China’s Unconventional Gas

Resources

China’s Energy Policies

International Energy & Transactions

Committee Brown Bag

Harry Vidas

Vice President, Fuels

harry.vidas@icfi.com

(703) 218-2745

May 13, 2013

Disclaimer

Warranties and Representations. ICF endeavors to provide information and

projections consistent with standard practices in a professional manner. ICF MAKES

NO WARRANTIES, HOWEVER, EXPRESS OR IMPLIED (INCLUDING

WITHOUT LIMITATION ANY WARRANTIES OR MERCHANTABILITY OR

FITNESS FOR A PARTICULAR PURPOSE), AS TO THIS PRESENTATION.

Specifically but without limitation, ICF makes no warranty or guarantee regarding the

accuracy of any forecasts, estimates, or analyses, or that such work products will be

accepted by any legal or regulatory body.

Waivers. Those viewing this presentation hereby waive any claim at any time, whether

now or in the future, against ICF, its officers, directors, employees or agents arising

out of or in connection with this presentation. In no event whatsoever shall ICF, its

officers, directors, employees, or agents be liable to those viewing this presentation.

© 2013 ICF International. All rights reserved.

2

Contents

Overview

Shale Gas Development

Shale Gas Development Impediments

Gas Pipeline Infrastructure

LNG Imports and Shale Development Impact

Conclusion

© 2013 ICF International. All rights reserved.

3

Overview – China’s Shale Estimate

48 Major Shale Gas Basins in 32 Countries

According to the U.S. EIA, global technically recoverable shale gas resources (based on

assessment in 32 countries) total 6,622 Tcf, the equivalent of 60 years of 2008 worldwide

natural gas consumption. More accurate number would be 12,000 Tcf for whole world.

The EIA estimates that China holds 1,275 Tcf in recoverable shale gas

Overview – Shale Gas Production Technologies

Conventional and Shale Gas Resources

Hydraulic Fracturing Process

Horizontal drilling and hydraulic fracturing have unlocked previously inaccessible

shale gas resources

Shale gas production has steadily risen over the past decade through use of these

upstream technologies (U.S. shale gas production now makes up 33% of total U.S.

gas production)

Shale gas wells are drilled 8,000-12,000 feet down and then laterally 3,000-10,000

feet

Contents

Overview

Shale Gas Development

Shale Gas Development Impediments

Gas Pipeline Infrastructure

LNG Imports and Shale Development Impact

Conclusion

© 2013 ICF International. All rights reserved.

6

Shale Gas Development – Shale/ CBM Basins

China has seven major

onshore shale basins thought

to contain shale gas, just two

(Sichuan in the southeast and

Tarim to the northwest) are

suited for near-term

commercial development.

China’s shale and CBM

basins are widely distributed,

China’s shale gas production

remains limited to

experimental well drilling in

the Sichuan basin, with

aggressive plans for future

development.

Current activity in Sichuan

Basin (60 shale gas wells

completed).

7

Shale Gas Development – Current Estimates

Shale, tight, and coalbed

methane

Some areas also have tight oil

potential (including Ordos

Basin)

Most of the resource is in

Sichuan Basin region; similar

geologic age to Marcellus

Shale

Region

Basins

Basin Type

Age

Area (sq

km)

Yangtze Region

Northern China

Northwestern China

Western China

Total

Sichuan, Yunnan, Jiangnan

Ordos, Bohai

Junggar, Turpan

Tarim

Cratonic

Cratonic

Foreland

Depression

S, D

C, P

P, J

K, N

900,000

600,000

700,000

500,000

8

Mean

Recoverable

(Tcf)

447

191

206

212

1,056

Shale Gas Development – Current Status

Most current/near term activity in Sichuan

Basin

60+ shale gas completions to date; no

commercial production, but commercial

scale well rates (up to 5 MMcfd for

horizontals and 1.5 MMcfd verticals)

achieved.

Government forecasts of up to 2.8 Tcf

shale production by 2020; “large scale”

commercial prod. forecast by EOY 2015

Date

International

Companies

NOCs

Activity

Oct-07

Newfield

CNPC

Shale gas joint Weiyuan Block,

study

Sichuan

Completed

in 2008

Nov-09

Shell

CNPC

FushunShale gas joint

Yuangchuan

assessment

Bock, Sichuan

Ongoing

Kaili Block,

Shale gas joint Guizhou;

Sinopec

Ongoing

assessment

Huangqiao Block,

Jiangsu

BP

May-09

Statoil

CNPC

Shale gas joint

Sichuan

study

Negotiation

3Q 2010

Conoco

Phillips

CNPC

Shale gas

Sichuan

Pening

4Q 2010

Chevron

Sinopec

Shale gas

exploration

Longli Counti,

Guizhou

Ongoing

Jul-05

Shell

CNPC

Jul-11

ExxonMobil

Sinopec

Shale gas joint Wuzhishan-Meigu

Ongoing

study

Block, Sichuan

Jul-11

ENI

Sinopec

MOU covering

N/A

shale gas

Active Companies: Shell/CNCP

―

―

$2B shale gas capex expected

through 2013; had completed 24 wells

by Nov. 2012; major decision middecade

production sharing contract recently

approved; the first in China for shale

gas

Status

Jan-10

SINOPEC plans 38 MMcfd of shale gas by

2014

Government gas price subsidies for shale

of $1.83 per Mcf; current wellhead price of

about $5.30 per MMBtu; drilling costs of $5

- $12 million per well

Location/Basin

Source: Gao, 2012)

Tight/shale gas Jinqiu Block,

exploration

Sichuan

Ongoing

N/A

9

Shale Gas Development – Production Forecasts

China’s natural gas use made up 4

percent of the energy mix in 2011, though

the most recent 12th five-year plan has a

goal to increase the share of natural gas

to 10 percent by 2020.

Demand currently exceeding production

Government forecast of 8 Tcf/y demand

by 2015 (5 year plan)

China’s National Energy Administration

has a goal of annual shale gas

production of 228 bcf (6.5 bcm) by 2015

and 2.1 Tcf (60 bcm) by 2020, an

ambitious goal, given the experimental

stage of Chinese shale gas drilling and

the technological/geological issues

Production of China’s unconventionals

could alter the recent dynamic of

increasing LNG imports

10

Contents

Overview

Shale Gas Development

Shale Gas Development Impediments

Gas Pipeline Infrastructure

LNG Imports and Shale Development Impact

Conclusion

© 2013 ICF International. All rights reserved.

1

Shale Gas Development Impediments

Potential challenges to shale gas production include limited pipeline access,

water access, limited technical knowhow, lack of sufficient regulatory

enforcement, and geological issues (e.g., deeper formations than those in the

U.S.)

Topography

Depth

Non-marine in NE areas

Water availability

Population density

Infrastructure

Wellhead prices

Environmental Issues

Water: fracking fluid content, chemical

use/reporting, groundwater contamination,

excessive water use, wastewater

treatment/disposal

Air emissions and climate: methane

leakage, other VOCs, drilling equipment

emissions,

Lifecycle emissions: methane emissions

limit environmental gains from natural gas

use

Contents

Overview

Shale Gas Development

Shale Gas Development Impediments

Gas Pipeline Infrastructure

LNG Imports and Shale Development Impact

Conclusion

© 2013 ICF International. All rights reserved.

1

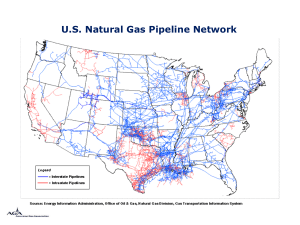

Gas Pipeline Infrastructure – Total Pipelines

As of 2010, China’s total gas pipeline

mileage totaled 24,000 miles, which

includes a gas pipeline network from

Kazakhstan that connects to the

West-East pipeline from Kazakhstan

to Shanghai, a substantial source of

gas for China. China has plans to

develop other West-East pipelines, as

well.

Gas Pipeline Systems

Gas pipelines are owned by the

state

Shale gas likely to require new

lines/expanded capacity

CNCP controls pipelines; may not

allow third party access

Source: EIA, 2012

14

Contents

Overview

Shale Gas Development

Shale Gas Development Impediments

Gas Pipeline Infrastructure

LNG Imports and Shale Development Impact

Conclusion

© 2013 ICF International. All rights reserved.

1

LNG Imports – Terminals

LNG Import Terminals in China

2012

Imports 1.9

bcfd

Existing

terminal

capacity 2.9

bcfd

2.1 bcfd now

under

construction.

Source: Poten & Partners, 2010

Adding in

planned

terminals

would bring

total capacity

[E+UC+P] to

11.2 bcfd.

16

LNG Imports – Global LNG Trade Forecasts

World LNG Demand Forecasts

Historical World LNG Imports by Region (2004-2011)

90

35

ICF

Range

Facts

Global

70

CERI

Poten

60

30

LNG Imports (bcfd)

LNG Demand (bcfd)

80

25

20

15

JKT

50

10

Credit S.

40

5

30

2011

2015

2020

2025

2030

2035

0

2004

Europe

North

America

2005

2006

2007

2008

2009

2010

LNG import demand exceeded 30 Bcfd in 2011, and is expected to grow another 39 to 57

Bcfd by 2035. Wide range of estimates on China’s LNG demand.

2011

LNG Imports – Global LNG Trade Forecasts

Supply Curve of LNG Supply Projects under Construction or Proposed

$15

$14

F.O.B. LNG Cost ($/MMBtu)

$13

$12

$11

$10

$9

$8

All

Non US

US

$7

$6

$5

$4

-

10

20

30

40

50

Bcfd of LNG Export

60

70

80

Globally, roughly 63 non-U.S. LNG export projects are underway or in the planning phase, with an

estimated total capacity of 50.5 Bcfd; other projects are expected, as well

Just as U.S. unconventional production is expected to make a significant impact on global LNG

markets, China’s successful unconventionals development could fundamentally alter global LNG

trends.

Contents

Overview

Shale Gas Development

Shale Gas Development Impediments

Gas Pipeline Infrastructure

LNG Imports and Shale Development Impact

Conclusion

© 2013 ICF International. All rights reserved.

1

Conclusion

China’s current estimates for unconventional gas resources are

significant, with current development seen in selected basins

Successful development of China’s unconventional natural gas

resources could alter the country’s energy mix and international LNG

trade trends, similar to trends seen in U.S. gas development

However, China’s energy growth needs and low starting base for natural

gas consumption could mean limited effects on international natural gas

trends, as domestic demand could still significantly outpace domestic

production

Impediments, including water usage and geological uncertainties mean

that China’s successful unconventional gas development remains

unclear