edga r higuera

advertisement

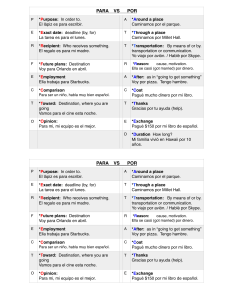

Intermodal Transportation in Colombia Sustainable Growth EDGAR HIGUERA Manager Logistics, Transportation and Infrastructure Management Office Bogotá, Octubre 23 de 2014 Atlantic Ocean Population: 47.121.089 1.600 km Economy Venezuela Panamá - GDP (current US$): 378,15 Billion (30th of the world) 266 km 2.219 km - GDP per capita (current US$) : 7.826 Foreign trade - Exports (current US$) : 67,11 Billion Pacific Ocean - Imports (current US$): 74,41 Billion 1.300 km Surface: 2.129.748 km² - Continental: 1.141.748 km² - Maritime: 988.000 km² Ecuador : 586 km Brasil Land border: 6.342 km Sea border: 2.800 km South America Perú 1.626 km 1.645 km Current Trading Integration 55 economies that represent 52,3% of the world GDP and an enlarged market of 1,5 billion people Colombia has 10 sea terminals that sirven 34 routes through 42 shipping companies Colombia has 2965 landing points in143 countries Fuente: Proexport y MCYT Signed Agreement Existing Agreement Memo of understanding With a close relation with transportation Cargo traffic in Colombia Vs GDP 50.00 En épocas de auge económico, el trafico de carga crece a tasas superiores y en épocas de recesión , el trafico decrece más rápido. 40.00 VARIACIONES ANUALES % 30.00 20.00 10.00 0.00 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 -10.00 -20.00 -30.00 Variación Trafico Portuario de Carga Variación PIB Real Fuente: Ministerio de Transporte, Supertintendencia de Puertos y Transporte, DANE - Construcción ANDI * Cifras de Movimiento de Carga terrestre a partir de 2009 son estimadas con base al incremento de la producción industrial EOIC - ANDI ** Cifra de trafico terrestre de Encuesta Origen – Destino 2014 Variación Trafico Terrestre de Carga * 2013** However our competitiveness index is increasing slowly and…. Índice de Competitividad Global - FEM Posición General ICG # Paises de Estudio Posición Relativa 2006 -2007 2007 -2008 65 69 125 131 48% 47% Evolución en la posición de Colombia 2008 -2009 2009 -2010 2010 -2011 2011 -2012 74 69 68 68 134 133 139 142 45% 48% 51% 52% Fuente: Global Competitiveness Report 2014-2015 - Foro Económico Mundial 2012 -2013 69 144 52% 2013 -2014 69 148 53% 2014 -2015 66 144 54% And we’re highly dependent on road transportation Miles de Toneladas AÑO Fuente: Ministerio de Transporte Evolución 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 TERRESTE FERREO FLUVIAL AÉREO CABOTAJE TOTAL 82,841 13,645 2,890 140 3,700 103,216 86,741 14,616 2,634 140 4,000 108,131 71,168 16,335 3,062 142 4,324 95,031 89,399 17,206 2,755 139 3,997 113,496 84,350 22,621 3,049 119 4,009 114,148 77,674 25,402 3,735 134 1,385 108,330 73,034 31,170 3,802 100 797 108,903 100,284 33,457 3,069 104 720 137,634 84,019 31,032 3,480 122 532 119,185 99,782 42,781 3,725 132 928 147,348 117,597 46,182 4,211 129 588 168,707 139,646 49,227 4,863 135 400 194,271 155,196 49,708 4,025 138 509 209,576 183,126 53,204 4,563 137 454 241,484 169,714 58,472 4,953 123 372 233,634 173,558 59,398 4,070 109 364 237,499 181,021 67,025 3,691 119 353 252,209 191,701 74,554 3,650 124 199,369 76,800 3,474 127 388 280,158 220,309 76,781 2,968 149 774 300,980 Fuente: Ministerio de Transporte ND 270,029 Currently there are infrastructure conditions to allow multi or intermodal transportation on the following corridors: •Bogotá –Caribe (road, train, river) •Bogotá –Cali –Buenaventura (road + train) CORREDORES LOGISTICOS Operating road concessions RIOHACHA PARAGUACHON SANTA MARTA BARRANQUILLA VALLEDUPAR CARTAGENA SAN PELAYO CARMEN DE BOLÍVAR SINCELEJO 5,176 Km (O- D) Total SAN ROQUE Achí NECOCLÍ MONTERÍA PALO DE LETRAS San Marcos CAUCASIA Simití CÚCUTA Pamplona PTO CARRENO SOGAMOSO ZIPAQUIRA PEREIRA GIRARDOT BUGA VILLAVICENCIO CALI PASTO 600 Km of dual highway constructed 2010 - 2014 2, 400 Km of dual highway to be constructed until 2016 World competitivity index New road concessions RIOHACHA PARAGUACHON SANTA MARTA Cuestecitas BARRANQUILLA Buenavista San Juan Ponedera VALLEDUPAR CARTAGENA La Paz Cruz del Viso Toluviejo Carreto + 42 New projects CARMEN DE BOLÍVAR SINCELEJO SAN PELAYO SAN ROQUE AchíAguachica NECOCLÍ MONTERÍA San Marcos Aguaclara Planeta Rica PALO DE LETRAS CAUCASIA Simití El Tigre CÚCUTA B/MANGA Pamplona BARRANCAB. REMEDIO S Santa fé de Ant. Túnel de Occidente ARAUCA PTO CARRENO Pto. Berrío TAME MEDELLÍN Camilo C Barbosa Bolombolo SOGAMOSO SOGAMOSO La Manuela MANIZALES PTO. SALGAR TUNJA ZIPAQUIRA VILLET Sopó Sisga EL SECRETO CARTAGO BOGOTA ARMENIA GIRARDOT TULUÁ Pto. Arimena CALERA Cáqueza IBAGUÉ PUERTO GAITÁN ESPINAL BUENAVENTURA YOPAL A PEREIRA VILLAVICENCIO BUGA Granada CALI STDER. QUILICHAO Victorias Tempranas (611 Km) In bidding process Centro – Sur (567 Km) Centro – Occidente (618 Km) Centro – Oriente (1882 Km) Norte (1335 Km) Cordillera oriental (2766 Km) Autopistas de la Prosperidad (1139 Km) In bidding process NEIVA POPAYÁN 8.918 Km in Total CHACHAGÜÍ PASTO MOCOA USD$ 23 billion to invest* 500.000 jobs * Estimated amount. It may vary. Current Concessions + 4G Concessions RIOHACHA PARAGUACHON SANTA MARTA Cuestecitas BARRANQUILLA Buenavista San Juan Ponedera VALLEDUPAR CARTAGENA La Paz Cruz del Viso Toluviejo CARMEN DE BOLÍVAR SINCELEJO SAN PELAYO La Yé NECOCLÍ MONTERÍA SAN ROQUE AchíAguachica San Marcos Aguaclara Planeta Rica PALO DE LETRAS - USD$1.18 billion saving per operation costs Carreto CAUCASIA Simití El Tigre CÚCUTA BARRANCAB. REMEDIO S Santa fé de Ant. Túnel de Occidente B/MANGA Pamplona ARAUCA PTO CARRENO Pto. Berrío TAME MEDELLÍN Camilo C SOGAMOSO SOGAMOSO La Manuela PTO. SALGAR ZIPAQUIRA VILLET Sopó A MANIZALES YOPAL EL SECRETO CARTAGO Pto. Arimena CALERA BOGOTA ARMENIA GIRARDOT IBAGU É Cáqueza PUERTO GAITÁN ESPINAL VILLAVICENCIO VILLAVICENCIO BUGA BUENAVENTURA TUNJA Sisga PEREIRA LA PAILA - USD$7.78 billion saving per carbon emissions Barbosa Bolombolo Granada CALI CALI STDER. QUILICHAO POPAYÁN NEIVA Current New 4G CHACHAGÜÍ PASTO MOCOA Project: Recovery of River Magdalena’s navegability General Extension: 908 KM. Sector: Transport Total costs: USD 1.25 billion Unidades Funcionales UF Alcance Entrada en Operación UF1 Bocas de Ceniza-la Gloria 2015 UF2 UF3 UF4 La Gloria –Barranca Barranca-Puerto Berrio Puerto Berrio-Puerto Salgar 2015 2021 2021 The aim of this Public and Private Association is to recover the Magdalena River as a main cargo transport way through the chanelling and maintenance of the canal. Benefits of intermodal and river transportation Minimizes waiting times at transshipment points and congestion Convoy de 7.200 ton Minimizes risks (citizen safety, accidents, 225 Camiones, equivales a una fila de 5 km uno detrás de otro stroke prevention, deaths) Reduces documentation and formalities. Lower carbon print Public health Optimizes the use of land 180 vagones de 40 ton Environmental Benefits Studies were used as a baseline for decision making Dredging has always been managed by Environment Management Plan Hydraulic works environmentally friendly. Neither marshes interventions nor overflowing areas There are funds for environmental compensations. Incentive for a change in the Corredor de Transporte transportation mode in Colombia Multimodal The reduction in carbon dioxide emissions program, leaded by CORMAGDALENA with the support of the French government and the Centro Centro Andino para la Economía en el Medio Ambiente will achieve its goal stimulating two practices: (a) Changing the road transportation to river transportation (b) Modernizing the naval fleet, promoting the purchase of high efficient naval fleet, the use of dual fuel, use of natural gas, hybrid motors (dieselelectric), and hopefully someday only solar and electric. 15 Ongoing challenges in Colombia • Make use of other hidrografic basins • Regulate intermodal transportation • Manage operative/commercial changes • Sustainable managing of the river • Information systems Fluvial Master Plan Estrategia para desarrollar actividades fluviales de la Nación, teniendo en cuenta la caracterización de ríos más representativos, terminación estimada Dic/2014 Colombia – Netherlands Water Alliance FLUVIAL MASTER PLAN Public sector reen Fluvial Transportation Infrastructure FUNDING Fluvial mode development support Operational Framework Marketing Strategy THANKS! Logistics, Transportation and Infrastructure Management Office Bogotá - Calle 73 No. 8-13, Phone: 571- 3268500 ext. 2240 - 2226 ehiguera@andi.com.co emaldonado@adi.com.co