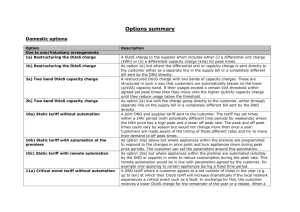

CMP### Title

advertisement

Distributed (Embedded) Generation Benefit Place your chosen image here. The four corners must just cover the arrow tips. For covers, the three pictures should be the same size and in a straight line. DCMF Iain Pielage – 4th April 2013 Overview Background Previous proposal work (GBECM-23) Way Forward 2 Background Exemptible distributed (embedded) generators avoid generation related transmission changes and receive equivalent demand charges from the relevant supplier (subject to their own commercial contracts) Due to the effect of the residual element within TNUoS, this leads to an ‘embedded benefit’ of ~ £25/kW (and increasing) Also receive BSUoS & Transmission Losses benefits Different definition of Transmission across GB. At BETTA, a directly connected gen. at 132kV in Scotland located in close proximity to one which is embedded would arbitrarily pay ~£18/kW more Ofgem introduced the time limited small gen. discount in Scotland for 132kV directly connected gen. to address this (SLC C13) Ofgem has indicated that it does not considered the current arrangements as sufficiently cost reflective nor a level playing field for competition and that an enduring solution is required. 3 How Does TNUoS Benefit arise? TNUoS consists of two elements Locational signal + Residual (revenue recovery) 20 TNUoS Locational Elements only All equal 15 Tariffs 10 Inclusion of the Residual Element 20 20 15 15 15 10 10 10 20 £10 embedded benefit 5 Dem 5 Gen 0 0 -5 -5 -5 -5 -10 -10 -10 -10 5 Charging Zones 0 A B C D E 5 Charging Zones A B Residual C D Dem Gen 0 E D@A paid £10/kW D@A paid £5/kW G@A pays £10/kW G@A pays £15/kW EG @ A pays £10/kW EG @ A pays £5/kW Relative ‘embedded benefit’ is 2 x the residual in this illustrative example - £10/kW (i.e. Generation Residual Component + Demand Residual Component) 4 BSUoS & Losses Similar to TNUoS, distributed generation does not pay BSUoS no adjustment for transmission losses Receives both BSUoS and losses benefit. Reduces the net demand for associated Supplier Reduces Suppliers share of BSUoS and Losses Associated costs recovered from other parties. 5 Where did we get to? - Recap Issue highlighted as a consequence of BETTA Charging pre-consultation GB-ECM23 raised to review embedded generator benefit (linked to Standard Licence Condition SLC C13) Work progressed over January – June 2010 Project TransmiT launched : September 2010 Consequential impact on GB-ECM23 At that time, the outcome of SCR was unknown CMP213 subsequently raised Standard Licence Condition C13 expires 2016 Allows for enduring charging solution replacement for SLC C13 based on new transmission charging baseline progressed under CMP213. Expectation “that industry will begin work during this time to produce an enduring solution” Link to Ofgem decision letter: http://www.ofgem.gov.uk/Networks/Trans/ElecTransPolicy/Charging/Documents1/SLC%20 C13%20decision.pdf 6 Previously Considered Options for Change Supplier DNO TODAY Net Gross 7 Previously Considered Options for Change Supplier • Existing arrangements / minimal disruption • Ofgem has indicated that there is an issue TODAY Net • Analysis indicates not costreflective. Directly addresses costreflectivity issue Gross Removes the need for more complicated contractual arrangements ~ Requires de-minimus threshold and robust/transparent discount level DNO ~ Could indirectly address cost-reflectivity issue ~ Introduces massive implementation complexity (revenue transfer, nodal market) Directly address costreflectivity issue Removes need for more complicated contractual arrangements Introduces significant implementation complexity for same result as gross supplier 8 Previously Considered Options for Change Supplier • Existing arrangements / minimal disruption • Ofgem hasNot indicated cost that there is anreflective issue TODAY Net • Analysis indicates not costreflective Directly addresses costreflectivity issue Gross Removes the need for more complicated contractual arrangements ~ Requires de-minimus threshold and robust/transparent discount level DNO ~ Could indirectly address cost-reflectivity issue ~ Introduces massive implementation complexity (revenue transfer, nodal market) Directly address costreflectivity issue Same Removes needresult for more from less complicated contractual complicated arrangements model Introduces significant implementation complexity for same result as gross supplier 9 Net DNO Model Charges still levied on net flow on / off transmission network Change from implicit to explicit access rights (injection / off-take) DNO manages access rights SO DNO purchase explicit nodal export/import access rights (i.e. per GSP) GSP Group Individual GSPs Supplier notify DNO demand (and possibly DG) requirements BMU1 DNO OR BMU2 BMU3 BMU4 BMU5 BMUX DG notify DNO directly of export requirements Supplier BMUs (DNO) Problem: Cannot directly attribute DG to single GSP 10 Gross Supplier Model Distributed Generation Tariff + Gross Demand Tariff Charge Suppliers on Gross HH imports & Gross HH metered output (versus) current net. Sub-options for calculating DG Tariff Average Maximum export DG Capacity (e.g. over triad) Net Locational Tariff + Gross Residual to demand TNUoS split into locational + residual elements Charge locational to both Suppliers & embedded Gross residual charged only to suppliers (demand) Sub-options for Gross demand charges – similar to DG Tariff Reminder: NGET’s overall revenue recovery remains unchanged 11 Embedded Charging – Way Forward Main Interaction: CMP213 – Project Transmit. Workgroup Consultation closed 15th January 2013 Expect Final Mod Report to be with Ofgem April 2013 Proposed way forward: Seeking Views Re-establish expert group April / May Review previous (GB-ECM23) work; Consider consequences of CMP213 Interaction with DNO charging? Other options? Possible Timeline: Raise CUSC modification proposal May / June Ofgem decision, 2014 Transition period up to 31st March 2016 Raise Consequential code changes during that time. 12