Building a Commodity Based Freight Model in Cargo

advertisement

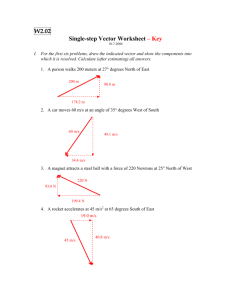

BUILDING A COMMODITY BASED FREIGHT MODEL IN CARGO : LOS ANGELES EXAMPLE Develops software for the modeling of transportation systems Florida Paris, Milan Beijing, Mumbai Offices USA Europe Asia 3000 cities on 6 continents in more than 70 countries North America: Los Angeles, Houston, Miami, Orlando, Washington. Atlanta, San Francisco, Minneapolis, St. Louis, Tampa, Baltimore, Pittsburgh, Cincinnati, Sacramento Europe: Dublin, London, Manchester, Glasgow, Liverpool, Oslo, Paris, Lyon, Nice, Strasbourg, Valencia, Seville, Milan, Venice Asia-Pacific: Taipei, Melbourne, Adelaide, Perth, Brisbane, Seoul, Beijing, Bangkok, Hong Kong, Singapore, Kuala Lumpur, Manila, Jakarta, Delhi Major engineering firms: AECOM, PB, Jacobs, Wilbur Smith, URS, PBSJ, Parsons Educational Institutions: IITs, NITs, SPA, Engineering Colleges Research: CRRI, ISRO, CSTEP Government DMRC, Dimts, MOUD, UMTC, PMC, RITES Major engineering firms: AECOM, PB, Jacobs, Wilbur Smith, Systra MVA, GMR, L&T Ramboll, Halcrow, Feedback Ventures, Mott MacDonald, Cube 6 Why Cube is the Best Transportation Modeling System The only system that covers all facets of transportation modeling • people • goods • land use • region-wide traffic simulation • multi-modal microsimulation Background • Significant growth in goods movement in the Los Angeles region required improved models to evaluate impacts • Models needed to address different potential improvements – – – – 6 Higher capacity intermodal rail terminals Truck-only lanes Extended working hours at the ports Short-haul shuttles from ports to inland freight facilities Objectives • Components of the freight model should include – Long-haul freight from commodity flows – Short-haul freight from socioeconomic data in the region and warehouse and distribution centers – Service truck movements • Recognize trends in labor productivity, imports, and exports • Integrate with passenger models 7 Modeling Process 8 Data Requirements • Detailed Socio-economic data • Reliable Commodity Flow Data • Origin-Destination Surveys to calibrate Trip Distribution • Port Data • Data on TLNs (Intermodal Terminals, distribution Centers, Warehouses) • Truck Classification Counts 9 Study Area • Within 5 county SCAG region – zip codes • Remainder of California – counties • Remainder of USA – states • 4 external zones; 2 each for Canada and Mexico 10 Truck Networks 11 Rail Networks 12 Truck Time Functions • LTL Time = Time+40 hrs for loading / unloading • TL Times – Drive 11 hrs between rest periods of 10 hrs 13 Model Descriptions – Tonnage Generation • Commodities were grouped into 14 categories • Productions based on tonnage rate per employee • Consumptions based on input-output matrix • Port trips added from the Port’s models • Trends in production efficiencies, imports and exports 14 Tonnage Rates by Commodity Category Agriculture Cement and Concrete Manufacturing Chemical Manufacturing Equipment Manufacturing Manufactuing 15 Description Tonnage Rate Crops 311.51 Livestock 4,863.69 Forestry, fishing, hunting, and trapping 7,329.10 Stone, clay, glass products 472.50 Concrete products 7,502.27 Chemicals and allied products 488.26 Industrial machinery and equipment 36.83 Electrical and electronic equipment 36.60 Transportation Equipment 72.96 Textile mill products 200.58 Apparel and other textile products 8.15 Furniture and fixtures 49.60 Printing and publishing 24.47 Rubber and miscellaneous plastics 170.78 Leather and leather products 412.91 Instruments and related products 1.84 Miscellaneous manufacturing industries 7.86 Commodity Classes Agriculture Mining and Fuels Cement and Concrete Manufacturing Motor Freight Transportation Chemical Manufacturing Nonmetallic Minerals Equipment Manufacturing Other Transportation Food Manufacturing Paper and Wood Products Manufacturing Manufacturing Petroleum Metals Manufacturing Wholesale Trade 16 Outbound Tonnage Produced by Commodity Group Wholesale Trade 3% Petroleum 8% Paper and Wood Products Manufacturing 4% Other Transportation 9% Nonmetallic Minerals 17% Motor Freight Transportation 11% Mining and Fuels 0% 17 Agriculture 8% Cement and Concrete Manufacturing 11% Chemical Manufacturing 5% Equipment Manufacturing 3% Food Manufacturing 11% Manufacturing 5% Metals Manufacturing 5% Model Descriptions – Tonnage Distribution • Trips split into short-haul and Long Haul • All short-haul trips are assumed to be truck trips • Short trip distribution based on a gravity model • Long trips are distributed using a joint distribution and mode choice model. 18 Trip Distribution Validation for Short-Haul Trips Average Trip Length (in Miles) 80 ITMS Short-Haul Model Short-Haul 70 60 50 40 30 20 10 0 Agriculture Chemical Manufacturing Cement and Concrete Manufacturing Equipment Manufacturing Commodity Group 19 Food Manufacturing Metals Manufacturing Manufacturing Mining and Fuels Motor Freight Transportation Other Transportation Petroleum Nonmetallic Minerals Paper and Wood Products Manufacturing Wholesale Trade Model Descriptions – Mode Choice / Service • Estimates Truck and Rail Trips • Based on a multinomial logit model • Three independent variables, time, distance and highway generalized cost • Applied for 3 distance classes – <500, 500-1500 ; >1500 miles • Service Model – Estimates safety, utility, public / personal vehicles 20 Model Descriptions – Transport Logistics Node Model • Estimates direct and non-direct trips • Includes intermodal terminals, warehouses, distribution centers etc. • Model Outputs are – Direct flows from origin to destination – Flows from origin to the TLN – Flows from the TLN to destination 21 Transport Logistics Node Model Partitions into Long-Haul Direct Flows by mode Define location of TLN Define service area of TLN Partitions into Long-Haul TLN Flows and Short-Haul TLN Flows by mode Study Area 22 Internal Area External Area External Zone TLN Vehicle Model • Converts tons to trucks • Parameters to influence empty trucks • Standard Vehicle Model to generate direct O-D flows • Touring vehicle model that simulates multi-point pick-up and drop off 23 Touring Vehicle Model • Performed on TLN’s and user-specified zones Generated tour from a TLN and back doing pickups and drop-offs Study Area 24 Internal Area External Area External Zone TLN Assignment Validation – External Cordons Gateway Routes Count Volumes San Diego / Mexico I-8, I-15, I-5 26,058 Truck Model Volumes 24,436 Rest of CA US-101, I-5, CA-14, US395 I-8, I-15, I40, I-10 29,698 31,840 7% 25,534 27,133 6% Arizona Total 81,291 25 83,409 % Difference -6% 3% Assignment Validation – Screenlines Screenline Dir Number of Counts 1 N-S 18 51,277 54,718 7% 2 E-W 28 96,480 91,096 -6% 3 N-S 18 70,323 53,375 -24% 4 E-W 12 71,266 56,140 -21% 5 E-W 23 77,268 74,714 -3% 6 E-W 13 78,972 86,753 10% 7 N-S 20 47,733 25,909 -46% 8 E-W 14 64,199 60,048 -6% 10 E-W 8 19,356 20,397 5% 11 E-W 8 16,278 18,389 13% 12 E-W 5 19,064 18,617 -2% 13 N-S 6 17,291 14,349 -17% 18 N-S 4 29,958 31,331 5% 700,699 644,421 -8% Total 26 191 Truck Counts Model Volumes % Diff Assignment at Key Freight Corridors Corridor Dir I-15 – S/O I-10 N-S Counts 17,000 Model Diff 13,272 % Diff -22% (3,728) I -15 – N/O Sr - 138 N-S 14,855 13,877 -7% (978) I-15 San Diego / LA County N-S I-15 San Bernardino / Nevada State Line N-S TOTAL I-15 N-S 5,388 11,503 113% 6,115 7,780 13,093 68% 5,313 45,023 51,744 -7% (3,072) I-215 - Betw I-10 & Wash' 27 N-S 10,267 8,224 -20% (2,043) 2030 Model – Tonnage Generation Change in Labor Productivity Commodity Group Growth Agriculture 1.43% Cement and Concrete 0.66% Chemical Manufacturing 1.85% Equipment Manufacturing 2.55% Food Manufacturing 1.47% Manufacturing 3.39% Metals Manufacturing 2.12% Mining and Fuels 0.93% Motor freight transportation 1.18% Nonmetallic minerals 1.88% Other transportation 1.93% Paper and Wood Products 1.71% Petroleum 2.57% Wholesale Trade 28 3.94% 2030 Model – Tonnage Generation Change in Imports and Exports Region / State Exports Imports Remainder of CA -8% -1% Sacramento -1% 0% San Francisco Bay Area -4% 0% San Diego -2% 4% Florida 1% 0% Illinois 1% 0% Iowa 0% -1% Arkansas 0% -1% Texas 2% -2% Colorado 0% 2% Arizona 1% 7% Utah 1% 0% Nevada 2% -3% Washington 1% -2% Oregon 1% 0% 0% 2% Mexico 29 2030 – Growth in Autos and Trucks Mode 2003 Drive Alone 25,645,643 35,513,032 9,867,389 38% Shared Ride 2 6,241,877 8,515,208 2,273,331 36% Shared Ride 3 3,685,651 4,947,531 1,261,880 34% 35,573,171 48,975,771 13,402,600 38% 679,220 905,052 225,832 33% 36,252,391 49,880,823 13,628,432 38% Total Auto Trucks All Vehicles 30 2030 Growth % Growth 2030 Assignments – Growth Screenline Dir 1 N-S 2 2030 Trucks % Growth 54,676 68,491 25% E-W 83,465 100,315 20% 3 N-S 52,029 55,234 6% 4 E-W 59,106 76,667 30% 5 E-W 77,044 86,608 12% 6 E-W 88,740 135,735 53% 7 N-S 31,930 45,009 41% 8 E-W 61,168 99,557 63% 10 E-W 23,023 30,105 31% 11 E-W 18,058 25,173 39% 12 E-W 18,224 28,515 56% 13 N-S 16,291 25,738 58% 18 N-S 31,030 39,680 28% 656,818 867,425 32% Total 31 2003 Trucks Summary • Developed and tested for one of the most complex freight transportation system in the US • Multimodal tool useful for freight investment decisions • TLN and service models provide accurate accounting of truck trips • Use of changes in labor productivity and trends • Model can evaluate a wider range of alternatives 32