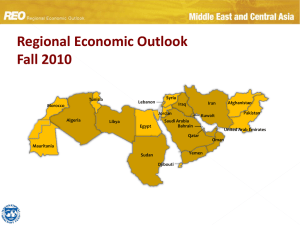

09 Regional Economic Outlook Middle East and Central Asia

advertisement