Financing First Nation Clean Energy Projects

advertisement

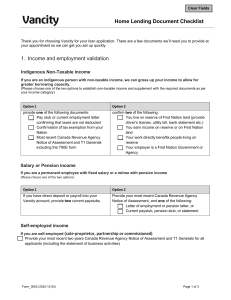

Financing First Nation Clean Energy Projects The Vancity Story Vancity was founded in 1946 to provide financial services to people from all walks of life. Through strong financial performance, we serve as a catalyst for the self-reliance and economic well-being of our membership and community. We are committed to delivering real solutions to help our members and communities achieve their financial goals. Who we are today Vancity has grown to become the largest credit union in Englishspeaking Canada, with more than $17 billion in assets. Vancity serves over 475,000 members through 59 branches located throughout the traditional territories of the Coast Salish People – in Metro Vancouver, the Fraser Valley, Squamish and Victoria. The Vancity Group is committed to a new definition of wealth, where the well being of people and communities is more than simply financial, and by working together we can all thrive and prosper. Strategic Focus Areas • Protecting the Environment • • Helping People Build Assets • • By reducing our impact and promoting solutions to climate change By improving access to financial services and affordable home ownership Strengthening Communities • By strengthening non-profits, social enterprises and investing in targeted communities Building relationships… Vancity Relationship Positioning Community planning activities including establishing community priorities Development of financial options to realize community priorities Positioned to be “top of mind” to provide financial product and services solutions Traditional Relationship Positioning Monitor and support relationship and participate in ongoing community planning Our track record Willing to work on the ground throughout BC • Project finance team has funded $150M in loans funded in last 5 years including 5 power deals • Ability to fund power projects up to $35 million in total cost. Provided debt for: • China Creek Hydro Hupacasath FN Project Canoe Creek Hydro Tla-o-qui-aht FN Project Hupacasath First Nation Upnit Power: China Cre January 2006 -Grand Opening with Chief Judith Sayers China Creek Project Concrete weir/intake pipe – limited environmental impact Twin generators provide redundancy Penstock installation followed by full land “rehab” Tail Race returning water flow to river China Creek – Lessons Learned • • • • Outstanding management – Chief Judith Sayers/CEO Trevor Jones were involved day-by-day. Hupacasath First Nation received critical early funding (Green Municipal Fund, WD, INAC) to complete environmental, hydrology and engineering studies. Conservative capital structure – 70% senior bank debt/30% equity provided safety “margin” when one generator unexpectedly broke down. Ownership structure – first nations, engineering firm, city – created “partnership” to overcome potential issues and roadblocks. Tla-o-qui-aht and Barkley Group Canoe Creek Project Intake structure Looking down the steep section – 60% grade Powerhouse and genset High pressure penstock Canoe Creek – Lessons Learned • • • • • Iain Cuthbert, John Ebell and TFN have built a strong Partnership: • Trust and respect: Shared values on environmental stewardship and business ethic • Collaboration – each brought unique skills and strengths Excellent project management Working with experienced partners: e.g. Hazelwood, Canyon, Vancity/CWB Creative funding sources e.g. Federal stimulus money More projects down the road together… Standard Terms and Conditions Loan to Project Cost Amortization Term Interest – construction Interest during term Security Guarantees Senior Debt Subordinated Debt 75% to 80% with cap 90% to 100% Match EPA or SOP term Same Construction period plus 5 years Same Prime + 1.25% to 3% Prime + 4% and up Prime + 1.25% to 3% or equiv fixed rate Prime + 4% and up (or equiv fixed rate) 1st charge over Project assets 2nd charge over Project assets Full Guarantees Full Guarantees Terms and Conditions, continued Senior Debt Subordinated Debt Covenants Debt Service Ratio> 1.3x all debt Debt Service Ratio > 1.3x all debt Advances After equity and sub-debt, based on Independent Engineer certified costs incurred Advanced behind equity but ahead of senior debt, based on IE certified costs incurred Repayment Interest only during construction, blended during term Same Prepayment Floating 3 mths penalty (Fixed rate full penalty) 6-12 months penalty 3-6 months principal and interest 3-6 months principal and interest Hydrology reserve account Terms and Conditions, continued Bonding Insurance Fees Legal costs Independent Engineer (IE) Working capital and GST Financial reporting Senior Debt Subordinated Debt Material contracts Same Reviewed for adequateness Same Application Fee: 0.5% Commitment fee: 1.0% Application Fee: 1% Commitment fee: 2% Under $50k Use same lawyer Monitor project, certify costs (IE costs passed on to Borrower) Use the same IE to minimize costs Can be funded Can be funded Annual Review, IE Report, Qtrly financials Same What does it take to get financing? • • • • • • Experienced development team First Nation approval, tangible involvement and/or equity participation All permitting, licenses, plans in place Electricity purchase agreement with BC Hydro Environmental approvals Strong site characteristics: hydrology, geology, interconnection, minimum environmental impact Vancity contacts Stewart Anderson, Manager, Aboriginal Banking 604.787.1988, stewart_anderson@vancity.com John Kirincic, Investment Manager, Community Capital 604.709.6950, john_kirincic@vancity.com Andy Broderick, Vice President, Community Investment 604.877.4559, andy_broderick@vancity.com To learn more about our work with Aboriginal Not for Profit and First Nation government organizations visit www.vancity.com/aboriginalcommunities Financing First Nation Clean Energy Projects