State aid falls under the GBER • 2015, est. 80% of NI State aid will fall under the GBER What is the de minimis regulation? • Very small amounts of aid have only negligible effects on competition and trade between Member States. • EC has decided such very small amounts of aid to a single undertaking (below a specified cumulative ceiling) do not have to be notified for approval. • Current ‘industrial’ de minimis regulation - Commission Regulation (EC) No 1407/2013 of 18 December 2013 • Ceiling €200k, per single undertaking, over any period of 3 years What if I have to fully notify? • Start as soon as you can and don’t waste time. • SA.36290 – NI gas pipeline extension (DETI) pre-notified 6 March 2013, EC decision 10 July 2014 • SA.37342 – Regional Stadia - Windsor, Casement and Ravenhill (DCAL) pre-notified 5 September 2013, EC decision 9 April 2014 • SA 34140 – NI Renewable Heat Initiative (DETI) pre-notified 10 May 2012, EC decision 12 June 2012 Notification processes • Procedural Regulation • SANI – State Aid Notification Interactive • Pre-notification • Formal notification • Standstill • Commission decision • Simplified procedure (time extensions, budget increases) Roles and Responsibilities • DETI – Advice & awareness to NI Depts, NDPBs etc – Monitor & report on NI State aid to EC via DBIS • DSO – Advice to Depts • DBIS – Advice & awareness to UK Bodies – Check & sign up notifications • UKRep – Official point of contact with EC – Liaise with UK bodies • NI Public Sector Bodies – Assess & manage compliance risks – Prepare notification documentation – Maintain records State aid training • European Institute of Public Administration (Maastricht) – http://seminars.eipa.eu/ • Lexxion Training (Brussels) – http://www.lexxion.eu/training/state-aid • European Academy (Berlin) – http://www.euroacad.eu/events/range/state-aid.html Further Information DETI European Support Unit Stephen Moore Tel: 028 9052 9415 email: stephen.moore@detini.gov.uk