kazakhstan - MINEX Central Asia 2014. Mining and Exploration Forum

MICHAEL WILSON & PARTNERS, LTD.

MINEX C ENTRAL A SIA 2014 - K AZAKHSTAN:

A NALYSING T HE P OLITICAL C LIMATE I MPLICATIONS

FOR M INING AND M INERAL E XPLORATION

B Y M ICHAEL E. W ILSON

April 2014

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

1

Outline

Overview of Kazakhstan and Government Policy – promining/foreign investors.

Kazakhstan’s policy compared to Central Asian neighbours.

Process to obtain Subsoil Use Rights: common barriers faced, pitfalls to avoid/solutions.

Methods for settling disputes re: mining/exploration

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

2

Outline

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

World’s No.1 producer of uranium,

30% of the world’s chrome reserves,

25% manganese,

13% lead zinc,

10% iron ore,

10% copper, as well as bauxite, coal, phosphate, potash, vanadium, titanium, gallium, precious and rare-earth metals.

3

Kazakhstan and Government Policy - pro-mining/foreign investors

All subsoil resources in Kazakhstan belong to the State, and always will.

Thus, there is a contracting regime involving PSAs, concessions, subsoil use contracts.

New Law “On Subsoil and Subsoil Use” defines mineral processing as “work

associated with the extraction of minerals from raw material”.

Does not include processing - governed by the general law.

Separate regulatory/legal framework likely to be drafted/adopted as part of the industrial policy.

New concept for geological exploration, providing better access to geological data adopted recently by Government which is committed to modernising. Government have invested +/-US$52.8 million in exploration and plan to increase this to +/-US$385.2 million by 2019.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

4

Kazakhstan and Government Policy - pro-mining/foreign investors

(contd)

2007, President imposed a moratorium on granting subsoil use rights (licenses) for hydrocarbons/minerals.

Moratorium lifted in January 2013.

July 2010, a new Law “On Subsoil and Subsoil Use” was adopted, which eliminated:

- the prior Subsoil Law (of 1996)

- the Petroleum Law (of 1995)

- the Offshore Petroleum Operations, PSA Law (of 2005)

- The prior regulations did not provide a clear picture of the procedures, deadlines established and expenses incurred.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

5

Kazakhstan and Government Policy - pro-mining/foreign investors

High priority on the development of downstream processing facilities

(especially in the iron and steel industry) to encourage production and the export of higher value-added products and to meet domestic market needs.

Blueprint is a Government-led program for mining and metallurgy as part of the State Program for Accelerated Industrial-Innovative

Development of Kazakhstan for 2010–2014.

Key goal is to double mineral production and within five years. This will require substantial foreign investment. Envisaged to attract US$13 billion in investments in the next 5 years.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

6

Kazakhstan and Government Policy - pro-mining/foreign investors

(contd)

Hydrocarbons and mining fall under separate Ministries.

Ministry of Industry & New Technologies (MINT) replaced the

Ministry of Energy & Mineral Resources, is now the “Competent

Authority”, is the principal regulatory authority for the mining industry.

Ministry of Oil & Gas deals with hydrocarbons.

MINT plans to amend the existing mining/subsoil regulations, and to create a Scientific Research Centre on Geology under the Nazarbayev University, the Samruk-Kazyna Fund, and a number of large subsoil users.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

7

Kazakhstan/Government Policy - pro-mining/foreign investors

(contd)

• Lack of access to existing quality geological data one of the main barriers to mining and exploration investment.

• In June 2011, the National Geological Survey Company JSC

“KazGeology” established. Based on JSC “Kazgeology”, the main areas of this Scientific Research Centre’s activity will be the processing/integrated interpretation of geological/geophysical/geochemical data, computer simulation and evaluation of forecast resources and ore reserves, in line with international standards.

• First projects include cooperation with Rio-Tinto plc on exploration for disseminated copper, with Iluka Resources of Australia, and with

KORES for polymetals.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

8

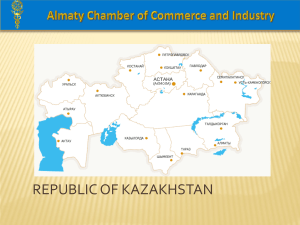

Kazakhstan compared to Central Asian/Caucasus neighbours

Kazakhstan is the leader, but the mining sector is behind hydrocarbons.

Kyrgyzstan and

Tajikistan lag behind the others in socioeconomic development

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

Uzbekistan and

Turkmenistan remain relatively closed and controlled societies with

Uzbekistan seeing itself as a leader in

Central Asia, but this does not reflect reality.

9

Kazakhstan compared to Central Asian/Caucasus neighbours

• More than 2,000 registered mining businesses (state statistics agency), 1,783 small scale, 165 medium and 100 large scale.

• Main players in the mining sector are large entities controlled by local entrepreneurs (ENRC (diversified),

Kazakhmys, copper) as a result of privatisations, Glencore

Xstrata (KazZinc), Kazatomprom (uranium),

Kazphosphate (phosphate), Kazakhaltyn (gold) and various others.

• Few foreign investors. Aversion to former FSU assets.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

10

Kazakhstan compared to Central Asian/Caucasus neighbours

Some of the key industry players include:

• Central Asia Resources: ASX-listed developing several gold projects in

Kazakhstan, comprising the former Moonstone Altyntas Group (funded by

Sheikh Khamed from Bahrain), and which had the greater Akbakai exploration area (i.e. Dalabai, Altyntas, Bizhe, Kepken and Kengir) with a total resource of 1.28m oz of gold. In 2008, Moonstone swapped their shares in the Altyntas JV for shares in Central Asia Resources.

• Yildirim Group of Turkey agreed to buy ferroalloy assets from Mechel for

$425 million as Russia’s largest coking coal producer seeks to reduce debt.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

11

Kazakhstan compared to Central Asian/Caucasus neighbours

• ENRC: formerly an LSE-FTSE 100 listed diversified group with chromium, manganese, ferro-alloys, iron ore, bauxite, alumina, aluminium, energy and coal, now in disposal mode.

• Kazakhmys: a fully integrated LSE-FTSE 100 listed company focused on copper, with by-products, including zinc, silver and gold. Largest gold producer, 15tpa.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

12

Kazakhstan compared to Central Asian/Caucasus neighbours

• Kazzinc: now part of Glencore Xstrata, large integrated zinc producer with much copper, precious metals and lead as by-products. Promised to spin off the gold assets comprising Vasilkovskoye and the Ust-Kamenogorsk

Smelter.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

13

Kazakhstan compared to Central Asian/Caucasus neighbours

• Kazakhaltyn: the leading independent gold producer with mines at Aksu,

Bestobe and Zholymbet, acquired by Polyus Gold from the Assaubayevs in

2011, bought by Vladimir Kim of Kazakhmys in 2013.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

14

Kazakhstan compared to Central Asian/Caucasus neighbours

ArcelorMittal Steel Temirtau: 7.2mtpa steel mill, 8 underground coal mines, coal washing plants, Atasu iron ore and power stations in the

Karaganda region. Part of ArcelorMittal. Pipe plant in Aktau.

• GoldBridges Global Resources Plc (formely Hambledon Mining), listed on AiM, owns/operates Sekisovskoye Deposit near Ust

Kamenogorsk, East Kazakhstan. Underground mining began in late

2011. Contracted to purchase Akmola Gold LLP (the former Teck-

Cominco Company), which owns the Tellur and Stepok Deposits, in

September 2011, but this was terminated. Used to own the Ognevka

Processing Plant at Leninogorsk. Under prior management attracted finance and equity from EBRD. Now controlled by the Assaubayevs who have a controversial track-record, given the Polyus claims of fraud. Acquired

Karasuyskoye nearby.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

15

Kazakhstan compared to Central Asian/Caucasus neighbours

• Kazatomprom: a national company dominating the uranium, rare-earth metals, nuclear sectors. Kazatomprom has joint ventures with Areva, Atomredmetzoloto, Cameco and

Westinghouse. Kazakhstan is the world’s largest producer of uranium.

• Tau-Ken Samruk: a national company managing the State’s holdings in various mining projects. Is actively seeking investors to participate in the development of various projects from early-stage exploration to project development. Has an exploration joint venture with Rio Tinto.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

16

Process to obtain Subsoil Use Rights: common barriers faced, pitfalls to avoid/solutions

• “Local Content” was introduced in goods and services to be purchased in the course of subsoil use operations.

• All investment projects under the Government’s consideration are likely to undergo more scrutiny to verify their contribution in terms of local job creation, as well as sustainability and competitive export capacity.

• It’s not just about building a money-making mine or oil field; such new developments must also create jobs and come with new roads, schools and clinics for local people.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

17

Process to obtain Subsoil Use Rights: common barriers faced, pitfalls to avoid/solutions

• Local Content requires purchasing goods, works and services through tenders with equal participation for local and foreign suppliers

• If bids are equal, priority is given to participants who:

• produce their works, goods and services in the territory of the

Republic of Kazakhstan

• attract high-technological productions into Kazakhstan

• use goods, works and services of Kazakhstani enterprises

• offer to use foreign goods, works and services through a joint venture where the Kazakhstani enterprise’s share will be at least 50%

• Advantage of locally established company

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

18

Process to obtain Subsoil Use Rights: common barriers faced, pitfalls to avoid/solutions

• Several companies vying for projects in the country, braving the political risks because of the grand-slam geologic opportunities there.

• Kazakh uranium sector is a prime example. Uranium production has jumped 145 percent since 2008, to 20,900 tonnes of uranium in

2013, according to World Nuclear News. Kazakhstan is now the world’s top uranium producer, accounting for approximately 37 percent of global output.

• As there are no legislative restrictions as to foreign ownership in uranium projects in Kazakhstan, there is an example when a uranium producer is a wholly-owned subsidiary of a foreign company.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

19

Methods of Settling Disputes

• Either Kazakh law, Kazakh courts or international arbitration.

• Foreign court judgments and orders are not enforceable in

Kazakhstan, but arbitration awards are.

• Kazakhstan is a signatory to the New York Convention,

ICSID Convention, Energy Charter and many bilateral investment protection treaties.

• Government is increasingly assisting on Kazakh law, Kazakh courts. Court system not reliable and difficult to recover adequate damages and costs.

20

Process to obtain Subsoil Use Rights: common barriers faced, pitfalls to avoid/solutions

• This barrier to entry may mean companies already holding exploration licenses will have a significant head start on Kazakhstan’s rich geology.

• Such companies include iron ore developer KazaX Minerals and

Orsu Metals which has signed up another copper-prospective license through an agreement with a private Kazakh company.

• Slater Mining holds the West Khazret gold exploration project, while gold miner Alhambra Resources may get some “grandfather” treatment as it has a mining history that dates back to 2004 at its Uzboy project.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

21

Process to obtain Subsoil Use Rights: common barriers faced, pitfalls to avoid/solutions

• Central Myunkuduk (JSC Ken Dala.KZ) and Shantobe mines were developed by Stepnogorsk Mining & Chemical Complex (SMCC), which is 100% owned by the Singapore-based company, New Power

Systems.

• In 2010 by a court decision the subsoil use licence in respect of the

Myunkuduk mine was revoked from Ken Dala and awarded to

Mining Company LLP, a wholly-owned subsidiary of Kazatomprom.

• Despite SMCC’s nominal independence, under a long-term trust agreement Kazatomprom provides “management services” for SMCC and its subsidiaries, including Ken Dala.

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

22

M

ICHAEL

W

ILSON &

P

ARTNERS, LTD.

Leadership & Networking Expertise

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

23

M

ICHAEL

W

ILSON &

P

ARTNERS, LTD.

AZERBAIJAN & the CAUCASUS

9th Floor

SAT Plaza Business Centre

133 Bashir Safaroglu Street

AZ 1009, Baku

Azerbaijan

T: +994 12 497 8948

F: +994 12 497 8947

E: info@mwp.az

W: www.mwp.az

©2014 Michael Wilson & Partners, Ltd. All rights reserved.

KAZAKHSTAN & CENTRAL ASIA

7th Floor, Building 1A

Nurly Tau Business Centre

5 Al-Farabi Avenue

Almaty 050059

Kazakhstan

T: +7 727 258 4890

F: +7 727 258 4894

E: info@mwp.kz

W: www.mwp.kz

24

M

ICHAEL

W

ILSON &

P

ARTNERS, LTD.

Comments? Questions?

Thank you for your attention!

©2014 Michael Wilson & Partners, Ltd. All rights reserved. This Presentation is prepared for the sole purposes of Michael Wilson & Partners, Ltd. to inform clients or other interested persons of recent legal developments which may affect or otherwise be of special interest to them. The statements and comments above are of a very general nature and do not constitute legal advice or opinion and should not be regarded as a substitute for detailed legal advice in individual cases. All or any part of this Presentation is prepared by employees of Michael Wilson & Partners, Ltd.

Any unauthorized copying and /or publication and /or other use of all or any part of this Presentation is permitted only upon the written consent of Michael Wilson & Partners, Ltd.

25