Presentation

advertisement

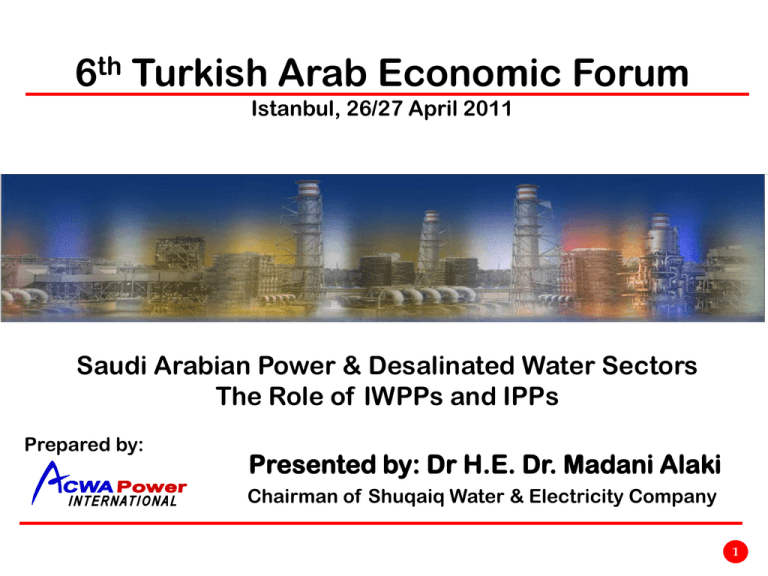

6th Turkish Arab Economic Forum Istanbul, 26/27 April 2011 Saudi Arabian Power & Desalinated Water Sectors The Role of IWPPs and IPPs Prepared by: Presented by: Dr H.E. Dr. Madani Alaki Chairman of Shuqaiq Water & Electricity Company 1 1. Sector Size and Growth both power & Desalinated water 2. Challenges & Opportunities 3. Sector Participants till 2004 4. The role of Privatization 5. The clear Success f the Programme 6. Benefits of transparent Competitive Procurement 7. Much Opportunity in the Future 2 1.1 Sector Size & Growth - Power Power Generation Capacity today – 43,000MW It is forecasted that Power demand in KSA would grow at 8% for the next 10 years requiring an installed capacity of 75,0001 MW in 2020 Growing to over 100 000 MW by 2030 KSA Power Landscape InStalled Capacity (in MW) 120,000 100,000 104,591 80,000 85,966 73,484 60,000 57,418 40,000 43,968 30,675 20,000 - 21,673 2000 Actual 2005 2010 2015 2020 2025 2030 Projected 3 1.2 Sector size & Growth – Desalinated Water Desalinated Water Capacity today – 6 million cu m per day It is forecasted that the need for Desalinated Water will grow to 10 million cum/day by 2030 (with the expectation that demand management + Conservation will signifanctly contain the need for new water) 13,000,000 12,000,000 11,000,000 10,000,000 9,000,000 8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Years 2001 0 2000 m3/day 1,000,000 4 2. Challenges & Opportunities High annual growth in demand for both power and water; Growth in population and the ever growing younger population segment reaching the stage of needing their own houses and services (schools, universities, hospitals). Rapid growth in the commercial and industrial sectors. In the case of electricity, extremely sharp daily and yearly load curve due to the significant air-conditioning needs Replacement of inefficient old generating units in the case of power plants and several desal units towards the end their economic life in the case of water. All needing to require very high levels of capital investment for both capacity expansion and refurbishment , upgrading or replacing existing units. 5 3. Sector Participants – Till year 2004, only 4. • Saudi Electricity Company - Responsible for generation, transmission & distribution of electricity. Aramco Saudi Electricity Co. Marafiq Saline Water Conversion Corp. • SWCC - Responsible for the production of desalinated water but it also generates electricity as it is economical to co-generate power when oil is used as fuel; SWCC then sells the power to SEC at factory gate. • Marafiq – A utility company that is responsible to provide utility services to the two industrial cities of Jubail and Yanbu and thus buys from SEC and SWCC to internally distribute but also self generates and produces some dsal water itself. • ARAMCO – The oil and gas produces Self generates for its own needs. 6 4.1. Role of Privatization In 2004 His Majesty the King and the Custodian of the two Holy Mosques passed Resolution 523 which established Water and Electricity Co. (WEC) signaling the Kingdom’s intention to progressively open up the electricity and water sector to the private sector to own and operate. The first step was to start filling the capacity deficiency by instructing WEC to launch four Independently Financed Water and Power Projects, where the private sector is given the reasonability of: • developing, constructing, owning and operating power and desal plants • at sites provided under a land lease by WEC . • Using fuel supplied by WEC • And sell the power and dsal water on 20 year off take contracts The other three participants in the sector, SEC, ARAMCO and Marafiq accepted the logic of outsourcing the services of owning and operating power and desal plants and have now launched their own programmes. 7 4.2. Typical IWPP /IPP framework PIF 32% SEC 8% Developer s 60% Government MOF Credit Support Shareholders Agreement SWCC WPA SWCC PWPA Project LLA Company Contract EPC EPC Contractor WEC FSA Aramco Fuel (ECA) O&M Contract PPA SEC O&M Contractor 8 5. 1. Success of the Private Public Partnership Programme • 10 IWPP/IPP projects in Saudi Arabia already contracted, 8 of which are in operation and are performing according to plan. 2 plants are under construction. • Note Worthy - Financial Close of Rabigh IPP, the 9th project Was achieved in July 2009, becoming the first Project Finance transaction with long tenor debt to achieve financial close post Lehman Brothers collapse (during the height of the financial crisis). 4000 Estimated Total cost (in Million Under USD) Construction 3500 3000 2500 2000 1500 1000 500 0 First 8 IWPP/IPP already fully operational 9 5.2 - 21% of power + 42% of Desal Water + USD 15 Billion Raising the efficiency of the national economy – A new industry has been created. Ten companies founded in Saudi Arabia are now delivering: • 9,350 MW of electricity - 21% of the power generation capacity of the Kingdom • 2.3 million cum/day. Representing 42% of the Kingdom's desalinated water production capacity of 5.5 million cubic meters per day. • One company, ACWA Power, which is involved in 7 out of the 10 privately owned and operated plants has emerged as a national champion now spreading its wings outside KSA. Encourage the investment of private (local and foreign) capital in a productive sector of the economy • SAR 56 billion (USD15 billion) of private investments has flowed into this sector. • Of this SAR 22.5 billion (USD 6 billion) is foreign direct investment. Most important of all - 21% additional power generation capacity and 42% desalinated water production capacity has been added at a price competitive basis all with out the customary delays. 10 6. Much Opportunity in the Future • • 30 – 40 % of Future generation is expected to be IPP(BOO) with Long term power purchase agreements (20years) SEC plans to add an additional 12,400 MW in the next 6 years through the IPP framework (SEC keeps moving more projects into the IPP programme) IPP Project – Pipeline1 NAME OF IPP PROJECT CAPACITY (GW) Estimated Bid Year PROJECT COMPLETION 2 2011 2014 DHEBA 1.6 2012 2015 SHUQAIQ 1.6 2012 2015 ALOGAIR 2.4 2013 2016 JEDDAH SOUTH 2.4 2014 2017 RAS ALZOUR 2.4 2016 2019 QURAYYAH Total 12.4 In addition, IWPP’s are planning to add additional capacity of 6,000MW over the next 6-7 years 1. Source : SEC Presentation 11 6th Turkish Arab Economic Forum Istanbul, 26/27 April 2011 Saudi Arabian Power & Desalinated Water Sectors The Role of IWPPs and IPPs Thank You for Your Attention 3 /day Desalinated Water Export 212,000 m 12 Appendix A1 The Value of Competitive Procurement Shuqaiq IWPP Developer Marafiq IWPP Power (Halals/ KwH) Water (Halals/m3) Developer Power Water (Halals/K (Halals/m wH) 3) ACWA/GIC/MC 10.27 385.59 Suez/ACWA/GIC 5.71 311.25 Marubeni/NBC 12.00 499.00 IP/Sumitomo/Oger 6.99 307.50 Powertek/Jumai 16.32 532.66 Mitsui/KEPCO/NPC 7.50 273.75 In net present value terms the saving between lowest and next Shuqaiq IWPP SR. 2.3 Billion Marafiq IWPP SR. 1.8 Billion 13 Appendix A2 Value of Competitive Procurement Rabig IPP Developer Qurayyah IPP Power (Halals/KwH) Developer Power (Halals/KwH) ACWA/KEPCO 12.59 ACWA Power/ Samsung/MENA Fund 7.41 GDF Suez/IP 16.56 Marubeni 8.56 Sumitomo/KEPCO 8.62 IP GDF Suez/Al Jomaih 8.75 Powertek/JGC/SaudiOger 9.25 Tenaga/Saudi Bin Laden 9.30 In net present value terms the saving between lowest and next Rabig IPP SR. 3.3 Billion Qurayyah IPP SR. 1.2 Billion 14