Legal Issues Update - Georgia Association of School Business

advertisement

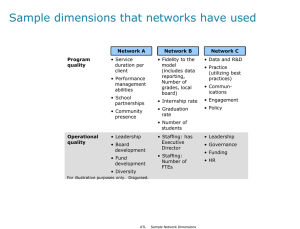

Legal Issues Update November 7, 2013 Presented by: Cory Kirby Harben, Hartley & Hawkins, LLP 1 2014-15 must use evaluation system approved by SBOE Prior written notice required “[M]ultiple, rigorous and transparent measures,” “[G]rowth in student achievement shall count at least 50%” - state assessments, SLOs, multiple additional measures Statute mandates number of meetings, notice of annual evaluation within 5 days, right to request conference with timelines 2 Four new ratings: Exemplary Proficient Needs Development Ineffective S / U / NA no longer used 3 Except as otherwise provided in Code Section 20-2-948, local school systems shall base decisions regarding retention, promotion, compensation, dismissals, and other staffing decisions, including transfers, placements, and preferences in the event of reductions in force, primarily on the results of the evaluations developed as required by this subsection. 4 O.C.G.A. § 20-2-212 on salary: …a teacher shall not receive credit for any year of experience in which the teacher received an unsatisfactory or ineffective annual summative performance evaluation or for the second year in which a teacher receives two consecutive annual summative needs development ratings pursuant to Code Section 20-2-210. May 15th is permanent 5 If two insufficient, Ineffective or Needs Development ratings (or any combo) within the past 5 years = no renewal certificate until deficit is addressed 6 March 1, 2013 = No more annual Ad Valorem or Sales and Use Tax NOW = A one-time tax based on value 7 "(11) For the period of time beginning July 1, 2013, and ending June 30, 2015, sales of motor fuel to public school systems in this state for the exclusive use of the school system in operating school buses when the motor fuel is purchased and paid for by the school system.“ georgiainfo.galileo.usg.edu 8 9 Constitutional amendment to create new 1% sales and use tax For 5-10 years Can expend for: 1. M&O for educational purposes 2. Capital outlay for educational purposes 3. Previously incurred debt i. Must reduce property tax 4. Any combination of the above 10 Not subject to “any sales and use tax exemption with respect to the sale or use of food or beverage.” 11 “The General Assembly shall provide for a reduction of ad valorem taxes on tangible property within the school district or districts with populations of more than 50,000 persons according to the most recent US decennial census implementing such LOST for general educational purposes in each year in which such tax is effective in an amount equal to at least 30 percent of the amount collected from such tax the preceding year.” 12 13-10-4. Lack of previous experience with job of same size no longer necessary to disqualify IF: (1) The bid or proposal is not more than 30 percent greater in scope or cost from the bidder's previous experience in jobs; (2) The bidder has experience in performing the work for which bids or proposals are sought; and (3) The bidder is capable of being bonded by a surety which meets the qualifications of the bid documents for a bid bond, a performance bond, and a payment bond as required for the scope of the work for which the bid or proposal is being sought." 13 Cannot include in documents requirements: a) That offerors enter into prehire agreements with specific companies; or b)That discriminate because offerors wouldn’t enter into such agreements. Can exempt from this process for imminent threat to public health or safety - must hold hearing 14 "(e) When the state invites competitive sealed proposals for a public works construction project and the request for proposals for such project states that price or project cost will not be a selection or evaluation factor, no bid bond shall be required unless the state provides for a bid bond in the request for proposals and specifies the amount of such bond." 15 13-10-70. Public works construction contracts may include both liquidated damages provisions for late construction project completion and incentive provisions for early construction project completion when the project schedule is deemed to have value. The terms of the liquidated damages provisions and the incentive provisions shall be established in advance as a part of the construction contract and included within the terms of the bid or proposal." 16 Requires a Concussion Management and Return to Play policy - Information sheet to parents about nature and risk of concussion - Insist athlete be removed form competition and evaluated if showing symptoms - Can’t return to play until obtain clearance from health care provider 17 (e) This Code section shall not create any liability for, or create a cause of action against, a local board of education, the governing body of a nonpublic school, the governing body of a charter school, or a public recreation facility or the officers, employees, volunteers, or other designated personnel of any such entities for any act or omission to act related to the removal or nonremoval of a youth athlete from a game, competition, tryout, or practice pursuant to this Code section; provided, however, that for purposes of this subsection, other designated personnel shall not include health care providers unless they are acting in a volunteer capacity." 18 Written agreement between the governing authority of a school and a private entity authorizing such entity to access the facilities of a school under the governing authority's jurisdiction for the purposes of conducting or engaging in recreational, physical, or performing arts activity. Agreement must include terms and conditions for use, hold-harmless provision, allow governing authority to revoke at any time, $1 million in liability insurance, and citation to code section. 19 20 Schools authorized to “acquire and stock a supply of autoinjectable epinephrine” with prescription Schools may designate trained “employee or agent ” to be responsible for storage, maintenance, and distribution of stocked epi-pens Employee can administer or give to student for selfadministration, even without student prescription School personnel who in good faith administer or choose not to administer are immune from civil liability for any act or omission to act, unless misconduct is willful or wanton. 21 • O.C.G.A. 20-2-84.3: By June 30, 2015, each local school system must either: • Notify SDOE of its intent to request flexibility pursuant to an IE2 (Investing in Educational Excellence) contract with SBOE, OR • Comply with O.C.G.A. § 20-2-80(b)- (status quo) • O.C.G.A. § 20-2-84.5: IE2 legislation does not apply to charter systems or those in the charter system application process. 22 23 Tiered flexibility based on CCRPI ratings- state would focus its efforts on struggling schools and systems, while allowing successful ones to “continue their efforts unfettered by state oversight.” School systems would be categorized as Category 1, 2, or 3; Category 3-charter systems, which continue as currently Category 2-high performers with certain scores will be free of most state regulations Category 1-all other districts, who remain under all laws and regulations or apply for waivers aligned with strategic plan; subject to strong oversight from SDOE 24 25 (3)(A) “Public benefit” means a federal benefit as defined in 8 U.S.C. Section 1611, a state or local benefit as defined in 8 U.S.C. Section 1621, a benefit identified as a public benefit by the Attorney General of Georgia, or a public benefit which shall include the following: 26 (c) ‘‘State or local public benefit’’ defined (1) Except as provided in paragraphs (2) and (3), for purposes of this subchapter the term ‘‘State or local public benefit’’ means— (A) any grant, contract, loan, professional license, or commercial license provided by an agency of a State or local government or by appropriated funds of a State or local government; and 27 SAVE 28 (4)(A) ‘Public benefit means a federal benefit as defined in 8 U.S.C. Section 1611, a state or local benefit as defined in 8 U.S.C. Section 1621, a benefit identified as a public 29 (i)(A) Adult education; (ii)(B) Authorization to conduct a commercial enterprise or business; (iii)(C) Business certificate, license, or registration; (iv)(D) Business loan; (v)(E) Cash allowance; (vi)(F) Disability assistance or insurance; (vii)(G) Down payment assistance; (viii)(H) Energy assistance; (ix)(I) Food stamps; (x)(J) Gaming license; (K) Grants; (xi)(L) Health benefits; (xii)(M) Housing allowance, grant, guarantee, or loan; (xiii)(N) Loan guarantee; (xiv)(O) Professional license; (R) Retirement Benefits; (xix)(V) State grant or loan; (xx)(W) State issued driver’s license and identification card; (xxi)(X) Tax certificate required to conduct a commercial business; (xxii)(Y) Temporary assistance for needy families (TANF); (xxiii)(Z) Unemployment insurance; and (xxiv)(AA) Welfare to work. (B) Each year before August 1, the Attorney General shall prepare a detailed report indicating any ‘public benefit’ that may be administered in this state as defined in 8 U.S.C. Sections 1611 and 1621 and whether such benefit is subject to SAVE verification pursuant to this Code section. Such report shall provide the description of the benefit and shall be updated annually and distributed to the members of the General Assembly and be posted to the Attorney General’s website: 30 31 (4) (A) "Public benefit" means a federal benefit as defined in 8 U.S.C. Section 1611, a state or local benefit as defined in 8 U.S.C. Section 1621, a benefit identified as a public benefit by the Attorney General of Georgia, or a public benefit which shall include the following: (i) Adult education; (ii) Authorization to conduct a commercial enterprise or business; (iii) Business certificate, license, or registration; (iv) Business loan; (v) Cash allowance; (vi) Disability assistance or insurance; (vii) Down payment assistance; (viii) Energy assistance; (ix) Food stamps; 32 33 Fingerprintfabric.com E-Verify (4) “Physical performance of services” means the building, altering, repairing, improving, or demolishing of any public structure or building or other public improvements of any kind to public real property within this state, including the construction, reconstruction, or maintenance of all or part of a public road; or any other performance of labor for a public employer within this state under a contract or other bidding process. 34 It is the intent of the General Assembly that all public employers and contractors at every tier and level use the federal work authorization program on all projects, jobs, and work resulting from any bid or contract and that every public employer and contractor working for a public employer take all possible steps to ensure that a legal and eligible workforce is utilized in accordance with federal immigration and employment. 35 (4) ‘Physical performance of services’ means the building, altering, repairing, improving, or demolishing of any public structure or building or other public improvements of any kind to public real property within this state, including the construction, reconstruction, or maintenance of all or part of a public road, or any other performance of labor or services for a public employer within this state under a contract or other using a bidding process or by contract wherein the labor or services exceed $2,499.99; provided however, that such term shall not include any contract between a public employer and an individual who is licensed pursuant to Title 26 or Title 43 or by the state Bar of Georgia and is in good standing when such contract is for services to rendered by such individual. 36 Title 26: Food – meat, poultry, dairy, eggs, bread, grains, fish/seafood & soft drinks Drugs and cosmetics/pharmacists at pharmacies Drug abuse treatment and education programs 37 • Accountant • Architects • Athlete Agents • Ga. Athletic & Entertainment Commission • Athletic Trainers • Auctioneers • Barbers • Professional Counselors, Social Workers, and Marriage and Family Therapists; Psychologists • Operators of Billiard Rooms • Professional Boxing • State Board of Cemeterians • Landscape Architects • Librarians • Massage Therapists • Operators of Motor Vehicle Racetracks • Music Therapy • Nurses • Nursing Home Administrators • Occupational & Physical Therapists; Speech/Language Pathologist s & Audiologists • Dispensing Opticians • Optometrists • Pecan Dealers & Processors • Peddlers & Itinerant Traders • Physicians, Acupuncture, Physician Assistants, Cancer and Glaucoma Treatment, Respiratory Care, Clinical Perfusionists, and Orthotics and Prosthetics Practice • Chiropractors • Cosmetologists • Dentists and Dental Hygienists • Disabled Veterans and Blind Persons Engaging in Peddling, Operating Businesses or Practicing Professions • Podiatry • Dealers in Precious Metals & Gems • Ignition Interlock Device Providers • Operators of Private Detective Businesses and Private Security Businesses • Instructors in Driver Training and Operators of Driver Training Schools • Real Estate Appraisers, Brokers & Salespersons • Electrical contractors, Plumbers, Conditioned Air Contractors, Low-Voltage Contractors, & Utility Contractors • Residential & General Contractors • Scrap Metal Processors • Snow Skiing Safety • Persons Engaged in Structural Pest Control • Transient Merchants • Used Motor Vehicle & Used Motor Vehicle Parts Dealers • Dealers in Used Watches • Veterinarians & Vet Technicians • Water and Wastewater Treatment Plant Operators and Laboratory Analysts • Professional Engineers & Land Surveyors • Firearm Dealers • Charitable Solicitations • Funeral Directors & Establishments, Embalmers & Crematories • Geologists • Hearing Aid Dealers & Dispensers • Registration of Immigration Assistance Act • Operators of Hotels, Inns & Roadhouses • Industrial Hygiene, Health Physics, & Safety Profession Recognition & Title Protection • Junk Dealers 38 39 40 41 Many Americans confused about health-care law, poll finds Washington Post - By Sandhya Somashekhar and Peyton M. Craighill, September 20, 2013 42 Important Notice to All Senate Members, Officers and Employees: wsbradion.com The Patient Protection and Affordable Care Act (ACA) contains a provision (Section 1312(d)(3)(D)) that affects the health care coverage of many Senate employees’ beginning in 2014. On August 8, 2013, the Office of Personnel Management (OPM) proposed regulations (which are not final and may be changed) to implement this requirement and establish procedures for affected employees’ enrollment in health insurance plans through the health insurance exchange (the “Marketplace Plans”) under the ACA. The OPM proposed regulations may be found at: http://www.regulations.gov/#!documentDetail;D=OPM-2013-0016-0001. As the OPM Regulations are not final and we are awaiting further information,Members and staff are advised that they should delay enrolling in health insurance plans until we are able to offer further guidance as to how they should enroll in these insurance plans for 2014. Premature enrollment could adversely impact eligibility for the employer premium contribution. As soon as we have additional information, we will provide that to you. In the interim, you are welcome to call the Senate Disbursing Office 43 Next Major Deadline is January 1, 2015 But, does this really mean open enrollment 2014? Substitutes – the 30 hour rule? Can we pay employees to go elsewhere for insurance? Beware the FLSA 44 From Department of Community Health 45 Yes, if you are confident that you can do so in compliance with the DOL’s electronic disclosure safe harbor regulation. Electronic delivery is sufficient when regular access to a computer is an integral part of an employee’s duties. Alternatively, electronic notice may be sufficient if you have an agreement on file with employees in which they have consented to receiving benefit information electronically. Keep in mind that you may meet the requirements for certain groups of employees, but not others. In all cases, ensure you can demonstrate the employee actually received the information. If in doubt, distribute paper copies. See, http://www.dol.gov.ebsa/newsroom/tr1302.html for further guidance. 46 The ACA requires employees to offer healthcare coverage to all full-time employees defined as anyone that works a weekly average of 30 hours in any month. Look-back and stability periods refer to a more practical method for identifying full-time employees other than month to month calculations. The look-back measurement period allows you to look backwards at the average weekly hours actually paid to employees to determine if they should be considered full-time and offered 47 healthcare during a future Stability period. No. Assuming that all salaried employees are already eligible for healthcare coverage, the ACA only impacts healthcare eligibility for a subset of the State’s hourly wage earners. Many agencies hold work hours for these employees below the 29-hour threshold as matter of routine business, and many have already taken steps to eliminate the variable nature of hours worked by these employees to keep the average below 30 hours a week. The decision not to mandate a 29-hour workweek means that compliance with the ACA will n ot be centrally controlled, but the responsibility of each state employer. Specifically, HR leaders will be called upon to manage 48 working hours of non-benefit eligible staff. Since the Oct. 1 rollout of the Affordable Care Act’s health care insurance exchanges, the number of problems facing the experiment in offering health insurance to the uninsured has only increased. Among the latest includes news that employer-based insurance plan cancellations currently outnumber new enrollments in the exchanges’ plans. In addition, the number of companies that opted out of employer-paid health insurance due to increasing cost — including Home Depot, UPS, Trader Joe’s and IBM — has increased. .... http://www.mintpressnews.com/why-are-health-insurance-policies-being-cancelled/171302/ 49 Yes. The standard look-back period will be 12 months. A 12-month look-back period helps to minimize the administrative burden associated with repeated calculation of full-time status; helps to limit enrollment activity; and provides cushion to adjust hours of employees coming close to the weekly average before the measurement period ends. The State’ standard look-back period will be October 16 to October 15 the following year. 50 Possibly, but it is a risk you must manage. There remain many questions surrounding the implementation of the ACA, and specifically related to the impact on temporary staffing agencies. The ACA does not directly address the matter, but it appears that staffing agencies themselves will likely be subject to Play or Pay penalties if they have more than 50 full-time equivalent employees. Traditionally the State has considered employees from different staffing agencies as “leased” labor, and employees of 51 the temporary agency. A number of recent DOL investigations involving employer use of leased staffing have deemed the employer and agency as joint employers resulting in costly back pay settlements. Therefore, agencies should be cautious with this approach and confer with your normal legal advisor to manage this risk if you choose to supplement your workforce using leased employees. As a minimum precaution ensure the temporary staffing agency has agreed to contract to comply with the minimum wage and overtime provisions of the Fair Labor Standards Act, and the ACA provisions to the extent that you, rather than the temporary staffing agency, believe the ACA applies. These considerations have been addressed during the procurement process to secure a new statewide vendor for leased labor. 52 53