MENAP Oil Importers

advertisement

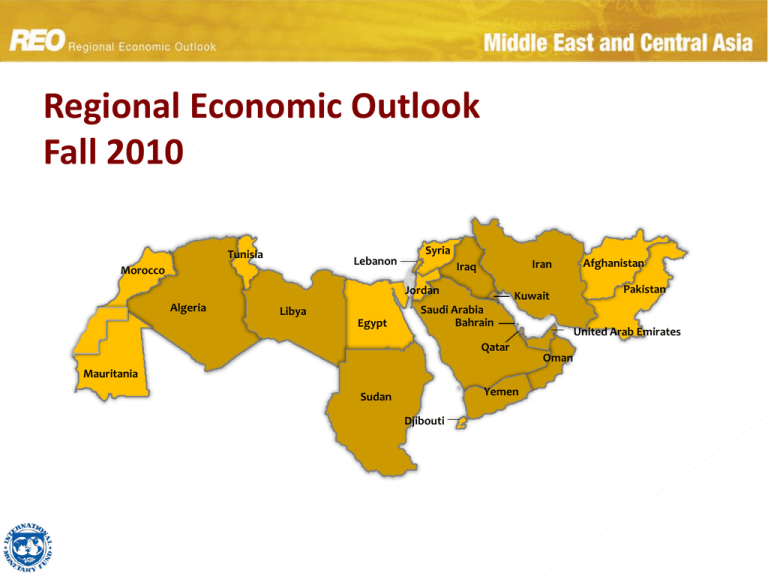

Regional Economic Outlook Fall 2010 Tunisia Lebanon Morocco Syria Iran Iraq Jordan Algeria Libya Egypt Kuwait Saudi Arabia Bahrain Qatar Mauritania Yemen Sudan Djibouti Afghanistan Pakistan United Arab Emirates Oman Global outlook: Two-speed recovery in motion Real GDP Growth (percent change from a year earlier) Emerging economies Temporary slow-down 2010:H2 — 2011:H1 World Advanced economies 2000 02 04 06 08 10 A closer look at the two-speed recovery Real GDP Growth (percent change from a year earlier) 3 Rebalancing is needed along two dimensions Demand from external surplus economies Private demand Demand from external deficit economies Public demand 4 Downside risks remain, but global double-dip unlikely Prospects for World GDP Growth (percent change) 5 Inflationary pressures are forecast to remain subdued Core Inflation (Twelve-month change in the core CPI) For countries with a peg to the USD or euro, this means that higher inflation rates may lead to real appreciation. 2002 04 06 08 Jul. 10 6 Oil Demand Growth (contributions to y-o-y growth in percent) Total demand 7 Temporary Wheat Supply Shock, Limited Spillovers Major Food Crops, Nearest Futures Prices (index, Jul. 1, 2010 = 100) Wheat Corn 8 Capital Flows, Reserves, Appreciation Net Monthly Flows to Emerging Market Equity Funds Net Monthly Flows to Emerging Market Bond Funds (billions of U.S. dollars) (billions of U.S. dollars) Sep. 10 Sep. 10 9 MENAP Oil Exporters Iran Iraq Kuwait Algeria Saudi Arabia Bahrain Libya Qatar Sudan Yemen United Arab Emirates Oman Overview — Oil Exporters Recovery continues Risks/medium term challenges • Oil production picks up, fiscal/external balances improve • But private sector is lagging • Fiscal space allowing continued stimulus in some countries • Keep eye on inflation • Financial sector development and stability • Reorienting spending, reducing reliance on oil revenues Global demand recovers, boosts activity Sources: National authorities; and IMF staff estimates. MENAP Oil Exporters …and external balances rebound 30 25 Current account balances; percent of GDP and billions of US dollars GCC $257 Algeria, Iran, Iraq, Libya 20 Sudan, Yemen 15 $107 $75 10 $124 $101 $31 $23 5 $5 0 -5 -10 -$7 -$7 -$6 -$10 -15 2008 2009 2010 2011 Sources: National authorities; and IMF staff estimates. MENAP Oil Exporters …as do fiscal balances 30 Fiscal balances; percent of GDP 25 GCC 20 Algeria, Iran, Iraq, Libya 15 Sudan, Yemen 10 5 0 -5 -10 -15 2008 2009 2010 2011 Sources: National authorities; and IMF staff estimates. MENAP Oil Exporters Many countries approaching break-even prices 160 SDN 140 YMN Break-even Price for Fiscal balance 120 ALG 100 BHR SAU 80 KWT 60 LBY IRQ IRN UAE OMN Average oil price in 2010 40 QAT 20 0 0 20 40 60 80 100 120 Break-even Price for Current account Sources: National authorities; and IMF staff estimates. MENAP Oil Exporters Some countries continue to provide stimulus Percent change in total government expenditures in U.S. dollars (From 2008 to 2011) Sources: National authorities; and IMF staff estimates. MENAP Oil Exporters Keep an eye on inflation 20 Consumer price index; annual percentage change 15 10 5 0 -5 -10 Aug-09 Other oil exporters¹ QAT IRN SAU SDN YMN Nov-09 Feb-10 May-10 Aug-10 Source: National authorities. 1Algeria, Bahrain, Iraq, Kuwait, Libya, and Oman MENAP Oil Exporters Financial sectors after the crisis (December 2009) 25 Capital adequacy ratio (Percent of risk-weighted assets) ALG BHR 20 UAE KWT QAT 15 SAU OMN 10 YMN LBY Financial sector strength 5 IRN¹ SDN 0 0 5 10 15 Nonperforming loans (Percent of total loans) 20 25 Source: National authorities. 1December 2008 MENAP Oil Exporters Diversification Financial market development Managing international financial linkages MENAP Oil Exporters MENAP Oil Importers Tunisia Morocco Lebanon Syria Afghanistan Jordan Egypt Mauritania Djibouti Pakistan Overview — Oil Importers • Growth picking up Recovery Policy adjustment Medium term challenges • Can start consolidating fiscal positions • In most cases, inflation not an immediate concern • More than 18 million new jobs required by 2020 • Need to improve competitiveness and reorient trade Trade recovery is moving ahead Annual percent change of U.S. dollar value, 3-month moving average 60 Region’s exports are again growing steadily 40 20 0 European Union: imports -20 MENAP oil importers:¹ exports Emerging and devel. economies: exports -40 Jun-06 Dec-06 Jun-07 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Sources: National authorities; IMF Direction of Trade Statistics; and Haver Analytics. ¹ Egypt, Jordan, Lebanon, Morocco, Pakistan, and Tunisia. MENAP Oil Importers Real GDP picking up across region Annual percentage change 10 China 9 India 8 7 AFG EM Total 6 5 4 3 EGY MRT TUN MAR SYR DJI LBN JOR PAK 2 1 0 2011 Source: National Authorities; and IMF staff estimates. MENAP Oil Importers Progress in fiscal consolidation Public debt (Percent of GDP) 90 MRT 80 2010 EGY 2011 70 JOR DJI PAK 60 Fiscal consolidation 50 MAR TUN 40 EM average 30 SYR 20 -10 -8 -6 -4 Fiscal balance (Percent of GDP) -2 0 Source: National Authorities; and IMF staff estimates and projections. MENAP Oil Importers Most can maintain current monetary stance Consumer Prices; annual percentage change 6 5 AFG 4 DJI TUN 3 JOR LBN 2 1 MAR 0 Aug-10 Sources: Haver Analytics; and national authorities. MENAP Oil Importers More than 18 million jobs needed Dominique StraussKahn: “We must not underestimate the daunting prospects we face: a lost generation, disconnected from the labor market, with a progressive loss of skills and motivation.” AFP/ABDELHAK SENNA/Getty Images. Reprinted with permission. (Unemployed workers wait for a job in the Bani Makada quarter of Tangiers, Morocco on March 20, 2004.) MENAP Oil Importers High unemployment a long-standing issue 23 MENA6 Youth unemployment (Percent) 21 19 17 Central and South-Eastern Europe (nonEU) and CIS South-East Asia and the Pacific 15 Latin America 13 Developed Economies World Sub-Saharan Africa 11 South Asia 9 East Asia 7 5 4 6 8 10 Total unemployment rate (Percent) Sources: National authorities; IMF, World Economic Outlook; staff estimates; and International Labor Organization. Note: MENA6 refers to Egypt, Jordan, Lebanon, Morocco, Syria, and Tunisia. Youth unemployment estimate for MENA6 excludes Jordan. Data refers to 2008 or latest available year. MENAP Oil Importers Growth and export gaps: getting bigger 35 10 Emerging and developing economies Real GDP per capita (average annual growth rate, 1990–2009) China 30 8 Emerging Asia 25 6 LBN 4 20 India TUN JOR MAR PAK 2 MRT 15 MENAP oil importers EM total EGY 10 SYR 5 0 -5 0 5 10 15 1990 1995 2000 2005 2010 -2 Volume of exports of goods and services per capita (average annual growth rate, 1990–2009) Goods exports (in percent of GDP) Source: IMF, World Economic Outlook. MENAP Oil Importers Competitiveness will need to improve Competitiveness Rankings, 2010–11¹ MENAP oil importers Emerging Asia Market size 100 Institutions Inf rastructure 75 Technological readiness Macroeconomic stability 50 25 Business sophistication Health and primary education 0 Best Higher education and training Innovation Financial market sophistication Goods market ef f iciency Labor market ef f iciency Source: World Economic Forum, Global Competitiveness Report, 2010–11. ¹Economies are ranked from 1 to 139, with first place being the best. MENAP oil importers is a simple average of Egypt, Jordan, Lebanon, Mauritania, Morocco, Pakistan, Syria, and Tunisia. Emerging Asia is simple average of China, Hong Kong SAR, India, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan Province of China, Thailand, and Vietnam. MENAP Oil Importers Broader Partnerships Real GDP trends, annual percent change Asia Latin America Advanced economies 1980 85 90 95 2000 05 10 15 Source: IMF, World Economic Outlook database. Note: 1980-2015 real GDP growth data are de-trended as 10-year backward rolling averages. MENAP Oil Importers Labor market flexibility Education Jobs and Growth Competitiveness Reorient exports toward new growth engines MENAP Oil Importers