case study of the NHS in England

The Public expenditure Implications of the Private Finance Initiative: case study of the NHS in England and

Scotland

Allyson Pollock

Centre for International Public Health

University of Edinburgh prison privatisation September

2007

1

Key Issues

Cost - debt

Affordability- Revenue

Quality - staff, environment resources

Value for money and risk transfer

Accountability prison privatisation September

2007

2

Status of PFI Policy now

The first large projects for hospitals and schools were not signed until the Labour administration came to power in 1997.

Private finance is now a major plank of UK government policy and the bulk of most

Departmental (Ministerial) capital investment projects are undertaken in this way.

Already, 749 deals have been signed at a value of

£48.4 billion pounds sterling in the UK (app. $92 billion USD).

prison privatisation September

2007

3

Previous funding of investment in health sector

Government formerly raised investment funds through borrowing, gilts (Government bonds) or through taxation.

Prior to 1991, funding of hospitals was traditionally through government grant. prison privatisation September

2007

4

What is PFI? (2)

“Under the PFI, the public sector does not buy assets, it buys services. The private sector is responsible for deciding how to supply these services and what investment is required to support these services”.

Kenneth Clark, 1996 Budget prison privatisation September

2007

5

PFI differs from Government loan schemes in that: a) the Government contracts with the private sector for services and not for, say the mere construction of a building.

b) the money is raised by the private sectorbank loans and equity (issue of shares), or bonds.

c) the contracts average 30 years and are guaranteed by Government.

prison privatisation September

2007

6

What is PFI (3)

PFI is not new investment, it is public sector government debt.

Interest and service charges are repaid by the public sector in an annual (or six-monthly) unitary charge.

prison privatisation September

2007

7

Capital charges since 1991

The PFI is a charge on capital payable from revenue. The PFI annual unitary charge is made up of two elements:

• availability fee (for building availability) (capital element of debt) + life cycle costs and maintenance.

• facilities management fee (services e.g., catering, cleaning, laundry etc).

prison privatisation September

2007

8

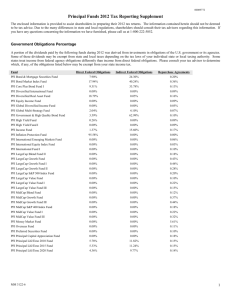

Long term costs (1)

PFI investment is long term public sector debt and the 30 year contracts mean that in the future there will be calls upon the PFI expenditure.

These are shown in a graph of data derived from FoI requests to the Doh in England: (next slide) prison privatisation September

2007

9

1500

1000

500

£m

0

-500

-1000

-1500

-2000

Figure 1. Capital expenditure and unitary payments for signed PFI contracts

Capital expenditure by the private sector (£m)i Unitary charges (£m)ii prison privatisation September

2007

10

Long term costs (2)

Between April 1997 and April 2007, the majority of contracts for new hospital projects – 85 out of 110, or some 87.3% - came through PFI. -

£8.5 billion out of a total of £9.7 billion - of the capital investment in the hospital building programme.

[1]

As of April 2007, the Department of Health had approved 126 PFI projects with a total capital value to £15.5 billion. 85 have been signed with private sector consortia, at a capital value of £8.5 billion have been approved. billion1. A further 41 PFI hospital schemes with a total capital value of £7

Future expenditure commitments for all current and future NHS

PFI schemes will increase from £52 billion as of November 2006, to £90 billion in 2013.

prison privatisation September

2007

11

The upfront capital expenditure relating to PFI schemes signed as of 30 November 2006 was

£8.3 billion [1] , whereas NHS spending commitments amount to more than £52 billion.

[2]

Payments to be made by the NHS will therefore be around six times greater than the upfront capital cost to the private sector. prison privatisation September

2007

12

What role does the PFI play in acute service reconfiguration?

prison privatisation September

2007

13

Cost escalation & affordability (1)

The costs of PFI always escalate during the planning stage and before, for example, hospital contracts are signed off.

Once signed, contracts between the public health provider and the private investor are legally binding and therefore usually inflexible.

This results in affordability issues: from the outset, the public authorities have calculated what they can afford to pay from their revenue budgets and so any cost escalation is a new cost pressure - see next slide.

prison privatisation September

2007

14

Increase in costs from Outline Business Case to current – Full Business Case

Trust

Swindon

Worcester

South Manchester

Norfolk

Bishop Auckland

South Tees

North Durham

Bromley

Dartford

Calderdale

Wellhouse

OBC cost

(£m)

Current cost

(£m)

90

26

65

60

80

45

49

40

97

55

30 prison privatisation September

2007

148

116

89

200

52

106

96

120

137

77

40

Change

(%)

229

137

123

122

100

63

60

50

41

40

33

15

Cost escalation and affordability (2)

Cost escalation squeezes the projected revenue budget and the result is that service planners come under pressure to make the project affordable by reducing services, closing hospitals, reducing the number of beds, cancelling services and making staff cuts; (see slide on beds and staff).

prison privatisation September

2007

16

Annual revenue implications of capital costs for 19 PFI hospital schemes comparing costs before and in the first year in which the PFI scheme is operating

NHS Trust

Dartford & Gravesham

Swindon & Marlborough

Greenwich Healthcare

West Middlesex University Hospital*

Carlisle Hospitals

Hereford Hospitals

South Tees Acute

Calderdale Healthcare

The Dudley Group of Hospitals*

University College London Hospitals*

Worcester Royal Infirmary

Before PFI

(Capital charges as % of income 1998-9)

6.7

After PFI

(Capital charges + Availability fee as % of projected income in 1st year of operations)

32.7

3.8

2.1

16.4

16.2

9.3

4.0

3.8

5.6

15.5

14.7

14.6

13.2

3.4

8.3

6.2

5.3

13.1

12.8

12.5

12.4

All calculations include payments to Treasury on existing and retained estate. * Refers to 1999-2000 prison privatisation September

2007

17

Changes in bed numbers at NHS trusts under PFI development

Values are average no’s of beds available daily (all specialties)

Trust

Bromley Hospitals

Calderdale Healthcare

Dartford & Gravesham

North Durham Acute Hospitals

Norfolk & Norwich

South Manchester

Worcester Royal Infirmary

South Buckinghamshire

Hereford Hospitals

Carlisle

Greenwich

Total

Percentage change from 1995-96

1995-96

610

797

524

665

1,120

1,342

697

745

397

506

660

8,063

1996-97

625

772

506

597

1,008

1,238

699

732

384

507

566

7,634

(-5.2) prison privatisation September

2007

Planned

507

553

400

454

809

736

390

535

250

465

484

5,583

(-30.8)

18

Cost escalation and affordability (3)

Another way of seeking affordability is to transfer some hospital care to “social services”, funded out of the budgets of local authorities.

Alternatively, services may close so that patients have to go elsewhere , go without care or pay to go privately. prison privatisation September

2007

19

Cost escalation and affordability (4)

Further economies are sought through staff cuts or reform of work practices (see slide).

However, evidence suggests that even when services are reduced there continue to be affordability problems and underfunding of

PFI charges.

prison privatisation September

2007

20

The costs of PFI – the evidence from the

FBCs- first wave of closures

30% reduction in acute bed numbers.

Reductions in budgets for primary care and community services.

Hospital closures - often 3 into 1.

Reductions in staff budgets especially nurses.

prison privatisation September

2007

21

Figure 2 Capital costs for Trusts with PFI schemes with a capital value of over £50m, in 2005/06

40

25

20

15

10

5

35

30

All capital costs as percentage of total income (%)

Capital costs funded in the tariff (%)

0

1.

Nor cute

H os pi tal s

G rav es ha m tfo rd & pi tal

, W oo lw ic h th

Cu mb ria A

2.

Dar

E liz abe

3,

Q ue en th

Hos

4.

Cou nty nd

Da rli ng to n dd ers

Hu fiel vers d ity

Hos

Du rha

5. m a

Cal

6.

S ou th de rda

M an ch es

7. le &

Nor fol te r Uni k &

Norw ic h Uni pi tal vers ity

Hos

8.

Her efo

9.

B arnet & pi ta l rd Ho

Ch as e spi tal s orc pi tal s es ters

10

. W

11

. K in g’ s Col hi leg re

A e Ho cute spi

12

. S tal

, L on do n wi nd on

&

Ma rlbo

14

. W rou gh ley

Hos pi ta ls les ex

U ni ver si ty cute

Hos

13

. B rom es t M idd

15

. S ou th

T ee

16 s A

. D udl

17 ey

G rou or th

W es

. N pi tal s

18 pi

. N ta ls p o f Hos t L on do n Ho th um or spi tal s bria

Hea lthc are

National Health Service Trusts prison privatisation September

2007

22

Funding shortfall through the tariff

Trusts are funded for average capital costs of

5.8% of income.

PFI Trusts have average capital costs of 10.5%.

Deficits and service closures. prison privatisation September

2007

23

“Value for Money” issues (1)

The key argument for PFI is “Value for Money”

- it is claimed that risk is transferred from the public to the private sector which is better able to manage it.

prison privatisation September

2007

24

Value for Money Issues (6)

The Government claims that PFI projects are more likely to come in on time and on budget.

But not all Treasury commissioned support these claims. For example, Pollock AM, Price

D, Player S. “An examination of the UK

Treasury’s evidence base for cost and time overrun data in UK value for money policy and appraisal. Public Money & Management, forthcoming 2 007”. www.health.ed.ac.uk/ciphp prison privatisation September

2007

25

Evaluating PFI: National Audit Office (1)

563 PFI deals were signed by April 2003 a) However, only eight financial inquiries into operational PFIs have been undertaken.

b) Only one inquiry attempts to audit the relationship between the cost of private finance and risk transfer.

prison privatisation September

2007

26

Evaluating PFI: National Audit Office (2) c) Government’s justification of PFI in terms of risk transfer is not evaluated.

d) This failure to evaluate raises fundamental questions about accountability.

prison privatisation September

2007

27

Political issues (1)

Loss of transparency at all levels.

Loss of public and parliamentary accountability over what used to be public bodies.

Democratic implications of long term debt finance- mortgaging the future.

prison privatisation September

2007

28

Political issues (2)

Inequities in funding and provision.

Political impact of health service cuts and reduction in capacity of health services.

Confusion of public and private sector roles as former civil servants take up posts in PFI companies (“revolving door” principle).

prison privatisation September

2007

29

Political Issues (3)

The effect of creating NHS trusts and introducing PFI has been to decentralise responsibilities for capital investment.

The affordability problem means that the PFI has to be made to work at the expense of other services e.g., older people’s care, mental health, community provision.

Inequities are arising between services, service groups, patients and at area level.

prison privatisation September

2007

30