ex ante

advertisement

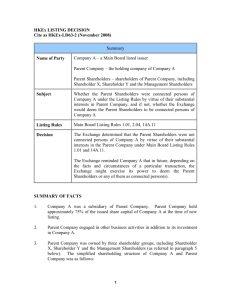

GODFREY HODGSON HOLMES TARCA CHAPTER 11 POSITIVE THEORY OF ACCOUNTING POLICY AND DISCLOSURE Early demand for theory • Capital markets research tried to explain the effects of accounting – was ultimately inconclusive and inconsistent • mechanistic and no-effects hypotheses • This research relied upon the EMH – ultimately there were too many departures • Led to the development of a positive theory of accounting policy choice 2 Early demand for theory • Positive theory incorporated a number of observations – many firms voluntarily provided accounting reports – firms lobbied in relation to accounting standards – firms made consistent policy choices – firms tended toward conservatism 3 Contracting theory • The firm is seen as a ‘nexus’ of contractual relationships • The firm is seen as an efficient way of organising economic activity to reduce contracting costs – equity (management) contracts (an agency contract) – debt contracts (an agency contract) 4 Agency theory • An agency contract is one where one party (the principal) engages another (the agent) to act on their behalf – e.g. where there is a separation of management and ownership • Both parties are utility maximisers – agent may therefore act from self-interest • divergence of interests is the agency problem – contracts incorporating accounting numbers can be used to align the interests of both parties 5 Agency theory • The agency problem in turn gives rise to agency costs spent to overcome it – monitoring costs – bonding costs – residual loss 6 Agency theory • Monitoring Costs – the cost of monitoring the agent’s behaviour; initially borne by the principal but passed on to the agent through an adjustment to their remuneration (price protection) • • auditing costs, operating rules… Bonding Costs – the cost borne by the agent as a result of them taking action to align their interests with those of the principal • • providing more regular financial reports (a cost to the manager in terms of time and effort) constraints on their activities… 7 Agency theory • The agents incur bonding costs in order to reduce the monitoring costs they eventually bear • Agents stop spending on bonding costs when the marginal cost equals the marginal reduction in the monitoring costs they bear – $1 = $1 8 Agency theory • Residual Loss – the loss associated with not being able to fully align the interests of the agent with those of the principal • Ex post settling up – (ex post = at the end of each period) – agent’s future remuneration based on observed agent performance – the principal changes the remuneration to be paid to the agent to align it with their performance 9 Agency theory • In the real world, price protection and settling up are not perfect or complete • Agents perceive that they will therefore not be fully penalised for their divergent behaviour • They have incentives to act opportunistically • This increases the residual loss • This loss is borne by the principal as well as, or instead of, the agent 10 Agency theory • Agency theory attributes a role for accounting • Accounting is part of the monitoring and bonding mechanisms • Accounting numbers are used in contracts 11 Price protection and shareholder/manager agency problems • The separation of ownership and management leads to divergent behaviour by agents • Divergence comes about because of – the risk-aversion problem – the dividend-retention problem – the horizon problem 12 Price protection and shareholder/manager agency problems • Risk aversion – managers prefer less risk than do shareholders • different degrees of diversification affecting risk • limited liability accorded to shareholders 13 Price protection and shareholder/manager agency problems • Dividend-retention – managers prefer to pay out less of the profits as dividends than shareholders prefer • pay their remuneration • empire building 14 Price protection and shareholder/manager agency problems • Horizon – managers have a shorter time horizon with respect to their association with the firm than do shareholders • shareholders are interested in future cash flows • managers have a time horizon only as long as they intend to remain with the firm 15 Price protection and shareholder/manager agency problems • Contracting can be used to reduce the severity of these problems – manager remuneration is usually tied to firm performance in some way to motivate managers to act in the shareholders’ interest • performance can be related to accounting numbers such as sales, profits, return on assets, net asset growth, cash flow, etc • performance can be related to the firm’s share price 16 Shareholder-debtholder agency problems • In this context, the manager is assumed to be either the sole owner of the firm, or has interests that are totally aligned with the interests of the shareholders – the principal is the debtholder – the agent is the manager acting on behalf of shareholders 17 Shareholder-debtholder agency problems • Firm value is the value of debt plus the value of equity • The value of equity can be increased by – either increasing the value of the firm (efficient contracting); or – transferring wealth away from debtholders (opportunistic behaviour) 18 Shareholder-debtholder agency problems • Varieties of opportunistic behaviour – excessive dividend payments – asset substitution – underinvestment – claim dilution 19 Shareholder-debtholder agency problems • Excessive dividend payments – reduces the asset base securing the debt – shareholders have received cash but limited liability protects them from being personally liable for the debts of the firm in the event of bankruptcy – the debt becomes mispriced – reduces the value of the debt 20 Shareholder-debtholder agency problems • Asset substitution – firm invests in higher risk projects to benefit shareholders • no benefit to debtholders • but do share in possible losses – shareholders are able to diversify and have limited liability – debt becomes mispriced 21 Shareholder-debtholder agency problems • Underinvestment – in some circumstances, shareholders have incentives not to undertake positive NPV projects because to do so would increase the funds available to the debtholders but not to the shareholders 22 Shareholder-debtholder agency problems • Claim dilution – occurs when the firm issues debt of a higher priority than the debt already on issue – decreases the relative security and value of the existing debt 23 Shareholder-debtholder agency problems • Lenders will price protect – through interest rates, the withholding of funds and the length of the loan • The interests of shareholders can be bonded to those of debtholders via restrictions in lending agreements – loan covenants 24 Ex post opportunism versus ex ante efficient contracting Ex post opportunism – occurs when, once a contact is in place, agents take actions that transfer wealth from principals to themselves 25 Ex post opportunism versus ex ante efficient contracting Ex ante efficient contracting – occurs when agents take actions that maximise the amount of wealth available to distribute between principals and agents – ex ante – before contracts are finalised 26 Signalling theory • Managers voluntarily provide information to investors - signals - to assist in their decision making • Similar to efficient contracting • Aligned with the information hypothesis • Managers signal expectations and intentions regarding the future • Incentives to signal good, neutral and bad news 27 Political processes • Often firms try to avoid public attention that is costly to them – financially – in terms of public perception and reputation • They reduce their reported profit or its volatility – e.g. banking sector in Australia 28 Conservatism, accounting standards and agency costs • Conservatism shows a bias by accountants accelerating recognition of expenses and decelerating recognition of revenue • IASB argues this does not reveal the real financial picture and reduces information available to users 29 Additional empirical tests of the theory • Testing the opportunistic and political cost hypothesis • Tests using contract details • Refining the specification of political costs • Testing the efficient contracting hypothesis 30 Additional empirical tests of the theory • Evidence that managers use accounting numbers to – counter political pressure – gain political advantages – set management targets related to remuneration – minimise breaching debt covenants – provide dividend constraints – constrain management manipulation 31 Evaluating the theory • Mixed support for positive accounting theory • Two categories of major criticism – methodological and statistical criticism • empirical evidence is weak and inconclusive – philosophical criticism • contrary to its claims, it is laden with value judgments • focuses on human behaviour and not the behaviour and measurement of accounting entities • positivism is no longer taken seriously 32 Issues for auditors • The demand for auditing can be explained by agency theory as part of the monitoring and bonding activity and costs – higher quality auditors – industry specialist auditors 33 Summary • Positive accounting theory has been a major force in academic accounting research • Incorporates a theoretical model of contractual exchange between persons who use accounting numbers to effect their payoffs • Provides an explanation as to why accountants account as they do – minimises the cost of agency relationships – yet opportunistic behaviour by agents is the norm – but some efficient ex ante behaviour by agents 34 Key terms and concepts • • • • • • • • • • • • Positive theory Contracting theory Agency theory Agents Principals Monitoring costs Bonding costs Residual loss Ex post settling up Risk aversion problem Dividend retention problem Horizon problem 35 Key terms and concepts • • • • • • • • • • • Shareholder/manager agency problem Shareholder/debtholder agency problem Excessive dividend payment problem Asset substitution problem Underinvestment problem Claim dilution problem Ex post opportunism Ex ante efficient contracting Signalling theory Political processes Conservatism 36 37