LOCAL ECONOMIC DEVELOPMENT STRATEGY

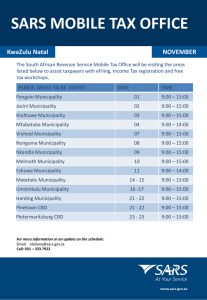

advertisement

PRESENTATION TO THE NCOP LOCAL GOVERNMENT WEEK BY SISONKE DISTRICT MUNICIPALITY 31 July – 3 August 2012 SISONKE DISTRICT MUNICIPALITY THE GLOBAL CONTEXT THE ENVELOP WITHIN WHCH WE HAVE TO RESPOND Prospects for global growth are being seriously compromised by the sovereign, banking and liquidity crises affecting the Eurozone. The global crisis Investors have been moving to assets perceived to be safer, especially US treasuries and German bonds, despite the miniscule returns. If effective steps towards a lasting solution are not taken swiftly, a catastrophic chain of events could be set off by one or more of the states in crisis, possibly Greece, in the not too distant future. The consequential economic costs could be enormous and widespread. The global challenge Serious structural adjustments are absolutely necessary, so as to enhance the competitiveness of these economies and restore their financial stability. However, protracted economic contraction, followed by stagnation, is likely to result in escalating social unrest. Growth stimulation is thus essential to take the weaker states out of crisis mode. Vulnerability of the global economy The vulnerability of the global economy to external shocks is being increasingly exposed and global growth rate is becoming rather anaemic. China, in turn, is again implementing growth stimulating measures in order to counter the possibility of a worse than anticipated slowdown. Weak international demand as well as insufficient local consumption Weak international demand as well as insufficient local consumption, are compromising country’s ability to continue posting the growth rates required to maintain socio-political stability. Countries are using monetary policy to ease global economic challenges and infrastructure spending again accelerated. However, the long-term recipe lies in a better balance between investment activity and household spending, as well as between external and domestic demand. South Africa’s very open economy makes it particularly vulnerable to external shocks. The sluggish recovery in parts of the advanced world and stagnation or recessionary conditions in others, are among the strongest inhibitors of economic activity at home. Europe accounted for approximately 26% of South Africa’s merchandise exports in 2011 and weakening demand in this regional market does not bode well for export-oriented sectors, particularly manufacturing. Critical as it is to reduce unemployment levels, particularly amongst South Africa’s youth, it has proven extremely difficult to reverse the large job losses incurred since the onset of the crisis. Comparing the opening quarter of 2012 with the losing quarter of 2008,significant net gainers of jobs were: the government and community services sector, financial services, – whilst manufacturing, which has shed the largest number of jobs at the broad sector level, is still facing difficult trading conditions and excess production capacity in several of its sub-sectors. Implications for RSA • The very difficult situation in the Eurozone, if prolonged in an unresolved manner, will continue posing a drag on South Africa’s economic growth beyond the near-term, with the adverse impact magnified if the crisis intensifies or, in a worst case scenario, spirals out of control. Structural unemployment South Africa has an acute problem of youth unemployment that requires a multi-pronged strategy to raise employment and support inclusion and social cohesion. High youth unemployment means young people are not acquiring the skills or experience needed to drive the economy forward. This inhibits the country’s economic development and imposes a larger burden on the state to provide social assistance THE ROLE OF SISONKE DISTRICT MUNICIPALITY IN STIMULATING LOCAL ECONOMIC GROWTH AND JOB CREATION SISONKE DISTRICT NATIONAL POLICY CONTEXT PSEDS-Provincial Spatial Economic Development Strategy PGDS-Provincial Growth Development Strategy NDP-National Development Plan NGP-New Growth Path NIPF-National Industrial Policy Framework Our LED Policy Context LED STRATEGY 2012 With clearly identifiable objectives, with outcomes and outputs defined, with times frames ranging from 3 to 5 years. INDUSTRIAL STRATEGY 2012 Focused on agriculture, tourism, trade and social services TRADE STRATEGY identified: soybean, sugar cane, maize, citrus fruit, tomatoes, potatoes, beef, poultry, dairy and wood products as viable commodities for investment, development and expansion BUSINESS RETENTION AND EXPANSION Local procurement opportunities and business support Tender advise SMME STRATEGY AND 2ND ECONOMY INTERVENTIONS Focused on Cooperatives, especially financial services cooperatives, social enterprises, youth enterprises and small business COORDINATION OF STRATEGIC DEVELOPMENT INTERVENTIONS Coordinated spatial planning and development interventions through IGR structures such as the Mayor`s forum, the municipal managers forum, etc. Joint Investment Attraction through a “one-stop-shop” as “information clearing house” on development applications A balanced strategy focusing on urban sprawl and rural decay Small towns regeneration program focused on primary and secondary nodal economic hubs A functional Geographical Information System which gives spatial location of our economic development interventions Share development planning capacity Our approach to co-ordination in achieving economic geography Effective use of IGR Structures Mayors forum, chaired by the District Mayor Municipal managers forum, chaired by the District MM Development Planning and Local Economic Development, chaired by one of the local MM’s Chief Financial Officers, chaired by an MM Building Social partnerships Annual LED Summit with resolutions integrated into the IDP/LED & SDBIP District LED & Tourism Forum (govt., business, labour and civil society) MOU’s with commodity organisations such as Milk SA, Potatoe SA, Forestry SA Business Retention and Expansion Forum Economic performance and key economic indicators of the District Economically Active Population EAP as % of total population: Income and Employment Position: Economically Active Population 17% 16% % of residents The District was the third highly economically inactive in the province after uMkhanyakude and uMzinyathi Only 15 percent of the total population in the Sisonke District Municipality was considered part of the EAP with just under 75707 District Municipality residents identified as EAP Men make a far higher proportion of the EAP and that economic activity in the district is still dominated by men. 18% 15% 14% 13% 12% 11% 10% 1996 1998 2000 2002 2004 2006 2008 2010 Income and Employment Position: Income Inequality 25,000 20,000 No. of households Inequality is also a problem with research evidence suggesting a wide income gap, one of widest income gaps in the province. Nearly 80 percent of all Sisonke District Municipality workers earn 1600 rand per month or less while over 40 percent report earnings of 800 rand per month or less 67 percent of households earned less than R42 000 a year while more than a third reported earning less than R18 000 a year. Annual household income: Sisonke District Municipality: 15,000 10,000 5,000 0 The number of district residents who could be classified as ‘poor’ was almost 350 000. If poverty is considered as part of a share of population than the District municipality has seen its poverty share decrease from a 2001 high of 74 percent to 66 percent in 2010. Limited purchasing power of district residents creates barriers for local economic expansion and development Percentage of residents living in poverty: Sisonke District Municipality, 76% 74% 72% % of residents living in poverty Income and Employment Position: Poverty Indicators 70% 68% 2010 (66.6%) 66% 64% 62% 60% 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Income and Employment Position: Job Creation 50,000 No. of unemployed residents Unemployment has declined significantly since 2007 when district unemployment was located at 55 percent to less than 25 percent in 2010 The official definition of unemployment is failing to capture a significant number of district residents who have exited the job market out of fatigue at their failure to find work but are still willing to work Using the expanded definition of unemployment –the unemployment rate for the district can be more accurately be represented at sitting at the 48-50 percent mark Number of unemployed residents: Sisonke District Municipality, 1996-2010 45,000 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Share of employment by industry: Sisonke District Municipality: 2010 Income and Employment Position: Where are the jobs? More than 52 percent of the employed in Sisonke District Municipality worked in low or unskilled occupations, 22 percent in elementary occupations. For those residents who are employed, the vast majority worked in the public sector – community service industry – and the agriculture sector. Together these two sectors accounted for more than 72 percent of total employment in the district Community services 37% Agriculture 34% Trade 13% Finance 5% Transport 2% Mining 0% Manufacturing Electricity 7% Construction 0% 2% Income and Employment Position: Where have the jobs been? Number of residents employed in the formal sector: Sisonke District Municipality, 13,000 11,000 In 2010 there were almost 11000 district residents employed in the community service industry –an increase of almost 60 percent since 1996 Agricultural employment –in the district has declined in real terms since 2002 Retail and wholesale trade industry which currently employs more than 3700 residents and has been steadily growing since 2005 9,000 7,000 5,000 3,000 1,000 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 1 Agriculture 2 Mining 3 Manufacturing 4 Electricity 5 Construction 6 Trade 7 Transport 8 Finance 9 Community services Economic Position: Gross Domestic Product (GDP) Growth 4,500,000 Constant 2005 prices (R 1000) 4,000,000 2011, R3 453 387 3,500,000 3,000,000 2,500,000 2,000,000 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 The GDP, in real terms, for the Sisonke District Municipality increased from R2.578 billion in 1996 to R3.361 billion in 2010 –an increase of more than 30 percent The financial recession of the 2008/2009 resulted in a significant reduction in growth rates with negative growth reported for the period 2009. Analysts predicted that, however, in the period 2010-2015 economic growth in the district will slowly return to pre2008 levels. Gross Domestic Product (GDP): Sisonke District Municipality, 1996-2015 Economic Position: Gross Domestic Product (GDP) per capita Growth Real GDP-R per capita for the Sisonke District Municipality, 1996-2015 8,000 7,000 Projected 2011-2015 Constant 2005 Prines (Rands) The data shows that since 2000, average output per person in the district has been grown. The financial recession 2008/2009 in particular has caused GDP-R per capita to stagnant during the period 20082011. Analysts predict a return to growth in 2012 and believe that GDP-R per capita might reach R7508 per person in 2015. 6,000 5,000 4,000 3,000 2,000 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 Economic Position: Annual Growth Rates Trend Analysis Annual growth rate: Sisonke District Municipality, 1996-2015 10% 8% Agriculture 2008: 13.8% 6% 4% 2% -2% -4% -6% -8% -10% Agriculture Manufacturing Trade Total Industries 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 0% 1997 Constant 2005 prices District economic growth rates are linked to the growth rates of the district’s agriculture sector 2008/2009 resulted in a significant reduction in growth rates for the agricultural sector with negative growth reported for the period 2009 Manufacturing in the district has suffered an even more severe decline than manufacturing since 2008/2009 –in 2009 the manufacturing sector in the district experienced a negative growth rate of more than 8 percent OUR INDUSTRIAL STRATEGY AND KEY ECONOMIC SECTORS Prime Economic Sector: Greatest Agricultural Potential The District Economy is primarily linked to Agriculture The District is particularly fertile and is well known for high agro-ecological potential due to an abundance of high quality soils, high altitude, and abundant water. Diverse climatic conditions make the area suitable for a variety of products including crops and vegetables, livestock and sugar cane around Ixopo/ Highflats area. Environmental constraints/threats Intensification of agriculture, afforestation and growing local demand may have potential dangers for future agribusiness Strain put on the local water ecology Soil degradation Growing demand of urban centres for resources The main enterprises for which the District is suitable include: Intensive livestock enterprises such as dairy Horticulture crops The key challenges faced by agriculture in the Sisonke District today include (cont.) Poor infrastructural support (logistics, road and rail infrastructure). Infrastructural development allows for farmers and buyers to link, and in turn, boosts local sales; translating into local economic development; Increasing input costs (animal nutrition, seed, fertiliser, etc.) Poorly defined economies of scale leads to poor farm management, and local agricultural economic planning. The number of commercial farms are decreasing while their farm sizes are increasing, indicating a consolidation of the commercial farming sector. Lack of, or poor agricultural spatial economic planning. Agricultural planning has to be considered at local, regional, and national levels, to effect market flows, infrastructural requirements and rural development. Poor information and knowledge management for improving farming practices among smallholder farmers. All farmers require information and knowledge, to improve and address production challenges. The distribution, collection and storage of required information and knowledge is pivotal to the success of any agricultural sector. Prime Economic Sector: Manufacturing Relatively underdeveloped manufacturing base Products related to agriculture feature strongly in the mediumsized sectors, and dominate small industry activities Competitive advantage in agri-processing the domestic dairy industry the domestic poultry industry District economic development advantages in manufacturing are strategic location, its fixed transport infrastructure, its lowwage workforce and its abundant natural resources Share of manufacturing’s contribution to the district economy: Sisonke District Municipality, 1996-2015 Manufacturing: Economic contribution 15% Projected 2011-2015 13% 11% Sector's share of regional total (%) The manufacturing sector contributed no more than 6.3 percent of the district economy in 2010 which represents a marked depreciation from the late 1990s when the manufacturing constituted 8.5 percent of the district economy. The most important manufacturing industries for the district economy are food, beverages and tobacco products as well as wood and wood products -in other words value added agricultural products. 9% 7% 5% 3% 1% 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 -1% Prime Economic Sector: The Forestry Sector The Sisonke District Municipality has a small but vibrant forestry sector, and the forestry industry is a significant land user in many of the Local Municipal areas of the District with proportionate provision of job opportunities. Forestry stocks largely taken up by SAPPI, Mondi and small scale independent producers such as NCT. Biggest challenge is the availability of wood logs and non compliance to the forestry charter by the forestry companies This has led to the complete collapse of the sawmilling industry and the large-scale job losses The Forestry Sector: The economic contribution –lack of beneficiation In 2010 the forestry sector contributed R 331.329 million to district GDP and constituted more than 8 percent of the district economy. Forestry sector which contributed 10 % of the district economy in 1996 Analysts predict that the sector will decline from 8 percent to 6.6 percent in 2015. Logging has declined as a share of the district economy from more than 10.5 percent in 2000 to less than 8 percent in 2010. Wood and wood products have remained stagnant for much of the period under discussion before declining in 2005. Share of forestry’s contribution to the district economy: Sisonke District Municipality, 1996-2010 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% 2015 2010 Plantations and logging 2005 2000 Wood and wood products 1995 Agro-Processing: Creating Value Added Chains –where opportunities are: Agro-processing is an important segment of the economy and has significant potential as a driver for future economic growth in the district. Issues impacting on agriculture and agro-processing include: Adverse climatic conditions – storms, hail, snow and frost Rugged terrain limits crop production Distances from access to machinery, plant and raw materials supply (Durban and Pietermaritzburg) Distances from established markets and commercial hubs; Economies of scale and volume production inhibit further beneficiation and production of dairy products like cheese and yoghurt. Agro-Processing: Creating Value Added Chains Despite these threats significant opportunities exist for the expansion of agro-processing in Sisonke District Municipality. These opportunities include: Land suitable for deciduous fruits and high value crops Land reform programmes supported by significant public sector investment and parastatal bank loans Arable land and water Globalisation and access to export markets Government support and support institutions, funding, technical advice, research etc New production techniques, tunnel / hydroponics and shaded production Processing, packaging and distribution of local produce – canning, drying, freezing and further product beneficiation Forestry, milling and production of related product INSTITUTIONAL FRAMEWORK FOR LED COORDINATION OUR DEVELOPMENTAL CHALLENGES AND WHAT WE WANT TO ADRESS Market failure Low skills base Low industrial base Reliance on primary agriculture and low agro-processing Informal economy Low fixed capital formation Industrial migration Government limitations Regulatory burden to small business Turnaround time on development applications Capacity to implement high impact investment projects Economic analysis capacity Public sector commitment Budget priorities HOW WE HAVE RESPONDED DEALING WITH STRUCTURAL PROBLEMS IN THE LOCAL ECONOMY Market failure Low skills base: Building new FET College for agriculture Work readiness programme for young people, leverage MIG projects as placement opportunities Training of cooperatives and SMME’s Financial support tru bursaries and scholarships Low industrial base Beneficiation and value addition Corridor development and new commercial nodes Revival of rail link Dealing with market failure Reliance on primary agriculture and low agro-processing Special economic zones Agri-parks or agribusiness development zones Leveraging land reforms for the production of cash crops Investments in high value crops Dealing with market failure Informal economy Regulation, control and development of street trade Informal traders regulatory council Partnership with “muthi” traders for coordinated interventions in health and hygiene Our strategic catalytic interventions Special Economic Zones 20 hector state land earmarked for: Dairy production through share milk scheme Meat production Perennial crops, with special focus on essential oils Cash crop productions, focussed on high value crops Greenhouse gasses through hydroponic farming The use of cooperatives model for packaging 2000 jobs (both direct and indirect) Tourism investment Game parks Accommodation and conferencing Events and cultural tourism Community owned theme lodges Heritage Building capacity of the state to deliver local economic development • Sisonke Economic Development Agency (“the sda”) – Limited Liability Propriety Municipal Owned Entity with a mandate to facilitate high impact projects and facilitate trade and investment between the region and the rest of the world – Specialist capacities such as: investment advisors, project managers, agro-economists, industrial development specialists focused on the implementation of high impact projects. CONCLUSIONS Global economic challenges will confine our LED interventions Area based approach to LED Industrial development approach to LED, that integrate the region to regional and international value chains High Impact vs small scale poverty eradication approach Thank You Feedback: Question and Answer Section