Cash Advance - Accounting Services

advertisement

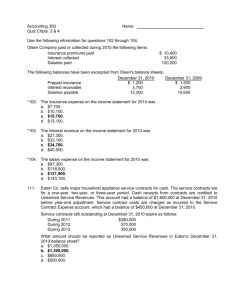

Cash Advance January 2014 Cash Advance for Travel • BPM 506-Cash Advance – Who can obtain • Active employee • University student (currently enrolled) employee – Purpose • Travel for University business • Use of University or personal credit card is not available (ex. Outside of the United States) • Expenses could not be paid in advance with other methods (ex. airfare and lodging) – Repayment • Repaid in full within 21 calendar days following completion of trip • Failure to repay may result in payroll deductions or student charge Cash Advance for Subject Payment • BPPM 2:250-Research Participation Compensation – Who can obtain • Employee (ex. Researcher) – Purpose • When it is not feasible or practical to issue University checks directly to the participant – Payment at time of participation – Participant/amount not known in advance – Repayment • Repaid in full within 21 calendar days following end of research • Ongoing research is due 3 months from issuance date of advance • Failure to repay may result in payroll deductions Preparing a Cash Advance • Travel & Expense Module – Navigation: Employee Self-Service > Travel and Expense Center > Cash Advance > Create Preparing a Cash Advance • Fields to complete – Description = Destination or IRB # – Business Purpose = Select from drop-down – Comment = • Travel - Departure and return dates, detailed purpose • Participant payment - Quantity and Amount of payments to participants • MOCODE or Department that will be reimbursing expenses – Details = • Source = ACH • Description = Budgeted item (ex. Per Diem, Transportation, Participant Payment) • Amount = Amount of budgeted item Preparing a Cash Advance • Click “Submit” to transmit your request • If IRB = attach Department Chair Approval Form as attachment to Cash Advance Cash Advance Approval Process • Routed from Employee to their HR Supervisor – HR Supervisor will receive email from T&E • Routed to Cash Advance Coordinator – CA Coordinator will receive email from T&E • Advance is released for payment – Employee will receive email confirming final approval & when payment has been processed Repaying a Cash Advance • Travel & Expense Module – Create an Expense Report – Click “Apply Cash Advance” Repaying a Cash Advance • Apply Cash Advance page Repaying a Cash Advance • Fields to complete – Advance ID = Enter the 10 digit cash advance ID – Total Applied = Enter the amount to be applied to this expense report • The entire cash advance amount is applied by default – Click “Update Totals” • Advance Applied = Sum of CA amounts applied on ER • Employee Expenses = Amount accrued on ER • Due Employee = Amount owed to employee after applying cash advance – Click “OK” to apply the CA and return to the ER Repaying a Cash Advance ER for Research Subject Payment • Attach Verification of Receipts Form Repaying a Cash Advance ER for Travel • Attach Daily Expense Log Repaying a Cash Advance • ER for Travel Reminders – Per Diem=Employee only • Hours in travel status; no receipts – Business Meal=Employee + others discussing University business • Document purpose & attendees; actual cost (receipts>$75) – Budget restrictions • Establish Travel Allowance pre-trip to set total maximum amount to reimburse; cannot limit expense types • Utilize “Expense Adjustment” expense type to reduce ER to trip maximum Expense Report Approval Process • Routed to Project Manager (if applicable) – Project Manager will receive email from T&E • Routed to Fiscal Approver – Fiscal Approver will receive email from T&E • Routed to Prepay Auditor (if applicable) • Expense Report is released for payment – Employee will receive email confirming final approval & when payment has been processed Repay Cash Advance • If expenses are GREATER THAN the amount of the advance, the employee will receive reimbursement for the difference on the ER. • If expenses are LESS THAN the amount of the advance, the employee must return the difference to the department for deposit on a Cash Received Report (CRR). Repaying a Cash Advance • Preparing the CRR to return unused funds – Chartfields = Per T&E Profile • Contact Cash Advance Coordinator if unsure – Account = 132801 – Comments = Original Cash Advance number – Notify Cash Advance Coordinator of the CRR # • They must “Reconcile” the Cash Advance Financial Statement Presentation • No longer uses Expense Advance Loan Fund • Cash Advance - only affects Balance Sheet – MOCODE stored in T&E Profile for Employee • First line of funding from HR if payroll is split funded • Can be changed in T&E by Employee, HR Supervisor or T&E Fiscal Approver • If CA not repaid, this is chartfield for payroll deduction – Once Submitted = Payable (210500) – Once Paid = Receivable (132800) – Once Applied to ER = Receivable (132800) • Unused CA balance = Receivable (132801) – Once CRR posted = Receivable (132801) equals $0 • Expense Report – MOCODE set as Employee Accounting Default, unless changed in ER – Once Submitted = Payable (210500) – Once Paid = Expense (7xxxxx) Questions • COLUM Accounting Services – http://accounting.missouri.edu/ – Accounts Payable -> Cash Advance – Subject Payments -> Subject Payments • COLUM Cash Advance Coordinator – Jennifer Walker • Walkerje@missouri.edu or 882-3051 • T&E Training Guides – https://doit.missouri.edu/training/peoplesoft/financials/tr avel_and_expenses.html • Online resources and policies are briefly under construction