MENSILIN HOLDINGS Sdn. Bhd Main plant - Biomass-SP

advertisement

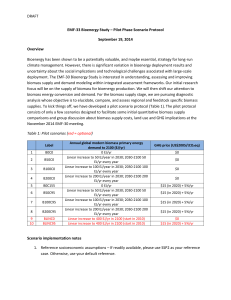

Challenges in Bioenergy Project Rollout in Malaysia Presentation by Ir. Mohamad Adan Yusof Mensilin Holdings Sdn Bhd 27 April 2010 Urgency to develop national economic models that incorporate climate protection and biodiversity management as part of strategies to alleviate global warming. Imminent need to switch fast to renewable energy to mitigate the impact of rising fossil-fuel cost on the economy, as well as avert the negative implications of depleting mineral resources, on top of reducing greenhouse gas emissions The main appeal of renewable energy that it does not cause pollution, can be derived from abundance of byproducts / wastes generated from palm oil and forest industries naturally replenishable resources such as solar, wind, hydro, wave and geothermal heat, is Electricity generation in Malaysia is still largely dependent on fossil fuels - coal, oil and natural gas account for around 85% of total electricity generation in the country Renewable resources make up only around 1%. Major drivers Bad experiences Financing •Price of RE electricity •Always lagging project development costs •Regulatory impediment •DOE – different interpretation with different bosses •Government subsidy removal U-turn •Failed projects (biodiesel, biomass) •Undermining overall confidence in bioenergy •Underperforming projects and NPLs •Economic upheavals strangle projects •Banks have yet to develop an appetite for bioenergy •Projects are undertaken by SME with poor credit worthiness Price of RE electricity – PPA issues Regulatory impediment •Always lagging project local development costs •No economic case to support project financing •Process of PPA is still long winded •Bio energy cost increased due to escalation in transport cost •Mismatch of expectation between financial Institution and small players •DOE – different interpretation with different bosses •Biomass projects are considered heavy industry and polluting – Not True •Promotion by government negated by others – No coherent effort •Government subsidy removal U-turn •Government reinstated gas and petroleum subsidy Mar 09 •RE projects becomes less attractive and relegated Failed projects (biodiesel, biomass) Underperforming projects and NPLs Success stories are limited •Undermining overall confidence in bio energy •Very few biodeisel manufacturers are making money •Failed projects – tsunamied new initiatives •Bio energy projects struggled to adapt to violent rapid changes •Global economic upheavals strangled bio energy projects •Lack of new capitals •Large bio energy companies in Europe collapse with the recent economic crisis •Banks very skeptical of bio energy projects •Still a pipe dream •Huge unleashed potential subdued Banks have yet to develop an appetite for bio energy Projects are undertaken by SME with poor credit worthiness • Commercial banks are still unaware of potential • Bioenergy poor performance has induced negative perception • Risks are amplified due to economic instability • SME do not command large funds • Banks are less merciful to SME (and so is DOE) • Low credit rating means high financing costs Growing market for CER and GHG emission trading Demand for fundamental GHG projects growing Spillover from China, Brazil and India New players in the market seeking projects Oil fluctuations and market realignment New government polices on Green Technology Opportunities – Emission Trading Market Exponential Growth USD 164b in 2008 Growing market for CER and GHG emission trading Exchanges are sprouting to trade CER Chicago Carbon Exchange – CCX Tianjin Carbon Exchange USA new administration pro GHG market Demand for fundamental GHG projects growing •Emission trading creates demand •Fundamental projects are sought after •CER post 2012 are being contracted •International funds seeking projects Spillover from China, Brazil and India Investors seeking new fields in south east Asia Growth in China creates new confidence for Greenfield projects in Malaysia Growing market for CER and GHG emission trading Demand for fundamental GHG projects growing Spillover from China, Brazil and India New players in the market seeking projects Oil fluctuations and market realignment New government polices on Green Technology Large Scale Implementation as a stimulus package Mainstream RE into the energy portfolio Provide funding to projects – a stimulus package Introduce GLC led implementation Address the challenges Economies of scale • Implementation has the opportunity to reduce unit cost Credit worthiness •GLCs are readily bankable Major player and major resources •Proper implementation agenda •Policy & programmes can be synchronised Bioenergy from POM (major inherent bioenergy asset) •Integrated waste management system •Biomass power – 5 Mwe •Biogas power – 1 Mwe •No of POM = 400 •Total distributed generation potential = 2,400 Mwe •Investment per MWe = RM 10 million •Total injection into rural economy = RM 24 billion Impact of National Savings •Avoided gas generation = 2400MWe x 8000h •GHG reduction = 2400x8000x0.6 = 11,520,000 tonCO2e •Savings from NG subsidy ; assuming 1kWh = RM 0.30 •2400 x 8000 x 300 = 5,760,000,000 RM/year •National Payback: 24/5.76 = 4.2 years Rural Electrification Rural Industrialisation •Using bioenergy as a tool for improving RE •Anchor tenant – palm sludge diesel •Small gasification plants for isolated areas •Distributing power from bio energy centres •Other tenants – cottage industry •Supports the ECER, poverty alleviation, Millennium goals, green technology policies Rural per capita income increased through employments created Fabrication and manufacturing industry stimulated Rural electrification objectives achieved IHL research and development accelerated Potential regional export for Bio energy technologies MENSILIN HOLDINGS Sdn. Bhd Main plant: PLO 481, Jalan Besi Kawasan Perindustrian Pasir Gudang 81700 Pasir Gudang, Johor D.T. MALAYSIA Tel .: +607 252 6235 Fax: +607 252 0237 Business office: 73, Jalan 7/132 Gasing Indah 46000 Petaling Jaya, Selangor D.E. MALAYSIA Tel: +603 7785 0396 Fax: +603 7785 0397 17