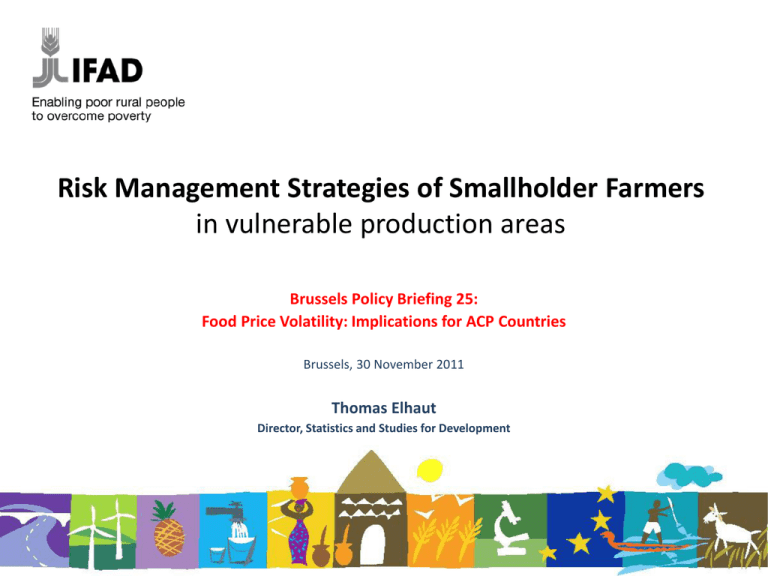

Risk Management Strategies of Smallholder Farmers

advertisement

Risk Management Strategies of Smallholder Farmers in vulnerable production areas Brussels Policy Briefing 25: Food Price Volatility: Implications for ACP Countries Brussels, 30 November 2011 Thomas Elhaut Director, Statistics and Studies for Development Typology of Risks Source: WDR (2000), and DFID (2004) The risk-web, trapping smallholders natural risks, climate change background market, institutional, policy failure public health risks policy biases, lack of voice political risks, conflict inequality spatial risks market risks Key message 1: a risky world • The global risks landscape (WEF 2011) is impressive and diversified, with … • increased frequency and intensity of incidents, eroding response capacities, and … • sharper market volatility exacerbates the world risk profile, and • asymmetry in access to market and other risk information constrains coping strategies. • Smallholders, women farmers, indigenous farmers and young farmers are particularly vulnerable categories of producers; … especially in remote, marginal production areas Key message 2: food security compromised These risks (and perceptions) and uncertainties compromise (returns to) assets, affect longer-term investment behaviour, generate risk of trapping vulnerable smallholder farmers in risk-averse, low-return and unsustainable production systems inhibit entry of new (young) entrepreneurs in the excessively risky and poorly remunerated business of agriculture, which … Ultimately compromises global food security While higher (“economic”) agricultural prices should provide and incentive framework for supply responses Key message 3: where there is a will, there is a way • Farmers have mitigated and adapted to risks, with a range of strategies: – from soft, traditional knowledge, solidarity based strategies; – to harder, know-how and resource intensive strategies; – including diversification of incomes and migration • We can build on this expertise, enhance risk resilience, develop more robust risk management systems, design risk transfer mechanisms • This requires coordinated action: research, innovation, impact assessment, systematisation, scaling-up, market information management, partnerships, private & public investment and effective brokerage Risk management strategies Source: Adapted from WDR 2000, World Bank (2001), Walker and Ryan (1990), Mathur and Gaiha (2004), and Gaiha and Imai (2004). The rural nature of the challenge Energy security Environmental security poverty Public health security Food security • The problem is rural: – agriculture as a contributing cause; – agriculture as a victim • Is also the solution rural? • Towards a new rurality … • … new rural futures? Smallholder agriculture transformation 2 - Modernised farmers: diversified, specialised Transformation path 1- Subsistence farmers: Surpluses of low value commodities, local markets 3 – Commercial farmers: competitive, high value commodities, national and world markets Market risks and volatility invisible hands that strangle smallholders • “rien ne va plus”: – subsistence farmers, in remote and vulnerable areas were traditionally relatively insulated (decoupled) from markets and global conditions (and opportunities) – in globalised economy, exogenous shocks transmit widely • the 2 edges of the sword: – market volatility, – price volatility • the need for innovation and governance Volatility and Growth of Food Prices in Selected Asia-Pacific Countries (1998-2008) Source:FAOSTAT Market and price volatility and responses – the 2008 case Addressing information asymmetry • The underlying logic: – World food security depends on smallholder farmers – Smallholder farmers need on-farm investment – Market uncertainty, price volatility and related information asymmetry constrain risk management options and strategies and thus investment – Smallholder access to agricultural market information (transparency) is essential for world food security • The ultimate goal: – – – – From club good to global public good Level playing field Transparency Efficiency Complex information needs of smallholders • Which information? – Non-tariff barriers – Quality and safety standards, phyto-sanitary regulations, – Certification norms – Production costs – Farm gate, local markets, national markets, regional markets – Rural competiveness and investment climate – Value chain data • Improving access – Information systems, versus supply of ad hoc data – Processed, analysed, visualised – ICT (private: cell-phones; public: media) Market information, what for? 1. 2. Micro- or enterprise level: Transmitting market signals to smallholder farmers Inclusive agri-business Macro-level: Pro-poor policy development Ultimately: global food security a) Transmitting market signals to smallholder farmers: – Transparency, price transmission, price-risk management – Supply response – Sales/storage decisions – Reduce transaction costs – Adjustment along value chain, managing transaction costs – On farm investment decisions b) Inclusive agri-business: – Investment decisions – Procurement decisions, and longer term relationships with farmers – Fair dividends along the value chain Layers that affect price transmission: Marketing Costs for Rice in Cambodia, 2002 (Riels per kilogram of paddy rice) Source: World Bank Study Team (July 2002). Concluding message 1: the risk cloud over our heads • the global risk landscape is becoming more complex and threatening • 500,000 smallholder farmers are particularly vulnerable (asset base, returns to assets, diversification options) • market volatility (prices, trade) exacerbates these vulnerabilities of small producers • traditional risk mitigation, risk spreading strategies and solidarity solutions are no longer as effective • this affects risk perceptions and depresses investment behaviour, which • threatens longer-term world food security • serious efforts are required to: mitigate smallholder risks, assist producers to adapt to risks, and put in place risk markets, supported with modern risk transfer mechanisms Concluding message 2: What will it take? • Coordinated: – research; technical, financial and other innovation, related to risk; – impact assessments (randomised control trials, participatory RRA, …); – systematisation, scaling-up; – market information management; – partnerships, beyond agriculture, involving the financial sector – private & (risk-tested) public investment; and – effective global solidarity and governance (of agricultural markets); and brokerage • Leadership: OECD, BRICS and other MICs – price makers – internalising externalities of restrictive policy actions • South-south cooperation and Trilateral cooperation Thank you for the attention t.elhaut@ifad.org