Date - Jamnalal Bajaj Institute of Management Studies

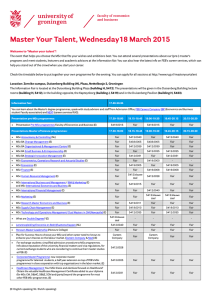

advertisement

University of Mumbai Jamnalal Bajaj Institute of Management Studies MSc Programme in Finance University of Mumbai • The University of Mumbai is one of the oldest and premier universities in India. • Established in 1857, it is one amongst the first three Universities in India. • • JBIMS • JBIMS was established in 1965 by the University of Mumbai JBIMS has evolved an indigenous model of management education in tune with the contemporary demands of both the Indian and the global environment. JBIMS has been rated among the top 25 business schools in the Asia-Pacific region, and has also been consistently ranked among the top 10 business schools in India • • Rationale of the Course • • • Mumbai is fast emerging as an International Financial Centre In line with the Government Of India’s initiative to make Mumbai as International Finance Centre This is creating opportunity for a large number of finance professionals University Proposed MSc Program In Finance to UGC UGC has granted the proposed program • Objectives of the Course • • The proposed MSc Finance course will help create a pool of trained and globally competitive finance professionals. The MSc in Finance course is structured to deliver a strong foundation in the principles and practice of finance The objective of this course is to help individuals enhance their effectiveness within the field of finance. Why MSc? • Finance as a field of study has strong roots in statistics and Mathematics. • The MSc Finance course is designed to combine rigorous academic work with real-world relevance and practical application to ensure that content is intellectually demanding while being related to the practical world of finance. • MSc (Finance) Vs MBA (Finance) • MSc Finance programme provides a broader and deeper exposure to finance, but more limited exposure to general management topics. MBA, by contrast, is more diverse, covering general aspects of business not dealt with in the finance programme, such as human resource management, marketing management, and operations management. MSc Finance Vs MCom • The objectives and focus of the MCom is different from that of the MSc (Finance) programme. • MCom programme aims at producing competent academics in finance • MSc (Finance) programme aims at providing a platform for producing professionals with expert knowledge and skill sets that are invaluable to the industry. Career Scope The employment opportunities for trained finance professions are available in: • Investment banks • Brokerage houses • Private equity entities • Banks • Insurance companies • Credit rating agencies • Portfolio management services • Venture capital entities. • • Eligibility Criteria • The candidate should be a graduate in any faculty having scored a minimum of fifty per cent of marks; and should have opted for mathematics at the higher secondary level or at least at the first year of the degree course. Candidates who are appearing for the final examinations may also be permitted to apply, but, their admission, will be confirmed only after she satisfies the eligibility criteria mentioned above. • • Entrance Test • • • The entrance test will comprise of an objective type written paper Content: General Awareness, Logical Reasoning, Quantitative Ability, Verbal Ability Date: 15th July 2013 at 10.00 am Short-listed candidates will be called for a personal interview and/ or group discussion Date: 16th and 17th July 2013 in batches Stage Programme Structure Foundation Semester I Semester II Semester III Semester IV Total Hours per Week 24 30 36 24 24 128 Credits 0 24 24 24 24 96 Foundation Course • Basic Economics • Basic Quantitative Methods • Basic Accounting • Basic Computing • Economics Semester I • Quantitative Methods • Accounting & Financial Reporting • Financial Management • Practical 1: Quantitative Methods • Practical 2: Accounting and Financial Reporting • • • Semester II • • • • Corporate Governance & Regulatory Environment Corporate Finance Econometrics and Financial Modeling Financial Markets and Institutions Fixed Income Securities Practical 3: Econometrics and Financial Modeling Practical 4: Fixed Income Securities Semester III • Technical Analysis • Portfolio Analysis and Management • Derivatives • Practical 5: Technical Analysis • Practical 6: Portfolio Analysis and Management • Summer Project Semester IV • Mergers, Acquisitions and Corporate Restructuring • Structured Finance • Risk Management • International Finance • Dissertation Contact Details Jamnalal Bajaj Institute of Management Studies 164 DN House HT Parekh Marg Backbay Reclamation Mumbai 400 020. Telephone: 022-22024118 Email: mscfin@jbims.edu Website: jbims.edu