Worksession Funding Opportunities Interstate 4

May 21, 2013

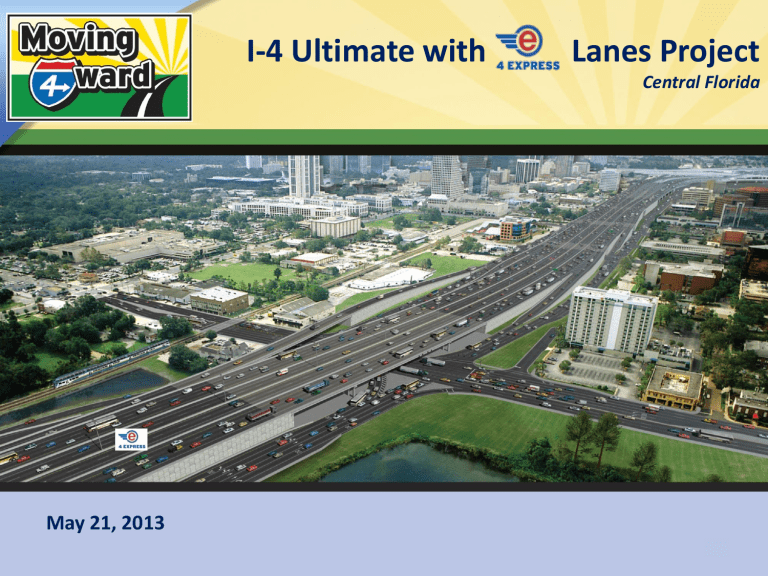

I-4 Ultimate with Lanes Project

Central Florida

1

Executive Summary

Executive Summary

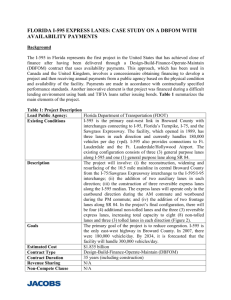

• The $2.1B I-4 Ultimate Project is the top priority for the state of

Florida

• The Project is being advanced using a Public-Private Partnership (P3) under Section 334.30, F.S. (P3 Law)

• A system of financing tools guarantee the lowest cost:

•

• Private Activity Bonds (PABs)

TIFIA

FDOT facilitates use of tools since administered by US DOT

• If PABs are used for the project, a conduit issuer is needed to issue bonds

• This can be accomplished through an interlocal agreement between Orange County, Seminole County and City of Orlando

2

Project Overview

$2.1B (FY2013$) Strategic Initiative for Florida

• 21+ miles from West of Kirkman Road (Orange) to East of

SR 434 (Seminole)

• Project replaces aging infrastructure and enhances safety

• Relieves congestion in heavily populated areas of Florida

3

I-4 Ultimate

Interstate 4 Typical Section

• 4 Managed Lanes (2 each direction)

• 6 General Use Lanes (GUL) + Auxiliary Lane

Managed

Lanes 4

Procurement Schedule

Draft RFQ and PIM

Industry forum

February 22, 2013

March 4, 2013

Advertisement and RFQ March 8, 2013

Shortlist and draft RFP May 21, 2013

Release draft RFP

Final RFP and ITP

Proposals due

Best value selection

Contract execution

May 2013

September 2013

January 2014

March 2014

June 2014

5

Why Public-Private Partnerships?

P3 Seeks to Achieve 5 Primary Goals

• Provides capacity improvements much sooner than a traditional pay-as-you go approach

• Eliminates project phasing and advances the overall project

• Capitalizes on the private sector’s innovation and access to capital markets

• Transfers of appropriate risk items to private partner

• Enhances long-term, lifecycle cost efficiency and service quality

6

FDOT’s P3 Legal Framework

Legal Framework Provides Strong Creditworthiness

• P3 Law originally enacted in 1991 - p rovides flexibility to advance projects while implementing safeguards

• Authorizes FDOT to advance projects programmed in the 5year work program or 10-year SIS

• Requires cost effectiveness and public-benefit analysis

• Authorizes performance-based payments to private sector

• Annual payments on multi-year P3s are prioritized ahead of new capacity

• Strong market acceptance of FDOT’s legal framework

• I-595 and Port of Miami Tunnel

7

P3 Financial Controls

Financial Controls Provide For Strong Creditworthiness

• Statutory requirements promote fiscal responsibility

• Governor and legislative approval of contractor financed projects

• 20% limitation on debt and debt like obligations

• 15% limitation on P3s

• Submittal of 5-year work program to the Legislature annually

• Budget requests are balanced to available resources

• Proven track record of effectively managing the work program as revenue forecasts change

8

Public-Private Partnership (P3)

Appropriation-Based Funds Finance the Project

Milestone Payments

Payments made during construction period

Incentivizes accomplishment of construction priorities

Reduces the amount of financing

Credit enhancement

Final Acceptance Payments

Post construction payments

Incentivizes on time completion of project

Repays short-term financing

Credit enhancement

35-years of Performance-Based Availability

Payments

Operations and maintenance period payments

Incentivizes:

On time completion of project

Construction quality

Level of service / Maintenance

Repays long-term debt, equity, operations and maintenance costs, renewal work costs

100% of payment must be performance based to ensure incentives are achieved

9

Public-Private Partnership (P3)

Proposer May Use A System of Financing Tools

TIFIA

A form of debt – like a bank loan

Federal credit assistance

May be subordinate to other debt

Long-term or short-term financing

Interest rate is tied to US Treasury

FDOT submitted a letter of interest January

2013

Bank Debt

A form of debt

Financing from commercial banks

Short-term financing - 5 to 7 years

PABs

A form of debt - like Industrial

Development Bonds

Long-term financing

Tax exempt bonds issued by government

SAFETEA-LU authorized up to $15 billion

Private Equity – “skin in the game”

Proposer’s contribution toward the project

Will be required within the capital structure

Used with debt

At risk until the end of the project term

Lost in the event of contractor default

10

Private Activity Bonds (PABs)

Only $7.2B of the $15B Allocation is Remaining

• $15B cap on PABs used to deliver highway and freight transfer facilities

• Exempt facility bonds – not subject to state volume caps

• FDOT wishes to submit an application to secure a PABs allocation from US DOT

• Estimated allocation request = $800M to $1.5B

• Conduit issuer is a key player in application process

• PABs are an important financing mechanism for proposers

• Limited financial capacity in current bank debt markets

• PABs provide proposers with access to tax-exempt interest rates

11

Public Involvement and

Community Outreach

• Project website: www.Moving-4-Ward.com

• Public involvement and community outreach will be incorporated

• Sign up and be notified when there is a major update or announcement

12