Documentation Requirements

advertisement

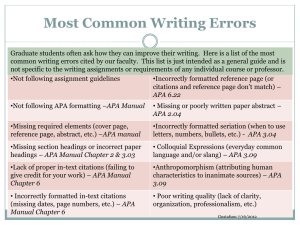

TRANSFER PRICING OVERVIEW OF THE TP REGULATIONS IN TURKEY ANKARA, 07 March 2012 Ayben ÜNEL 1 Turkish Regulations January 2007 (with respect to OECD Guidelines) Article 13 of the CITL No. 5520 November 2007 General Communiqué No.1 December 2007 Cabinet Decision April 2008 General Communiqué No.2 April 2008 Cabinet Decision April 2008 November 2010 Circular TP Guidelines 2 Contents scope of taxpayers comprehensive definition of related parties definition of arm’s-length principle comparability analysis definition of arm’s-length range methodologies APA documentation requirements penalties adjustments intangibles intra group services 3 Scope & Applicability Scope : all resident and non-resident corporate taxpayers all resident and non-resident individual taxpayers both domestic and cross-border transactions Conditions for determination of disguised income profit via transfer pricing: purchase or sale of a good or service made with related parties contrary to ALP 4 Definition of Scope of Transactions Sale or purchase of goods and services include : purchases sales manufacturing and construction leasing and renting borrowing and lending distribution of bonus, salary, or similar items 5 Definition of Related Parties - Article 13(2) The following ones can be given as an example : shareholders of the corporation individuals or legal entities related to the corporation or its shareholders individuals or legal entities which control the corporation directly or indirectly in terms of management, supervision or capital individuals or legal entities which are controlled by the corporation directly or indirectly in terms of management, supervision or capital other relatives (including third-degree) 6 Arm’s Length Principle - Article 13(3) in determining arm’s length price internal comparable external comparable comparability analysis I. II. III. IV. characteristics of goods or services; functional analysis economic conditions business strategies * When comparing the items, “contractual terms” should be taken into account as well 7 Transfer Pricing Methods - Article 13(4) CUP C+ RPM Other methods a) PSM profit-based methods b) TNMM c) Method determined by the taxpayer 8 Documentation Requirements 3 types of documentation requirements : Annual Transfer Pricing Report Transfer Pricing, CFC and Thin Capitalisation Form Annual APA Report Deadline to prepare documentation : TP documentation report and supporting documents must be prepared and available when the corporate income tax return is submitted following the end of the fiscal Deadline to submit documentation : submission of the TP documentation is required on request 9 Advance Pricing Agreements - 1 corporate taxpayers applicable for up to 3 years types of APAs unilateral ( first APA was signed in July,2011) bilateral multilateral renewing / revising / revoking annual APA report application fees (for the year 2012) 38.147,30 Turkish Lira (app. 16.580 €) for each new APA 30.517,75 Turkish Lira (app. 13.260 €) for each renewal. non-refundable 10 Advance Pricing Agreements - 2 APA Application Process Written Application Pre-review of application (If it is needed) Additional information and/or Interview with the taxpayer Analysis Rejection Signing of a formal APA (max. 3 years) 11 Penalties no specific TP penalties, general rules regulating tax penalties under Tax Procedure Law No. 213 will be applied. if transfer prices are not arm’s length if documentation requirements are not fulfilled 12 Thank you aunel@gelirler.gov.tr 13