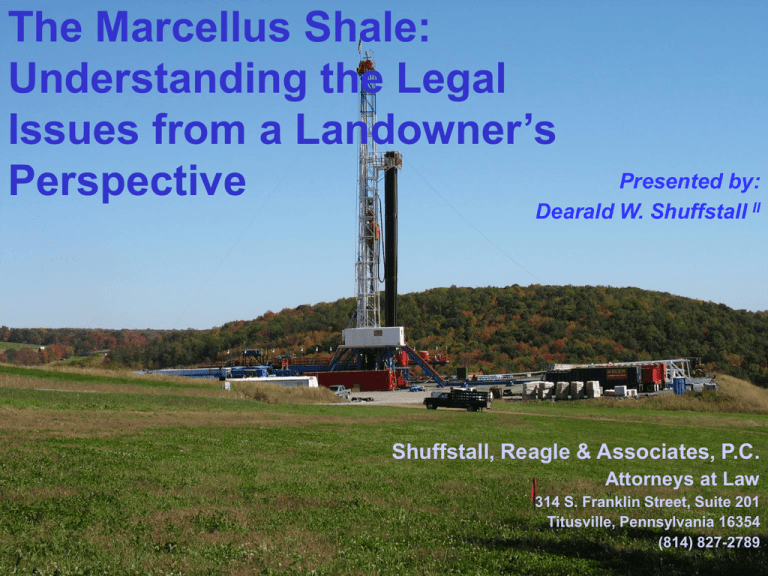

The Marcellus Shale:

Understanding the Legal

Issues from a Landowner’s

Perspective

Presented by:

Dearald W. Shuffstall II

Shuffstall, Reagle & Associates, P.C.

Attorneys at Law

314 S. Franklin Street, Suite 201

Titusville, Pennsylvania 16354

(814) 827-2789

What is the Marcellus?

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

The Marcellus Formations in PA

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

The Marcellus “Fairway”

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

It’s a GREAT Time to get Started in the

Marcellus!

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Pennsylvania Active Rig Count

Vertical Exploratory Stage Over—Horizontal Production Phase Now In Full Play

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Marcellus Shale Permits Issued & Wells

Drilled 1st quarter 2010

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Marcellus Shale Permits Issued & Wells

Drilled 2010 YTD through August

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Horizontal Development

The Marcellus “Pitchfork”

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Gas Leasing from a

Landowner’s Perspective

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Gas Leasing - How does it work?

• Typically, representatives from a gas producing company

will contact the owners of the OGM (Oil, Gas and Mineral)

rights in a location where the gas producer wishes to

explore and, hopefully, produce.

• The owner of the OGM rights may not be the owner of the

surface estate.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Gas Leasing - How does it work?

• The gas company representative may be an employee of the

gas company or, more commonly, a professional Landman.

Regardless, ask to see his or her credentials.

• In the case of a professional Landman, ask for proof of his

membership in the American Association of Professional

Landmen.

• In the unlikely case of a gas company employee, ask for

details about the company such as how many Marcellus wells

it has drilled, how many are currently in production, etc.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Gas Leasing - How does it work?

• If you are approached by someone other than a professional

Landman, exercise increased caution and scrutiny.

• Be extra cautious where the instrument presented is

something other than a true oil and gas lease. Watch for

words like “option,” “option agreement” and “marketing

agreement” in the title.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

“Option” or “Marketing” Agreements

• “Wal-Mart logic” – add your acreage to theirs to increase the

collective bargaining power…

• Peer pressure/fear of being excluded…

• The landowner authorizes the marketer to try to lease the

OGMs to undisclosed third parties in return for a percentage of

any up-front monies paid by the third party upon execution of a

lease.

• The landowner is assured minimum per-acre up-front monies

and minimum royalty percentages if a lease is successfully

executed, both of which are typically reasonable.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

“Option” or “Marketing” Agreements

• Many landowners are primarily interested in these two

economic provisions and sign them.

• HOWEVER – the “option” or “marketing” agreements typically

include a form lease attached as an exhibit. By executing the

option or marketing agreement the landowner forfeits any

ability to negotiate any other lease terms.

• These agreements may be useful to attract interest on the

part of a gas producer sooner, but be sure to exercise

heightened scrutiny and caution when presented with them.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Basic Lease Clauses - Economics

• Landowners are typically drawn first to the “economics” of the

proposed lease.

• Bonus: A one-time payment to induce a landowner to sign a

lease. Ranges greatly from a few hundred dollars per acre to

upwards of $6,500.00 per acre.

• Delay Rental: A payment made by a lessee to hold the lease

while deferring drilling. Typically expressed as a price per acre

per year in the primary term of the lease.

• Royalty: Recurring payments reflecting a share of production.

Statutory minimum is a 1/8 interest, or 12.5%. Higher royalties between 15% and 20% - have been negotiated.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Basic Lease Clauses –Economics

• Note: where drilling and production never occur on a

lease, the bonus and delay rental payments constitute the

bulk of the value the landowner will receive.

• HOWEVER, where production occurs, the royalty payment

income stream represents the lion’s share of the economic

value paid to the landowner.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Basic Lease Clauses – Term

Typically, an oil and gas lease has 2 terms:

1) a PRIMARY term for a stated number of years during

which the lessee has no duty to drill and for which

DELAY RENTAL is paid; and

2) A SECONDARY term that lasts from when production

is achieved “for so long thereafter as oil or gas or

either of them are produced in paying quantities.”

These terms are negotiable.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Basic Lease Clauses – Term

Gas leases extending the primary term take your property off the

market for longer periods of time, be sure to factor this in when

evaluating the adequacy of bonus payment and delay rental offers.

Trend – extend the primary term and front-load the bonus, delay and

other damage payments into a “paid-up” lease. Not the best for the

OGM owner.

• If no drilling occurs, the lease lapses at the end of the primary

term.

• If drilling occurs during the primary term, the secondary term is

triggered.

Trend – strange and unusual language is added to the secondary

term to perpetuate the lease beyond production. Very bad for the

OGM owner.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

NOTE: Many of these lease clauses will not appear in a draft oil and

gas lease first offered by a gas producer. They require specific

negotiation.

Mother Hubbard clause - states the lease includes all lands of

Lessor whether adjacent to the leasehold or not (generally, adds

land not specifically described in the lease)

Unitization clause – the acreage under the lease is added to or

unitized with other lease acreage. Production on any acreage within

the unit holds all leases within the unit by production, even if no

production ever occurs on some acreage within the unit.

“Pugh” clause – provides the landowner with some relief in the event

that some of his or her acreage is not unitized.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

Access easements – provide for the right to enter upon the property

for purposes of the lease.

Location of roadways, pipelines, well sites, etc. - Unless negotiated

by the OGM owner they will be at the discretion of the lessee.

Best practices – commits Lessee to utilize industry best practices in

development of the lease (e.g. horizontal, not vertical, Marcellus

wells)

Arbitration provision

Non-disturbance clause – Prohibits surface access to the property

(except possible seismic testing).

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

Pipeline easements - Provide the right to install, construct, lay, maintain,

operate etc. These are necessary to get gas to market BUT they can

be overly broad; OGM owners (especially those who also own the

surface) may wish to limit the number, size, location, etc.

Timber, crop damage clauses – compensates the owner of the surface

for damages to timber, standing crops, fences, etc. cause by production

activities.

Gas storage clauses – give the lessee the right to store gas on the

property, even if that gas was produced elsewhere. These clauses

should be carefully examined, particularly when the secondary term of

the lease is linked to the gas storage clause.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

Water rights – The lessee’s right of access to and use of water on the

premises, if any, should be addressed. Issues pertaining to water

quality monitoring and responsibility in the event of contamination

should be addressed as well.

Assignment – most gas leases are assignable, and for good reasons

which the lessee may require. However, it is reasonable to require the

lessee to give Lessor notice of the assignment.

Depth horizon limitations – There are a number of formations in

Pennsylvania capable of producing oil or gas or both. Development in

a particular area is often within a particular formation (for example, the

Marcellus). Limit the formation for which the oil and gas lease applies

to preserve future rights in the development other formations.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

Royalty calculation methods - Describes what costs may be

subtracted from the royalty to be paid to the Lessor. These costs

can be significant and can result in a significant reduction in the

royalties paid to Lessor over time.

End of lease provision – Requires lessee to record an instrument

which indicates the expiration of the lease.

Spud fees - Provides compensation for surface damages caused by

well sites being located on the property.

Setbacks – Specification of setbacks from buildings, ponds,

streams, and wetlands.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

Information – Lessee must provide Lessor with a copy of the drill site

plan, MSDS sheet, production records, etc. upon request

Free Gas/Payment in Lieu of free gas

Bonds/well plugging insurance – Provide for source of payment for

well-plugging in lessee is unable to do so when the gas runs out

Land restoration – Provide specific requirements for reforestation,

slope restoration, wildlife food plots, etc.

Taxes/tax penalty provisions – Require the lessee to compensate the

Lessor for any penalty imposed as a result of a change in use of the

property under Clean and Green, CREP, etc.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

Shut-in clauses – Define whether and on what terms a well may be

“shut-in” or production intentionally stopped temporarily.

Payment provisions – Require cashier’s or certified checks, no

DRAFTS

Disposal of water – OMG owners should require that water used in

the drilling and production processes be disposed of off-site and in

accordance with applicable state and federal environmental laws and

regulations.

Transportation rights – These provide the right to construct, operate,

maintain and repair gas transportation pipelines, pump stations

etc. Landowners should avoid granting transportation rights or

negotiate them separately for additional compensation

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Other Important Lease Clauses

Indemnification – Recommended for Landowner protection, these

clauses require that the Company indemnify Landowner from any and

all claims and costs arising from Company’s operations, including

attorneys’ fees.

Removal/forfeiture of equipment at end of lease – Require Company

to remove its equipment at the end of the lease or forfeit it .

Severance tax – Allocation of any severance tax which may be

imposed by the Commonwealth. Commonly, the Landowner pays tax

only on that portion of the gas removed for which Landowner is paid a

royalty.

Real estate taxes – Allocates the liability for payment of real estate

taxes on the premises together with any future increase in real estate

taxes.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Watch Out For:

• Bad leases – some are not even leases at all but rather are

conveyances of the entire OGM interest. Sometimes for as little

as a few hundred dollars an acre

– Even when a Landowner challenges a bad lease and wins it

takes considerable money and time (in which interest in

producing the property may have come and gone).

•

•

•

•

•

Pushy Company representatives

“standard form of contract” = the Willy Wonka approach

Peer pressure/threat of being left behind

Marketing/option agreements

Speculators interested in acquiring your OGM rights at discount

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Special Issues in NW PA

• Existing leases – “heaven to hell”

– Are they still good? Consult with an attorney.

• Temptation on part of smaller operators to produce from the

Marcellus using cheaper traditional vertical methods under

existing leases

• Non-production, expiration of leases not documented of

record

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Conclusion – So what do I do?

• Know who you are dealing with – is he or she a professional

Landman. Ask for credentials.

• Know what it is you are being asked to sign. Is it a lease or a

marketing agreement?

• Take the document to a qualified lawyer for review. Only lawyers

are licensed to advise you concerning your legal rights under these

agreements, and to negotiate these instruments on your

behalf. Only lawyers carry legal malpractice insurance to provide a

fund for your recovery in the event that you receive bad advice.

• Choose your attorney wisely. Inquire about that attorney’s

experience in dealing with oil and gas leases. Ask whether or not

the attorney has malpractice insurance and if so what the limits of

that insurance are.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Conclusion – So what do I do?

• Consider using a consultant. Consultants, while not lawyers, can

be an invaluable source of information to you and to your

attorney in maximizing the “economic” provisions of your lease,

particularly where the consultant has recent experience and

knowledge of the current leasing environment in the area.

• BUT: check their credentials too! Self-proclaimed experts are

coming out of the woodwork in other parts of the commonwealth,

claiming expertise because they once signed a lease as a

landowner…we are fortunate in our area to have seasoned

veterans who are capable of bringing depth of knowledge of the

industry to the table.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Conclusion – So what do I do?

• Involve your tax planning professionals and investment advisers

early.

• There are significant and distinct potential tax ramifications

involved with signing a lease, receiving up-front lease payments

and receiving royalty payments over a significant period of time.

• You will want an investment adviser to help counsel you

regarding how best to invest the income you receive from your

lease. Choose these professionals wisely as well, making sure

that they understand and have experience with oil and gas lease

issues.

• If you do not have a tax planning adviser or investment adviser

with specific experience in this field, your oil and gas attorney

should be able to refer you to one.

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

Conclusion – So what do I do?

• Update your estate plan, or prepare one if you don’t have

one. Your oil and gas attorney may be able to assist you with

this as well, if he or she has experience with complicated

estate planning issues pertaining to oil and gas leases and

income streams. The potential tax ramifications to you and to

your family in NOT revising your estate plan could be

significant. Through the use of Family Limited Partnerships,

Trusts or other planning tools, maximize the wealth that you

pass on to your family while minimizing your tax bill.

• www.naro-us.org

Copyright 2010 All Rights Reserved – Shuffstall, Reagle & Associates, P.C.

(Except as to Original Graphics and Content)

The Marcellus Shale:

Understanding the Legal

Issues from a Landowner’s

Presented by:

Perspective

Dearald W. Shuffstall

II

Shuffstall, Reagle & Associates, P.C.

Attorneys at Law

314 S. Franklin Street, Suite 201

Titusville, Pennsylvania 16354

(814) 827-2789