file

The use of heuristics in valuation practice: implications in a changing market

Dr Georgia Warren-Myers RMIT University

Dr Chris Heywood The University of Melbourne

Dealing with change in valuation practice

• Introduction

•

Valuation practice: The art and the science

• Existing research

• Heuristics and their creation

• Valuers reliance on heuristics in valuation practice

• The case of sustainability: implications of valuers ability to adapt to change

• Consequences for practice and the market

RMIT University©2008

Information Technology Services 2

Valuation practice: The art and the science

• The praxis of valuation in a commercial sense is one of considerable uncertainty, knowledge, fortitude, perception and interpretation using a combination of algorithms and heuristics to identify the value of a property.

• Science

– Prescribed methodologies

– Approaches used e.g. Comparison approach, income approach

– Standards e.g. IVS, RICS Red Book

• Art

–

The value of judgements made by the valuer based on

–

Experience

–

Knowledge

–

Heuristics - are accepted as the construct of using rules or patterns in order make decisions or develop strategies for uncertain tasks or in complex situations (Havard,

1999).

• Science and art intertwined, as a result of judgements required in the scientific approach to valuation

RMIT University©2008

Information Technology Services 3

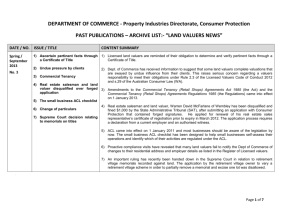

The Art and Science of the Valuation process

Science

Step One Definition of the Problem

• Purpose of assignment and le property and legal interests

• Type of value sought

• Date of valuation

Step 2 Plan of

Valuation

• Data requirements

• Appropriate valuation methodology selection

Step 3 Collection and verification of data

• Comparable data collection

• Market Analysis

• Economic activity

Step 4 Application of valuation method

• Cost Approach

• Income Approach

• Market Comparison Approach

Step 5 Reconciliation

• Review of the facts

• Statistical and probability indicators

• Logic and judgement

Report of Final Value

Estimate

• Letter of opinion

• Full Report

1. Art

2. Art

3. Art

Change and Uncertainty in Valuation Practice

• Research into heuristics in examining efficiencies of financial markets has developed the field of ‘behaviour finance’, which progressed theory to better understand and explain the decision-making process, and the emotions and errors of influence found in financial markets. lead by

– Tversky and Kahneman (1974), Kahneman and Tversky (1979), Kahneman, Slovic and Tversky (1982)Shefrin and Statman (1994), Shiller (1995) and Shleifer (2000);

•

In business, accounting and management disciplines, studies have explored and identified the use and application of heuristics in practice

– Ashton and Ashton, 1990; Assere, 1992; Black and Diaz, 1996; Caverni and Peris, 1990; Gallimore, Hansz and

Gray, 1994; John and Schkade, 1989; Krull et al., 1993; Nagata 1992; Wright and Anderson, 1989.

• Existing research regarding heuristics in valuation practice has focused on

–

Bias, inaccuracy, error, expert vs novice valuers

– for example Northcraft and Neale (1987), Black (1997), Black and Diaz III (1996), Diaz III (1990, 1990a, 1997),

Diaz III and Hansz, (1997), Diaz III and Wolverton (1998), Eiser and White (2004), Gallimore (1994, 1996),

Geltner (1993), Hardin (1997), Havard (1999, 2000) Levy and Schuck (1999, 2000, 2005) Wolverton (1996).

•

However, heuristics have a fundamental role in valuation practice.

• Limited research addressing heuristics in cases of:

– Major market change or market uncertainty

– e.g. Sustainability or the GFC

– Valuers’ development of appropriate heuristics for practice

RMIT University©2008

Information Technology Services 5

Heuristics and their creation

• Heuristics in valuation praxis are predominately created via:

– Experience

– Knowledge

• Limited acknowledge within literature or practice of the fundamental role heuristics play in valuation.

• For example:

– Implications of changing market places

– Development of new heuristics required – strategic knowledge

– Highlighted the importance of the relationship between senior and junior valuers in the development of heuristics

RMIT University©2008

Information Technology Services 6

Heuristics and their creation

Market adoption and creation of more market evidence

Identification of the effect of sustainability on market value

Industry knowledge of the benefits

(occupiers and investors);

Introduction

Decline

Acknowledgement of the value benefits of the effect of

Growth sustainability

Intuitive

Maturity value

Sustainability becomes the norm

Time

RMIT University©2008

Information Technology Services 7

The case of sustainability: implications of valuers ability to adapt to change

• Sustainability is a new trend within the property market – likened to technological and social change within the market

•

Research has found;

– Valuers have limited knowledge of sustainability – what it is, what it constitutes and its application and comparison within practice;

– Compounded by limited market evidence and appropriate and equitable sustainability comparison tools for commercial property;

– Market evolution and heuristics are linked; and consequently the relationship between sustainability and market value;

– Valuers at present are resistant to developing strategic knowledge regarding sustainability (although this is changing!)

– Are relatively ignorant of particular dynamics investors are factoring in as a result of sustainability

• How can valuers accurately portray the impact of sustainability, if any, on market value in practice?

RMIT University©2008

Information Technology Services 8

Where do we start?

• Valuers need better techniques for developing strategic knowledge,

– Not just evident as a result of sustainability but also for other major market changes or trends that will come along;

– Education

– Engagement of valuers

– Demonstrations, transparency and sharing of knowledge required

• Further Research:

– Formation of heuristics

– Strategic knowledge development for changing markets

– Strategies or learning practices which can be applied in order to minimise potential bias, error or inaccuracy in valuation as a result of market change

RMIT University©2008

Information Technology Services 9

Thank you

• Any questions

• Contact details:

– Dr Georgia Warren-Myers georgia.warren-myers@rmit.edu.au

RMIT University©2008

Information Technology Services 10