The case of Spain (ppt - 296.50 Kb)

advertisement

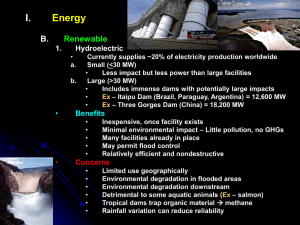

Energy transformation under the pressure of austerity: The case of Spain. Bruno Estrada. Director de Estudios y Proyectos de la Fundación 1º mayo. Brussels, 25th November 2013. Fundacion 1º mayo. CC.OO. 11 1.-The regulatory framework of the electrical system in Spain 1) A Great external dependence; 2) An uncertain access to the resources; 3) A great volatility in the prices of the energy; 4) High environmental impacts of the energetic cycle. 5) High costs of the system; 2 A Great external dependence According to Eurostat methodology the Spanish external energy dependence index was 75,6% in 2011. In 2012 energetic imports increased reaching the 18’4% of total imports. 4.6% of GDP. 115% of total trade deficit. That means that Spanish trade balance (without energetic goods) shows a surplus. 3 An uncertain access to the resources; A great volatility in the prices of the energy Prices resulting from changes in international oil prices. Except on gas supplies: Long-term contracts, aimed to ensure security have resulted in a rise in prices Spanish imports of Algerian gas, 1995-2012 (% of total imports). 4 High environmental impacts of the energetic cycle The carbon footprint of the energy sector in Spain is very high. 78.1% of total emissions of greenhouse gases (GHG) in Spain in 2007. 5 High costs of the system - The Spanish prices of electricity are in the medium-high band of the European Union for the small consumers (almost 25 millions). - The prices of the big consumers are lower, and very similar to the rest of European countries, due to the interest of the government in order that the electricity will not be a factor that affects negatively to the competitiveness of the Spanish companies. 6 Two elements determine the price of electricity for this majority of consumers: - The CESUR (Energy Contract for Supplier of Last Choice) quarterly auctions in the liberalised part (production and marketing). - The additional costs of the regulated part by the government. 7 The price fixed by the liberalised part is the production costs of the last generating technology built into the system in order to meet the needs of demand. In other words, if the last technology meets 1% of the expected demand and the cost of production is 50€/MWh, all the MW used for the rest of demand are paid to 50€/MWh, whatever the generation cost have been. 8 CESUR auctions produces an unrealistic cost of electricity for some installations (hydraulic and nuclear, with investments done many years ago) that receive a “shocking” premium. Most of the nuclear power plants the most hydroelectric power plants in Spain belong to two electric companies: Endesa and Iberdrola. 9 - The difference between the electric supply cost and the electricity tariff, that is lower in many cases is the “tariff deficit”: A “false” consumer debt with electric companies of 26.000 millions €. The electric companies can issued debt warranted by Government until 25.000 millions €. 10 2.- Measures to balance prices between different social groups With the aim of promoting the most vulnerable groups among small consumers, in 2009 entry into order the Discount Rate (Bono Social) and the Social Tariff (Tarifa Social). Four groups may qualify for the Discount Rates: A) The residential domestic customers with contracted power less than 3 KW. The Discount Rate is automatically granted for this group. B) Pensioners with minimum benefit. C) Large families. D) Households in which all members are unemployed. 11 The Government estimated that about 5 million consumers would be included at Discont Rate. Consumer organizations calculate the savings on the electricity bill by up to 20%. Domestic Energy expenditure in Spain is lower than the countries of central and northern Europe, due to the different climatic conditions. In the period 2006-2010 it represented only 5% of annual net income of an average family, but it is growing very quickly. 12 3.- Effects of the crisis and austerity: changes in the regulatory framework Recent regulatory changes in the sector are reflected in the following laws and royal decrees: • • • • • • • • • • • Royal Decree-Law 6/2009, of April 30, by adopting certain measures in the energy sector and approving the Social Bond. Royal Decree 1565/2010, of 19 November, regulating and modifying certain aspects of the activity of electricity production scheme. Royal Decree 1614/2010, of December 7, which regulates and modifies certain aspects of the activity of electricity production from wind and solar technologies. Royal Decree-Law 14/2010, of 23 December, establishing urgent measures to correct the tariff deficit in the electricity sector. Royal Decree 1699/2011, of 18 November, regulating the network connection facilities electricity production of small power. Royal Decree -Law 1/2012, of January 27, by which we proceed to the suspension of preallocation procedures and the suspension of economic incentives for new installations of electricity production from cogeneration sources renewable energy and waste. Royal Decree-Law 13/2012, of March 30, measures adopted for the correction of the deviation because of imbalances between the costs and income of electrical and gas sector and to transpose Directives on home markets of electricity and gas and electronic communications. Law 15/2012, of 27 December, on tax for energy sustainability. Royal Decree -Law 2/2013, of February 1, on urgent measures in the electrical system and the financial sector. Royal Decree -Law 9/2013, of 12 July, by which urgent action to ensure financial stability of the electrical system. Since the 4th of October of 2013 there is a new Law project of the Electrical Sector in the Parliament. 13 4.- Renewable Energies in Spain. Incentive system. • • • The RDL 9/2013 aims to reduce profit margins in the industry, setting its reasonable return, before taxes, 3 points above the interest rate of the Bonds of the State to ten years in secondary markets. But the judgment of the CNE is that it will take large uncertainties to the approximately 60,000 existing installations. The CNE warns that the return on the investment can reach negative values, which "could be considered incompatible with the design of a specific remuneration aims to promote the production of electricity from renewable sources". The Associations of Renewable energy producers consider that the retroactivity of these changes affects the profitability of many projects already installed. 14 The government has recently abolished the CNE, integrating some of its functions in a new Competition Commission which includes other regulated sectors, but others have assumed the Ministry of Industry, subtracting powers to independent regulator. Regulatory changes, and declining public support on renewable energy in Spain has caused the biggest European drop in investment in 2012 in this sector. According to New Energy Finance Bloomberg, sector investment declined by 68% (ie € 2.200 million). 15 5.- Evolution of employment in the RE sector There are no official statistics on employment in renewable energy, since in the Labour Force Survey there is no renewable energy subsector. Until 2011, the Institute for Energy Diversification and Saving (IDAE) of the Ministry of Industry has been funding studies on employment in different research institutes, such as ISTAS of CCOO, as well as industry associations. It is not currently possible to know the evolution of employment in the sector in the last two years, when remuneration for renewable energy has been changed. The data provided by industry associations shows a loss of 20,000 jobs in 2009 and 2010 on a total of 111.455 workers in 2010, both direct and indirect jobs. 16 6.- Evaluation by the author. The pressures of major conventional companies (Endesa, Gas Natural, Iberdrola) on the government (it is worth remembering that there are several former heads of government and former finance ministers in their boards) have broken the promotion model of renewable energies. 17 Members of Adminitration Boards and Experts paids by Companies PSOE Partido Popular Gas Natural Felipe Gonzalez (Expresidente) Narcis Serra (Exvicepresidente) Rafael Villaseca Carlos Kimder Nemesio Fernandez Cuesta (Exsecretario de Estado de Energía) Endesa Pedro Solbes (Enel), (Exministro de Economía) Elena Salgado (Chilectra) (Exministra de Economía) Jose Maria Aznar (Expresidente) Miquel Roca Junyent CiU Braulio Medel Presidente de Unicaja. Jose Luis Olivas (Expresidente de la Generalitat Valenciana y Expresidente Bancaja y Banco de Valencia) Juan Miguel Aynat (Expresidente de Bancaja y B. Valencia) Ricardo Alvarez Isasi. PNV. Iberdrola PNV, CiU. 18 PSOE REPSOL Paulina Beato (Expresidenta Red Electrica y CAMPSA) Luis Carlos Croissier. (Exministro Industria) Enagas Miguel Angel Lasheras (Exconsejero de la Comisión Nacional del Sistema Eléctrico) Ramón Perez Simarro (Ex S.G de Energía) Dionisio Martinez Martinez CEPSA UCD, franquismo Casa Real PNV y CiU Mario Fernandez (Ex vicelendakari) Jon Imaz (Exsecretario G. PNV ) Artur Carulla, CiU Carlos Perez de Bricios (Exministro de Industria) Juan Manuel Otero, (Exministro Presidencia) Carlos Borbón de las Dos Sicilias, Infante de España. 19 The European Commission itself has published a report, done by Ecofys, which concludes that Spain would only reach between 12.6% and 17.1% of power generation from renewable sources, away from the lens the 20% proposed by the Commission and included in the plan of Renewable Energy 2011-2020. 20