4th Session Kathy Robbins

advertisement

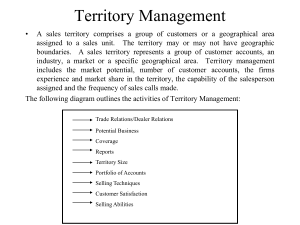

TEI Regions V & VI IRS Liaison Meeting Kathy Robbins, Acting NRC Industry Director May 14, 2012 1 LB&I International Function Recently revised structure Douglas Shulman, IRS Commissioner Steve Miller, IRS Deputy Commissioner for Services & Enforcement Commissioner Large Business & International Treaty Unit Michael Danilack, Deputy Commissioner (International) Doug O’Donnell, Assistant Deputy Comm’r (Int’l) Sam Maruca, Director, Transfer Pricing Operations 2 EOI Program Kathy Robbins, Director, International Business Compliance (IBC) JITSIC Foreign Posts Service-wide Strategy Rosemary Sereti, Director, International Individual Compliance (IIC) LMSB International Large Business and International Division Director International Individual Compliance (IIC) Commissioner Large Business & International IRS Commissioner Dep. Comm. for Services & Enforcement EA Deputy Commissioner (International) Director, International Individual Compliance (IIC) Tech. Coord. & Training DFO, IIC Campus Compliance Unit Terr Mgr Territory 1 Terr Mgr Territory 2 Terr Mgr Territory 3 Terr Mgr Territory 4 Terr Mgr Territory 5 Future Territory 6 Offshore Compliance Initiatives Nonresident Compliance Initiatives Central Withholding Program LB&I International Function Revised structure EOI Program Treaty Unit Deputy Commissioner (International) JITSIC Foreign Posts Assistant Deputy Comm’r (Int’l) Service-wide Strategy Sam Maruca, Director, Transfer Pricing Operations Director, APMA Deputy Director Combined MAP/APA team 4 Matt Hartman, East Tom Ralph, Central Nancy Bronsen, West Large Business and International Division Director, International Business Compliance (IBC) Draft Structure as of 2/6/2012 EA – Operations Margie Maxwell Washington DC International Practice Networks Nanette Hamilton San Jose CA Inbound Martha Regan Phoenix AZ Outbound Violette Walter Bloomington MN DFO, IBC East Howard Martin Downers Grove IL Territory 1 Theodore Setzer New York NY Territory 2 Anna Petinova New York NY Territory 3 John Evancho Edison NJ Director, International Business Compliance Kathy Robbins Washington DC DFO, IBC West Carol Poindexter Downers Grove IL Territory 8 John Hinman Troy MI Territory 9 David Oyler Downers Grove IL Territory 10 Glen Duncan Farmers Branch TX Territory 4 Orrin Byrd Atlanta GA Territory 11 Jackie Topping Phoenix AZ Territory 5 (Foreign Payments) Vacant Territory 12 Vacant Territory 7 (Economists) Lynn Redmond Indianapolis IN Territory 14 (Economists) Dave Jackson Farmers Branch TX EA – Technical Donald Murray Columbus OH Foreign Payments Program Stuart Mann Iselin NJ Training Nieves Narvaez Houston TX Integrated International Program Strategy Metrics Networks Training Data INTERNATIONAL MATRIX The International Matrix Strategy Metrics Networks Training Income Shifting Data IBC MATRIX FTC Deferral Planning Management Repatriation BUSINESS OUTBOUND BUSINESS INBOUND INDIVIDUAL OUTBOUND INDIVIDUAL INBOUND 7 The suite of core technical areas that serve as the foundation by which our strategy, training, networks, and data management are developed and utilized The “Four Faces” of the Matrix Income Shifting Deferral Planning FTC Management Repatriation BUSINESS OUTBOUND Jurisdiction to Tax Income Shifting Inbound Financing Repatriation/ Withholding BUSINESS INBOUND Jurisdiction to Tax Offshore ArrangeMents Foreign Tax Credit Pass-Thru Entities Foreign Corporations INDIVIDUAL OUTBOUND Jurisdiction to Tax US Business Activities US Investment Activities INDIVIDUAL INBOUND Treaties Information Gathering Foreign Currency Corporate Organizations/ Transactions IBC Focus for 2012 • International Practice Networks • Training – Phase Training – Monthly Centras – Continued CPE • Hiring – IBC has internal authorization to move 200 domestic agents to International – International has external authority to hire 100 Program Areas of Focus: Three of the areas IBC is currently focusing: • Forms 1120F • Joint Audits • Withholding and FATCA Forms 1120F • Three categories of Forms 1120F we are addressing – Filed Forms 1120F – Protective Forms 1120F – Non Filers Forms 1120F • Have created 1120F Task Team to look at all areas and develop strategies. Protective 1120Fs • Ability to claim deductions • Statute date Joint Audit – Definition Joint Audit is where: • Two or more countries • Join together to form a single team to • Examine issue(s) or transaction(s) • Of one or more related taxable persons • With cross-border business activities. 14 Joint Audit – Definition • Taxpayer jointly makes presentations and shares information with the countries • The joint audit team will include Competent Authority representatives, joint audit team leaders and examiners from each country. 15 Joint Audit Process • Benefit taxpayers by reducing time and cost to address multiple audits with common factual issues • Fully coordinated audit from start to finish for all compliance activities • Allows for acceleration of the Mutual Agreement procedure by early involvement of the Competent Authority where double taxation involved. Joint Audit Process • Important to keep open channels of communication with the taxpayer throughout the joint audit process. • Cooperation of taxpayer and their advisors will be a key factor in securing a satisfactory outcome. • Best if examination years/cycles and processes of countries are the same. Joint Audit Benefits • Development of enhanced relationships between revenue bodies and taxpayers • Providing certainty for taxpayers • Reduction in compliance costs for taxpayer • More effective management of tax issues in real time Withholding and FATCA • Creation of new Territory to address Chapter 3 Withholding • Currently have QI and USWA groups in New York • Territory to also be first responders to issues relating to FATCA