Financial integration and Economic growth

advertisement

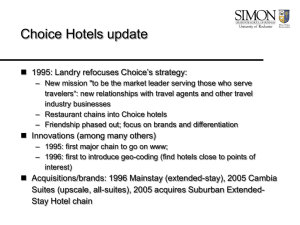

Select references: Prasad, Rogoff, Wei, Kose (2003); Kaminsky, Reinhart (1999); Obstfeld and Rogoff (1998); Kaminsky, Reinhart, Vegh (2004) THE SECOND ERA OF GLOBALIZATION 1985- present Unprecedented increases in the trade and financial integration Based on the sample of 76 countries (Prasad Rogoff, Wei, Kose (2003)) • Volume of trade as a share of GDP increased from 75% in 1980s to 150% at the end of 1990s • Countries with liberalized trade regimes increased from 30% to 85% with open financial accounts increased from 20% to 55% • Increase in the capital flows from Industrialized to Developing countries Figure 2.3. Net Private Capital Flows (Billions of U.S. dollars) 180 All Developing Economies 160 Bank lending 140 Portfolio flows 120 FDI 100 80 60 40 20 0 –20 1970 180 160 75 80 85 9 More Financially Integrated Economies 140 120 100 90 7 Portfolio flows 6 FDI 5 Bank lending Portfolio flows FDI 4 80 3 60 2 40 1 20 0 0 –1 –20 Less Financially Integrated Economies 8 Bank lending 95 1970 75 80 85 90 95 –2 1970 75 80 85 90 95 Source: IMF, World Economic Outlook, various issues. Notes: Bank lending to the mor e financially integrated economies was negativ e between 1997 and 1999. FDI denotes foreign direct investment. FINANCIAL GLOBALIZATION AND GROWTH: THEORY AND EVIDENCE How did financial integration affect economic outcomes? Things to keep in mind: Experience with globalization is relatively recent for many countries– empirical evidence can be misleading. The “growing pains” of countries learning to live in globalized world can result in both success and failure The current data may reflect the “short run” as opposed to the “long run” effect of financial integration. The big question: what can we learn from countries experience to reap the benefits of financial integration while minimizing the costs? FINANCIAL GLOBALIZATION AND GROWTH: THEORY PERSPECTIVE Growth theory: one of the key ingredients in economic growth is domestic private investment It (contributes to capital stock) Production function general form : Y = A*(KaL1-a) Were Y – output (GDP); A – technology ; K- capital stock; L – quantity of labor used in production; a – parameter that tells us by how much (in percent) output will increase if K increases by 1% Production function exhibits “diminishing returns to capital” – each unit of capital increases output, but at a decreasing rate IMPLICATIONS FOR DEVELOPING ECONOMIES Openness to foreign capital flows has several important benefits Directly - provides an additional source of savings (the country does not have to sacrifice current consumption for the sake of future output growth) Closed economy: Y = C + I + G => Y-C-G = I In the closed economy investment must equal to national savings ( Y-C-G). This creates potential for a poverty trap when Y is very low. Open economy : Y = C + I + G + CA CA – indicates how much the country is lending/borrowing from the rest of the world => ( Y-C-G) – CA = I IN ORDER TO INVEST THE OPEN ECONOMY DOES NOT NEED TO RELY ON NATIONAL SAVINGS ALONE. IMPLICATIONS FOR DEVELOPING ECONOMIES In theory countries with lowest capital stock should attract the most capital. Why? Due to diminishing returns, the return on capital is much higher when the stock of capital is low. Financially open economies should be better able to diversify country-specific risk Better risk-sharing results in the lower cost of capital, increases domestic investment. Competitiveness improves the quality of DOMESTIC financial institutions (better, more efficient domestic banks) IMPLICATIONS FOR DEVELOPING ECONOMIES Indirectly: Financial integration ENCOURAGES SPECIALIZATION by allowing better risk diversification options Financial integration may constrain the country’s government to pursue better policies (the cost of bad policy decisions is greatly increased in financially integrated economies) Signaling effect: liberalization of financial markets may signal broader policy reforms favorable to foreign investment EMPIRICAL EVIDENCE At first glance there seems to be a positive correlation between financial openness and economic growth. BUT correlation does not imply causation Could growth be caused by other factors unrelated to financial openness? Could it be that economies which are fast growing to begin with also tend to experience higher financial openness? Most recent empirical studies: accounting for other factors, financial openness has at best weak association with economic growth. CONCLUSION: FINANCIAL OPENNESS ON ITS OWN DOES NOT GUARANTEE HIGHER ECONOMIC GROWTH EXPLAINING THE THEORY- EMPIRICS DISCONNECT Capital accumulation alone can increase growth but only up to a point Solow growth model: because capital breaks down/becomes obsolete, the country must invest every year just to keep the capital stock at the existing level. The larger the capital stock, the more investment is needed just to keep it up. At some point the country’s entire savings will be devoted just to replace the obsolete and worn out capital stock. (at that point the growth of capital stock would stop) Example: USSR in the 1960s – growth driven by capital accumulation Modern day China – output growth driven in part by factors other than capital and labor (technology improvements?) Strong institutions and productivity improvements, rather than capital accumulation, are responsible for differences in the growth rates and levels of output per capita between countries EXPLAINING THE THEORY- EMPIRICS DISCONNECT Financial openness and economic volatility: Financial openness is often accompanied by financial crises – currency, banking and twin crises (all of them are damaging to output in the short run and some of them possibly in the long run). Financial openness promotes specialization, which can make the country more vulnerable to output shocks. This is not a problem if a country can borrow in bad times and repay in good times. BUT: Developing countries often experience SUDDEN STOPS - abrupt reversals of capital flows from abroad during bad times. This amplifies the cost of financial crises and output shocks. Figure 4.1. Volatility of Income and Consumption Growth (10-year rolling standard deviations; medians for each group of countries) 0.10 0.09 Income LFI countr ies 0.08 0.07 0.06 MFI countr ies 0.05 0.04 0.03 0.02 Industr ial countr ies 0.01 0 1970 74 78 82 86 90 94 national lev economies, ternational c Consisten ture sugges flows appea sumption vo manifestatio non of “sud and Reinhar national cap which tends well as exc that of incom that sovereig spreads on strongly infl costs of bor cyclical as w sent more d ior of capita 98 Crises as 0.10 0.09 Total Consumption 0.08 LFI countr ies 0.07 0.06 0.05 0.04 MFI countr ies 0.03 0.02 Industr ial countr ies 0.01 0 1970 74 78 82 86 90 94 98 Source: Kose, Prasad, and Terrones (2003a). Note: MFI denotes more financially integrated, and LFI less financially integrated, economies. Crises ca episodes of nancial crise aspects of th over the last recent crises led to these of the unequ and risks. T about wheth time, what f whether suc globalization Some as changed ove vu all over a episodes in capital acco to as curren EXPLAINING THE THEORY- EMPIRICS DISCONNECT Capital flows into developing countries depend on both external and internal factors: External: - macroeconomic conditions and shocks in industrialized countries. Example: low US interest rates usually imply heavy investment flows to emerging markets (can create credit bubbles). (The most volatile types of capital: short-term portfolio investments and bank lending. FDI is less sensitive to external conditions) - contagion (when investors pull out capital from the country after a crises happens in another developing country). Financial globalization increases the risk of financial contagion. - herding behavior on the financial markets Internal: country’s own shocks and macroeconomic conditions WHAT CAN THE COUNTRY DO TO MINIMIZE RISK? Structure of debt and strength of financial institutions is important: although financial crises can happen even in the economy with more or less good economic fundamentals, the severity of financial crises increases when - country borrows in foreign currency - country can only borrow short-term - ratio of (bank borrowing + other debt) to FDI is high. - high government spending (together with fixed exchange rate regime can lead to currency crisis) - opening financial markets when institutions (for example banking regulations are weak). - counter-cyclical fiscal policies OTHER POLICY OPTIONS TO BENEFIT FROM FINANCIAL INTEGRATION The theoretical channels through which financial integration improves growth can work only under certain conditions: Empirical evidence: - FDI improves growth, for countries with high level of human capital - The level of FDI inflows is highly correlated with low corruption, higher transparency of macroeconomic policies and corporate finance - Higher levels of financial integration reduce volatility of output and consumption but only beyond a certain threshold ( which has not been reached by most developing countries). - Having good financial supervision in place BEFORE the country opens up to capital inflows from abroad is essential for minimizing the risk of devastating financial crises.