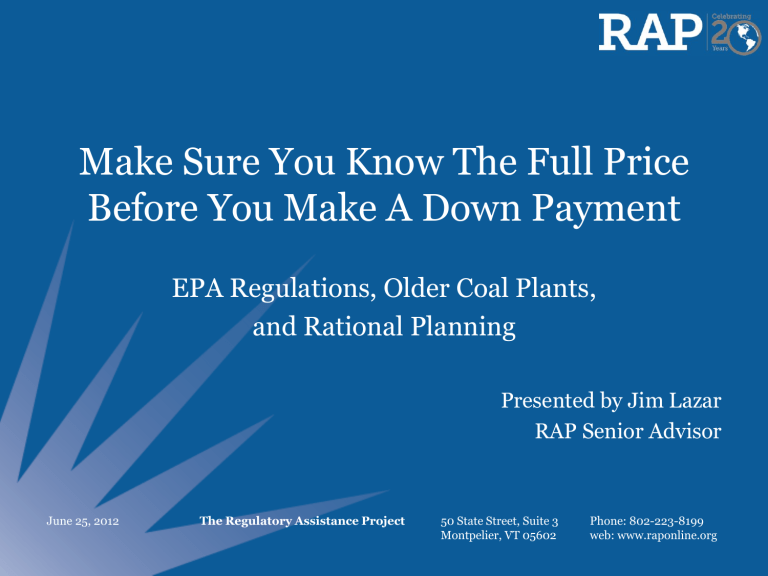

Jim Lazar

Make Sure You Know The Full Price

Before You Make A Down Payment

EPA Regulations, Older Coal Plants, and Rational Planning

Presented by Jim Lazar

RAP Senior Advisor

June 25, 2012 The Regulatory Assistance Project 50 State Street, Suite 3

Montpelier, VT 05602

Phone: 802-223-8199 web: www.raponline.org

About Jim Lazar

Jim Lazar is a RAP Senior Advisor, based in Olympia, WA

• Economist with 34 years experience in utility resource planning, rate development, and financial analysis

• Expert witness in more than 100 rate proceedings on resource planning, revenue requirement, cost allocation, rate design, and energy efficiency.

• Long-time consultant to Washington Public Counsel (1983-2008)

•

Participated in development of energy efficiency programs in Washington, Oregon,

Idaho, Montana, California, Arizona, and British Columbia

• Assisted RAP in many US states, plus Brazil, China, Hungary, India,

Indonesia, Israel, Mauritius, Mozambique, Namibia, Philippines

• Author or co-author of RAP publications on Electricity Regulation,

Energy Efficiency, Pricing, and Emissions Costs.

• Get a copy of “ Incorporating Environmental Costs in Electric Rates ”

2

Old Power Plants Are At Risk

• 1,000 power plants over 40 years old. ~100,000 Megawatts.

• Many will need multiple retrofits to continue operations.

• Even with retrofit for all criteria pollutants, still have high operating costs, limited lifetime, and exposure to CO2 regulation.

3

Retrofits are Expensive

~$300 million for a 300 MW power plant.

About the same as new CCCT Capacity Graphic: Brattle

4

Cumulative Retrofit Costs Could

Easily Exceed Any Reasonable Value

5

Regulated and Unregulated Owners

Approach the Problem Differently

Regulated Utilities

• Have responsibility for reliability, so concerned about resource adequacy.

• Concerned about recovery of existing sunk costs.

• Concerned about regulatory disallowances.

• Concerned about quarter-toquarter financial results.

• Averch-Johnson effect may induce capital spending.

• Direct role in EE and DR.

Non-Utility Generators

• No reliability obligation.

• No ability to recover sunk costs if unit retired.

• No issue with regulatory disallowances.

• Concerned about short-term and long-term financial results.

• No attraction to capital spending.

• No role in energy efficiency or DR

6

There May Be Low-Cost Options

For Capacity and Energy

Capacity: NEISO has invited Demand Response and

Energy Efficiency into the auctions for several years.

NEISO:

$41.20/kW-Year

Energy: Efficiency options abound at costs of $.03 - $.06/kWh

7

Some Regions With Greatest Risk

Also Have Greatest EE Opportunities

States With Greatest Exposure to

Capacity Retirement (NERC )

States With Best and Worst EE

Program Achievment (ACEEE)

CA Risk is oncethrough cooling

Graphic: NERC

Graphic: ACEEE

8

Cost Allocation and Rate Design

• Retrofit costs are incurred to allow continued use of coal .

$/kW-Year For

“Capacity” Resources

• They are effectively fuel costs, rates should reflect this.

• If capacity is needed, there are usually cheaper options.

• Demand Response

• Energy Efficiency

9

Bottom Line

• Technology has improved.

• Emissions matter.

• Old machines wear out.

• Demand Response and Energy

Efficiency are viable alternatives.

Is it smart to spend $100,000 to fix up a

1967 Ford Country Squire?

Or maybe we should buy a new Ford

Escape Hybrid. For $30,000

10

About RAP

The Regulatory Assistance Project (RAP) is a global, non-profit team of experts that focuses on the long-term economic and environmental sustainability of the power and natural gas sectors. RAP has deep expertise in regulatory and market policies that:

Promote economic efficiency

Protect the environment

Ensure system reliability

Allocate system benefits fairly among all consumers

Learn more about RAP at www.raponline.org

Jim Lazar, RAP Senior Advisor jlazar@raponline.org