TINA Phil Seckman NCMA_Pikes_Peak_Chapter_Presentation_(8

advertisement

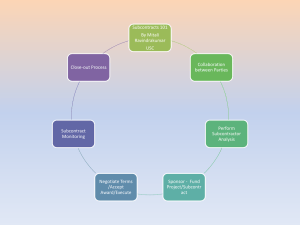

- Truth in Negotiations Act Overview and Update NCMA Pikes Peak Chapter October 18, 2012 Phillip R. Seckman mckennalong.com Today’s Agenda • TINA overview and purpose • Recent developments relating to commercial items and case law • The common compliance/subcontracting issues • Best practices 2 TINA: Overview and Purpose • During contract negotiation, contractors are required to disclose cost or pricing data regarding their costs and pricing • Government is placed on equal information footing with the contractor • Improves government’s bargaining position and ability to negotiate contracts and modifications • Contractors must: – – – – Submit accurate, complete, and current cost or pricing data . . . Existing on date of agreement on price . . . For covered contract actions . . . Not subject to an exception 3 TINA Overview - When Does TINA Apply? • Negotiated contracts expected to exceed $700,000 (indexed) – Government can ask for other than cost or pricing data for contracts below threshold, but above simplified acquisition threshold if necessary to determine price is fair and reasonablen • Four exceptions (aka “prohibitions”): – – – – Contract awarded after adequate price competition Price set by law or regulation Commercial item contract (or modification) TINA waiver (rare cases) 4 When Does TINA Apply (continued)? • Exception 1: contract prices based on adequate price competition – Two or more responsible bidders, competing independently, submit offers and price is substantial factor; or – There was a reasonable expectation that there would be two or more offerors and CO can conclude offer was submitted with expectation of competition; or – Price is reasonable in comparison with recent prices for same or similar items purchased in comparable quantities, under contracts resulting from adequate price competition 5 When Does TINA Apply (continued)? • Exception 2: commercial items – Commercial items defined at FAR § 2.101 – No cost or pricing data, but may rely on “other than cost or pricing data” – Recent changes relating to the commercial item definition - change is in the air! • September 2011 DCAA Guidance regarding commercial items • September 2011 Update to DoD Commercial Item Handbook • DoD’s proposed change to the commercial item definition in the FY 2013 NDAA 6 Requirements for Submitting Cost or Pricing Data • Absent an exception or waiver, cost or pricing data are required before: – Contract awards of: • Negotiated contracts expected to exceed $700,000 (indexed); • Subcontracts at any tier expected to exceed $700,000 (indexed), if contractor and each higher tier subcontractor required to furnish cost or pricing data; – Modifications: • Of sealed bid or negotiated contracts expected to exceed $700,000 (even if cost or pricing data initially not required) • Of a subcontract expected to exceed $700,000 (if contractor and each higher tier subcontractor required to furnish cost or pricing data) 11 Requirements (cont.) – Modifications/price adjustments include both increases and decreases: • Example: A $350,000 upward price modification may still be subject to TINA when modification results from: – Reduction of $550,000 and – Increase of $200,000 (Δ of $550K) + (Δ of $200K) Total Δ = $750K • Agency head may still require submission of cost or pricing data where the award or modification is below $700K, as long as: – Contract is above simplified acquisition threshold; and – Cost or pricing data is necessary to determine that the price is “fair and reasonable” 12 What is “Cost or Pricing Data?” • Defined: – All facts that “prudent buyers and sellers would reasonably expect to affect price negotiations significantly” • Factual, not judgmental; and therefore verifiable • Includes factual data forming basis for contractor’s judgment of estimated future costs 13 Examples of Cost or Pricing Data • • • • • • • Actual labor rates and hours Indirect costs Vendor/subcontractor quotations and analyses Nonrecurring costs Information regarding changes in production methods or volume Unit cost trends (like those associated with labor efficiency) Data supporting projections of business prospects and related operations costs • Data on management decisions that could have a significant bearing on the costs • Schedule or workload changes that affect costs • Make-or-buy decisions 14 TINA Issues: “Fact vs. Judgment” • Pure judgments are not subject to disclosure • Facts supporting a judgment should be disclosed, however • Problem areas are data that are a mix between fact and judgment – Examples: business strategies and estimates • United States v. Lockheed Martin Corp., 282 F. Supp. 2d 1324 (M.D. Fla. 2003) – Disclosure of preliminary findings on work performance was required; data was relevant to price negotiations • “The [contractor]'s duty is to disclose all data which might affect the contract price . . . . It cannot unilaterally decide what can be disclosed and what cannot” – Rejected Lockheed Martin’s arguments that: • Data constituted judgment/estimate because it analyzed work performed to predict future costs • Data was not relevant because it was for a different type of labor being performed 15 Example: Subcontractor Bids • Aerojet Solid Propulsion Co. v. White, 291 F.3d 1328 (Fed. Cir. 2002) – Aerojet contracted to provide chemical compound for use in plastics to the government • Received multiple bids from two subcontractors to provide particular chemical ingredient • Aerojet used bids to price chemical at $1.98/lb and present as cost or pricing data to government – Aerojet solicited and received additional bids from subs that would remain unopened until after negotiations – Government and Aerojet agreed on final price on June 20, 1990 – Aerojet opened bids the next day; subcontractors priced chemical ingredient at $1.47 or lower 20 Aerojet Solid Propulsion – Arguments: • Government: the fact that Aerojet had received additional bids needed to be disclosed • Aerojet: contractor had no knowledge of prices in sealed bids until after negotiations were over – could not affect price negotiations significantly – Result? – Held: TINA required disclosure of the additional unopened subcontractor bids; mere knowledge of the existence of the undisclosed bids could reasonably and significantly affect price negotiations 21 Disclosure by Date of Agreement Controls • TINA requires full disclosure of data existing as of the date of agreement on price • Date of agreement on price means the date the parties agree that the price has been negotiated • Existing means actually existed – “Should have” existed is irrelevant – Data created after agreement does not need to be disclosed – Data discovered after agreement but created prior to cutoff date should be disclosed • Perform “sweeps” after initial agreement and prior to the mutually agreed to date of price 27 Subcontract Requirements • TINA applies to subcontracts • “Subcontract” means a contract to furnish supplies/services for performance of the SOW of prime government contracts, including: – First and lower tier subcontracts – Purchase orders (and changes/modifications thereto) – Transfer of commercial items between divisions, subsidiaries, or affiliates of contractor or subcontractor • Should “subcontract” include an agreement – To support performance of government and commercial contracts? – Acquired for contractor inventory? – Acquired to support indirect cost functions? 28 Subcontract Requirements (continued) 16 29 Subcontracts (cont.) • Prime must submit (or cause submission) to CO cost or pricing data from prospective subs for subcontracts that are lower of: – $12.5M or more; or – Over $700K and more than 10% of prime contractor’s proposed price; or – Otherwise necessary for adequately pricing prime contract • Subcontractors only required to submit cost and pricing data if all higher-tier subcontractors and prime contractor required to submit data 30 Subcontracts (continued) • “Availability of data” interpreted broadly against prime contractors to require disclosure of all subcontractor data • McDonnell Aircraft Co., ASBCA No. 44504, 03-1 BCA ¶ 32,154 – Prime contractor held liable for not disclosing subcontractor’s cost analysis of a second tier’s subcontractor’s proposal • “Controlling date” for submitting data is prime contract award date – Primes should be careful about agreeing on price with government prior to subcontractor price agreement unless subcontractor obligated to disclose all cost or pricing data to the prime as of the prime’s agreement on price with the government – Subcontractor data coming into existence after agreement on the prime price should not be cost or pricing data when prime contract is FFP 31 Subcontracts (continued) • Prime contractors liable to government for defective data of prospective or actual subcontractors – Cost or pricing data clause should be “flowed down” to subcontractor by prime – Prime contractors likely want indemnification provisions or other protections in subcontracts for submission of defective data – Lack of privity between government and subcontractor makes prime contractor target for any subcontractor’s defective pricing 32 Contractor Liability for Defective Pricing • Government recovery under “Price Reduction” clause (FAR §§ 15.408(b); 52.215-10) • Government entitled to: – Amount by which contract price overstated due to defective data, plus – Interest from date of overpayment through date of repayment • Contractors knowing submission of defective data may result in: – Penalty equal to amount of overpayment – Civil False Claims Act litigation – Criminal prosecution • Criminal false claims • False Statements Act 33 Impact of DOD’s Business Systems Rule • New Business Systems Rule (DFARS § 252.244-7001) creates withhold risk for a significant deficiency • Purchasing systems must: – Obtain subcontractor cost and pricing data in accordance with TINA – Perform “Timely and adequate cost or price analysis and technical evaluation for each subcontractor and supplier proposal or quote to ensure fair and reasonable subcontract prices” – Establish and maintain procedures to ensure performance of adequate price or cost analysis on purchasing actions” • CO may withhold up to 10% of amounts due from progress and performance-based payments until significant deficiencies are corrected 34 Defenses to Existence of Defective Pricing • Not cost or pricing data – Not factual – Did not exist – Not significant • Government would not have relied on data (defense expressly recognized in statute): • Statute of limitations – McDonnell Douglas, ASBCA No. 56568, 10-1 BCA ¶ 34,325 • Defective pricing claim dismissed under Contract Disputes Act’s statute of limitations 35 Defenses to Reduce Damages for Defective Pricing • Government must establish causal connection between defective undisclosed data and contract price • Presumed that natural consequence of nondisclosure was dollar-for-dollar increase in price • To rebut, provide evidence that disclosure would not have impacted price • Example: internal documents demonstrating that price offered to government was absolute floor • Example: government/upper tier contractor states lack of interest in the data 36 Weak Defenses to Defective Pricing Claims • Agreement was on total price, not individual components • Data was not “significant” • No impact because contractor is sole source or in superior bargaining position • Inadequate proposal time (GKS, Inc., ASBCA No. 47106, 00-1 BCA ¶ 30,907) • Government could have/should have known of relevant data • Government aware that contractor’s price higher than competitor 37 Offsets to Liability • Contractors may offset TINA liability for failing to disclose required data by demonstrating that other data (not disclosed) would have lowered the contract price • To claim offset, contractor must: – Certify entitlement to offset; – Prove “offset” data was available prior to contract award and not submitted; and – Demonstrate that data relates to same pricing action as defective pricing claim • Offsets only applicable to reduce liability; cannot be used to renegotiate contract price 38 Government Audit Rights • Government examines records to verify accuracy, completeness, and currency of cost or pricing data • “Audit and Records-Negotiations” clause (FAR § 52.215-2) • Includes access to records relating to – – – – Proposal Negotiation Pricing Performance 39 Best Practices to Minimize Risk • Seek commercial item exemption to greatest extent possible • As prime contractor, include indemnification agreements with subcontractors • Pay attention to forward pricing rates and potential changes • Agree with government on cutoff date for disclosing data • Make final sweep at time of price agreement • Err on side of disclosure • Keep records of negotiations and preserve all files • Disclose mistakes as soon as known DOCUMENT, DOCUMENT, DOCUMENT 40 Presenter • Phillip R. Seckman 303-634-4338 pseckman@mckennalong.com 32230997 41