Share of Personal Care Print Ads PowerPoint Presentation

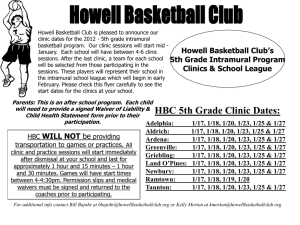

advertisement

Insights on Retail Promotions Prepared for Our Friends at NACDS June, 2011 ECRM’s MarketGate Ad Comparisons www.AdCompare.MarketGate.com Top Promoted Categories Across All HBC Weighted Share of Total HBC Ad Blocks Hair Care Skin Care Vitamins Oral Care Personal Cleansing Baby Care Cosmetics Analgesics Cough/Cold Digestives Home Health/Incontinence Shaving/Toiletries Feminine Hygiene Deodorant/Anti-Perspirant Personal Care Appliances First Aid/Wound Care Allergy Nutritional Supplements 10,8% 9,6% 8,0% 7,9% 5,3% 5,3% 5,1% 4,9% 4,8% 4,6% 3,6% 3,5% 3,1% 3,0% 2,8% 2,4% 2,3% 2,3% Each of the top promoted HBC categories is driven by unique needs with few brands dominating multiple categories. Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011 HBC Promotions Shifting Across Categories Shifting HBC Categories Share of Total HBC Ads Categories Increasing Share of HBC Ads: Vitamins 8.0% Baby 5.3% Personal Cleansing 5.3% Feminine Hygiene 3.1% Digestives 4.6% Shaving/Toiletries 3.5% Categories Decreasing Share of HBC Ads: Diabetes Care 1.2% Skin Care 9.6% Fragrances 1.3% Cough/Cold 4.8% Oral Care 7.9% Source: ECRM’s MarketGate Ad Comparisons, 52 Weeks Ending 6/11/2011 Change Vs. Year Ago +0.57 pts +0.52 pts +0.39 pts +0.24 pts +0.23 pts +0.23 pts -0.52 pts -0.38 pts -0.31 pts -0.29 pts -0.27 pts Top Promoted Manufacturers Across HBC Categories Weighted Share of Total HBC Ad Blocks Procter & Gamble Company 17,1% Private Brand Manufacturer 14,8% Unilever 4,0% L'Oreal Paris 3,8% Kimberly-Clark Corp. 3,3% Colgate-Palmolive 3,1% Johnson & Johnson Consumer 2,7% McNeil Consumer Healthcare 2,5% Glaxo Smithkline 2,5% Pfizer Consumer Healthcare 2,4% Bayer Corporation 1,9% Novartis Consumer Health 1,9% Energizer Holdings, Inc. 1,7% Garnier 1,5% Procter & Gamble HBC products receive more retail ad support than the next five players combined. Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011 Top Promoted Brands Across HBC Categories Weighted Share of Total HBC Ad Blocks Private Brand 14,80% L'Oreal Paris 2,31% Crest 2,17% Olay 2,16% Gillette 2,07% Colgate 1,79% Huggies 1,72% Pampers 1,41% Dove 1,36% Garnier 1,31% Neutrogena 1,11% Advil 1,01% Prilosec 0,96% Aveeno 0,91% The top 10 promoted brands represent less than 18% of HBC promotions. No one brand dominates HBC. Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011 HBC Promoted Segments Vs. Year Ago Share of Total HBC Ads Cosmetics, Fragrance & Bath 7,7% 7,3% Health Care 39,2% 39,1% 53,0% 53,6% Year Ago Current Personal Care The mix of promoted HBC segments is very similar to year ago. Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011 Retail Ad Support Across Personal Care Categories Personal Care Travel Kits; 0,1% Family Planning; 0,9% Share of Personal Care Print Ads Hair Care; 20,2% Hair Accessories; 1,0% Sun Care; 2,3% Skin Care; 18,0% Personal Care Appliances; 5,2% Deodorant/ AntiPerspirant; 5,5% Feminine Hygiene; 5,8% Oral Care; 14,6% Shaving/ Toiletries; 6,5% Baby; 9,9% Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011 Personal Cleansing; 9,9% Retail Ad Support Across Health Care Categories Share of Health Care Print Ads Vitamins; 20,5% Foot Care; 0,8% Analgesics; 12,6% Diagnostics; 2,9% Diabetes Care; 3,1% Eye/Ear Care; 4,6% Cough/Cold; 12,2% Diet; 4,7% Nutrition; 5,8% Allergy; 6,0% First Aid/ Wound Care; 6,0% Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011 Home Health / Incontinence; 9,2% Digestives; 11,7% Retail Ad Support Across Cosmetics, Fragrance & Bath Categories Share of Cosmetics, Fragrance & Bath Print Ads Bath Accessories; 1,5% Bath Specialty; 5,4% Cosmetic Accessories; 6,5% Fragrances; 17,6% Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011 Cosmetics; 69,1% Pharmacy Ads in Retail Circulars Retailers Running the Most Pharmacy Ads Per Year Navarro Disc Pharm 399 Fry's Food & Drug 213 Marsh Supermarkets Price Chopper (Golub) Pharmacy Ads/Year at Key Retailers 180 162 Walgreens 75 Rite Aid 71 CVS Pathmark 141 Waldbaums 130 Albertsons LLC 126 Kmart A&P 125 Target Superfresh 124 Ingles Markets 120 Coborn's 108 Schnucks Markets 106 Walmart-US 34 66 47 25 Source: ECRM’s MarketGate Ad Comparisons 52 Weeks Ending 6/11/2011