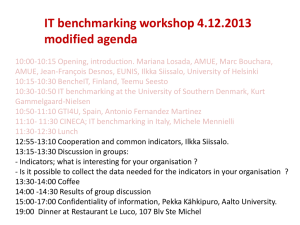

ERISA Section 408(b)(2) Fee Disclosures

advertisement

Benchmarking Services A Potential Solution to Every 401(k) Plan Fiduciary’s Problem Marcia S. Wagner, Esq. I. Current Outlook on 401(k) Plan Fees Fees are being scrutinized by regulators, Congress and the plaintiffs’ bar. ◦ Recent explosion in fee litigation, involving complaints that plan sponsors breached their fiduciary duties by authorizing the use of plan assets to pay excessive fees. ◦ DOL has launched regulatory initiative to improve fee-related disclosures in DC plans. ◦ Congress is proposing legislation to uncover “hidden” plan fees, including the 401(k) Fair Disclosure for Retirement Security Act and the Defined Contribution Fee Disclosure Act. 2 Facing Up to the Fiduciary Challenge Plan sponsors have a fiduciary duty to ensure the reasonableness of plan fees. But does the typical employer have the necessary expertise and resources to make this determination? Benchmarking services are potential remedy. ◦ ◦ ◦ ◦ ◦ Scope, cost and quality can vary greatly. Assessing fees only vs. fees and services. How can plan sponsors use these services? Selection of benchmarking service provider? Role of financial advisor? 3 II. Fiduciary Requirements for Plan Fees ERISA imposes 3 sets of rules regarding fees. 1. ERISA 403: Establishing of Trust ◦ Plan assets must be held in a qualifying trust. ◦ For “the exclusive purposes of providing benefits and defraying reasonable expenses” of the plan. 2. ERISA 404(a)(1): Prudent Man Std. of Care ◦ Similar to ERISA 403 “exclusive purposes” standard. ◦ Must discharge duties with the care, skill, prudence and diligence that a “prudent man acting in a like capacity and familiar with such matters would use.” ◦ Thus, plan sponsor must discharge duties regarding plan fees under a Prudent Expert standard. 4 Fiduciary Requirements for Plan Fees (continued) 3. ERISA 406, 408(b)(2) – PT Exemption ◦ PT occurs if plan assets used to pay for services. ◦ Exemption applies if: “Contracting or making reasonable arrangements” “Services that are necessary” for plan operation. No more than “reasonable compensation” is paid. ◦ Current DOL reg’s apply facts-and-circumstances test for determining reasonable compensation. ◦ Proposed reg’s would impose fee and conflictsrelated disclosure requirements (to be finalized this year). 5 III. Penalty for Breaching Fiduciary Duties Penalties under ERISA are substantial. ◦ ERISA 409 imposes personal liability for losses ◦ ERISA 502(l) imposes a 20% civil penalty. ◦ Excise taxes on prohibited transactions. ERISA 502(a) gives participants the power to sue for fiduciary breaches. Growing number of lawsuits have been filed against employers and providers. ◦ Alleged failure to monitor direct and indirect compensation paid to providers. ◦ Courts generally cautious in dismissing lawsuits. 6 IV. How Benchmarking Services Can Help Plan Fiduciaries Assist the employer in its efforts to identify all plan fees, including “hidden” indirect compensation. Equip the employer with tool to be used as part of a prudent review process to monitor the plan’s services and fees. Provide the employer with competitive pricing information that a Prudent Expert might have, to help assess reasonableness. 7 Identifying “Hidden” Compensation GAO prepares report on plan fees (2008). ◦ Employers can not meet fiduciary duties without disclosure of compensation flowing from plan’s investments to providers. ◦ Hidden fees include “soft dollar” payments (e.g., 12b-1 fees, shareholder servicing fees). ◦ Plan sponsor might select “free” services, not realizing costs are passed on to participants. DOL Advisory Opinion 97-16A ◦ Fiduciaries must ensure both direct and indirect compensation is reasonable. ◦ Must obtain sufficient info regarding indirect compensation to make an informed decision. 8 Using Benchmarking Services to Help Review Hidden Compensation Benchmarking service providers can work with plan’s recordkeeper to obtain indirect compensation info. ◦ Benchmarking services can simplify employer’s review of direct and indirect fees. ◦ Revenue sharing data can also be used to confirm reporting for Form 5500 purposes. New reporting rules under Form 5500. ◦ Requires enhanced reporting on fees payable to the plan’s service providers. ◦ Effective beginning with plan year for 2009. 9 Prudent Review Process to Monitor Fees DOL procedural guidance from Information Letters, proposed 408(b)(2) reg’s and FABs. ◦ Fiduciary must engage in objective process designed to elicit necessary information. ◦ Must assess: 1) Qualifications of provider, 2) Quality of services, and 3) Reasonableness of fees in light of services. ◦ Soliciting bids is a recognized means for obtaining necessary info at the outset, but may not be necessary in subsequent years. 10 Prudent Review Process to Monitor Fees (continued) To satisfy the DOL procedural guidance, plan sponsors should: 1) Request updated info about the provider’s qualifications, 2) Objectively assess provider’s historical performance, and 3) Use benchmarking services to determine prevailing rates for similar services. This simple procedure can be used as part of a prudent review process. ◦ Much less burdensome than soliciting bids. ◦ Plan’s advisor can assist in implementation. 11 Gaining Expert’s Knowledge With Competitive Pricing Information Prudence standard of care under ERISA. ◦ Can not be satisfied with process alone. ◦ Requires substantive expertise. Reasonableness of fees must be evaluated with skill and knowledge of a prudent expert. ◦ Employers can acquire this requisite knowledge through benchmarking services. ◦ Plan’s advisor can assist in interpretation of competitive pricing information. 12 V. Selecting a Benchmarking Service Selection of benchmarking service provider is also subject to ERISA fiduciary standards. Financial advisors should encourage plan sponsors to inquire about: ◦ ◦ ◦ ◦ ◦ ◦ ◦ Qualifications of provider Scope of analysis (all types of fees?) Ability to identify indirect compensation Reliability of benchmark data Size and profile of benchmark group of plans Benchmarking quality of investments/services Baseline for comparison (per-participant fees vs. asset-based fees) ◦ Consulting services 13 VI. Interpreting the Benchmarking Analysis Properly “What do I do if the benchmarking analysis says that my plan is too expensive?” ◦ Never consider price to exclusion of other factors. ◦ Sponsors should never conclude services are too expensive based on benchmarking alone. Financial advisors should remind sponsors to review/document quality of services. If conclusion is that fees are excessive: ◦ Renegotiate fees or ask for more services. ◦ Use an ERISA fee recapture account. ◦ Terminate services as a last resort. 14 Concluding Comments Every plan sponsor has a duty to ensure plan fees are reasonable. ◦ Employers can meet this duty with the assistance of benchmarking services. ◦ Benchmarking can be included as part of a broader, prudent review process. ◦ Results of any benchmarking analysis need to be evaluated in the proper context. Advisors can play a crucial role in helping the plan sponsor: ◦ Select a reliable benchmarking provider. ◦ Develop a simple review process. ◦ Evaluate the plan’s fees in light of services. 15 Benchmarking Services A Potential Solution to Every 401(k) Plan Fiduciary’s Problem Marcia S. Wagner, Esq. 99 Summer Street, 13th Floor Boston, MA 02110 Tel: (617) 357-5200 Fax: (617) 357-5250 Website: www.erisa-lawyers.com marcia@wagnerlawgroup.com A0037201 16