UACS Foundation and Challenges for SUCS

advertisement

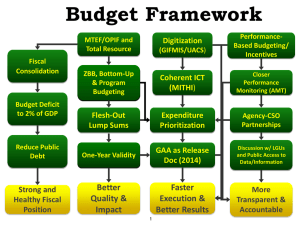

UNIFIED ACCOUNTS CODE STRUCTURE UACS FOUNDATION and CHALLENGES FOR THE STATE UNIVERSITIES AND COLLEGES CARAGA STATE UNIVERSITY December 1, 2014 Agenda Topics Covered Day 1 1. Unified Account Code Structure (UACS) – Foundation for PFM 2. Application of UACS Funding Source Code 3. Workshop / Exercise on UACS Funding Source Code 4. Application of UACS Organization and Location Code 2 Agenda Topics Covered Day 2 1. Budget Primer and Application of Budget with UACS – Part 1 PIB 2. Budget Primer and Application of Budget with UACS – Part 2 Budget Execution 3. Budget and Financial Accountability Reports (BFARS) for UACS (CY 2014) 4. Application of UACS Major Final Output / Program, Activity, Project (MFO/ PAP) Code 5. Workshop / Exercise on UACS MFO/PAP and Budget 3 Agenda Topics Covered Day 3 1. Application of UACS Object Code and Sub Object Code 2. Workshop on Funding Source Code, Organization Code, Location Code, MFO/PAP Code, and Object Code 3. Open Forum, Closing 4 PFM Projects GIFMIS Improve cash management for operational efficiency Improve management of government’s contingent liabilities and financial exposure Treasury Cash Management Operations Improvement Budget Reporting & Performance Standards Accounting and Auditing Liability Management Capacity Building Also CHRIS and PIB Generate real-time, reliable, accurate financial info and reports for policy decision making Harmonize and consolidate data structures and apply consistent set of budget and accounting rules for reporting Enhance government accounting & auditing systems & standards & strengthen external and participatory audit capacity Professionalize the PFM workforce and build stakeholder (Congress and civil society) support for reforms Rolling-Out Key PFM Reforms Towards: In 2014: Unified Account Code Structure (UACS) 1 GAA as Release Document (GAARD) 4 Performance Informed Budgeting (PIB) 2 Early Procurement for Infrastructure, Goods and Consultancy 3 Checkless Payments thru Advice to Debit Account (ADA) 5 Government Integrated Financial Management System (GIFMIS) Treasury Single Account (TSA) Budget Transformation Agenda Spending within means Spending on the right priorities Spending with measurable results In an empowering regime of transparency, accountability and citizen’s engagement Unified Accounts Code Structure Government-wide harmonized budgetary, treasury and accounting code classification framework to facilitate reporting of all financial transactions of agencies including revenue reporting 8 Every IT and Manual system should adopt the UACS for: • Budget cycle - Preparation, Legislation, Execution and Accounting, Accountability Where should UACS be used? • Reporting Appropriation, Allotment, Obligation, Disbursement • Enabling reporting of actual expenditure against budget appropriation as envisaged in PFM roadmap • Payroll, budget, cash management, budget execution and forward planning • Performance measurement – performance indicators linked to UACS MFOs and outcomes achieved are reported against budget and targets 9 To serve as the foundation for the improvements of the Public Financial Management (PFM) Reforms Main Purpose of UACS 1. It serves as the backbone for recording, accounting, analyzing, and reporting government finances. 2. It enables the oversight agencies responsibilities for improving the way financial information is utilized 3. It facilitates the integration of financial systems 4. Utilized properly to enhance the Internal Control Structure to provide more complete and effective information 10 To enable timely and accurate preparation of the following documents/ reports Main Purpose of UACS 1. Financial Reports as required by the Department of Budget and Management and the Commission on Audit, including the Budget and Financial Accountability Reports (BFARS) 2. Financial Statements as required by the Public Sector Accounting Standards Board of the Philippines, 3. Management Reports as required by the executive officials/heads of departments and oversight agencies 4. Economic Statistics in accord with Government Finance Statistics Manual 2001. 11 To educate and inform everybody about the new accounting language – UACS Main Purpose of UACS 1. All forms, documents, internal and external reporting must be updated for UACS, for example: – SARO, ABM, NCA, ANCAI – BFARs (BARs and FARs) – Consolidate Report on Periodical Status of Allotment Releases – NCA Utilization Reports – Monthly Breakdown of NCA Releases by Allotment Class 2. All data sources of DBM must provide information in UACS format (all agencies) 12 To eliminate the problems being encountered from the existing coding structure Main Purpose of UACS 1. The existing coding structure has a disconnect between budget, accounting, and cash. They are relatively independent with each other 2. The existing Systems are independent from each other and unable (or very difficult) to properly report the problems encountered 3. Until data is properly structured, agencies cannot be Financial Systems - ready 13 To have one coding framework for whole Benefits of UACS Budget process (Preparation, Legislation, Execution and Accountability) and for reporting Appropriation, Allotment, Obligation, Disbursement in all systems To enable reporting of – 1. Allotments released against appropriation, 2. Obligations against appropriation and 3. Disbursements against obligations To facilitate compliance with OPIF Reference Guide and NBC 532 14 Benefits of UACS To enable timely accurate preparation of financial reports in accord with IPSAS, GFS and requirement of central oversight agencies and the executive of Departments and Agencies UACS should allow implementing / spending agencies to facilitate management reporting and decision making Ability to link / integrate Physical and Financial Progress information 15 THE UACS JOINT CIRCULAR – MANDATE HIGHLIGHTS COA-DBM-DOF Joint Circular No. 2013-1 August 6, 2013 16 JOINT CIRCULAR NO. 2013-1 (page 1) 17 JOINT CIRCULAR NO. 2013-1 (page 2) 18 JOINT CIRCULAR NO. 2013-1 (page 3) 19 JOINT CIRCULAR NO. 2013-1 (page 3) 20 JOINT CIRCULAR NO. 2013-1 (page 4) 21 Revised Chart of Accounts COA Circular 2013-002, 30 Jan 2013 • Revised the NGAS chart of accounts to provide new accounts for adoption of the Philippine Public Sector Accounting Standards (PPSAS) • Major component of the Unified Accounts Code Structure (UACS) to ensure comparability of financial information from budgeting and accounting systems • Government-wide training on the revised Chart of Accounts and new Philippine Public Sector Accounting Standards (PPSAS) THE UACS CODING CHALLENGES 23 To eliminate misconceptions regarding the new Codes Challenges of UACS 1. Agencies perceive UACS as a compliance exercise and will likely just do mapping and conversion for required reporting 2. Low likelihood of data being analyzed 3. Low likelihood of sufficient focus on data accuracy 4. Limited attention given to underlying agency systems when UACS was announced. 5. Agencies do not have systems that are UACS compliant 6. Until data is properly structured, agencies cannot be systems -ready 24 UACS Challenges Establishment of UACS Help Desk To address questions during the application of UACS to Budget Execution process. Should evolve to Financial Management Help Desk UACS Help Desk Number is 791-3002 – operational on September 22, 2014 (email uacs@dbm.gov.ph) UACS Web Site – www.uacs.gov.ph 25 Questions and Comments ? 26 Thank You!