Year End Training

advertisement

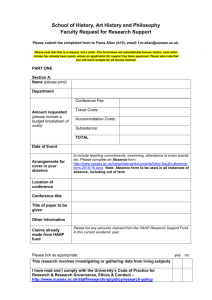

July 2014 Fiona Hudson Why required Types of adjustments Form filling Issues Timetable Management Reports Contact details Accounts made simple! Financial Year to 31 July Allocate income/expenditure to correct year Income - earned or received in advance Goods/services - must have been delivered Expenditure - incurred or paid in advance Goods/services - must have been received Creditor (we owe supplier) Debtor (customer owes us) Prepaid expenditure (paid in advance) Prepaid income (received in advance) Credit cards (we owe bank) Forms & guidance http://www.finance.stir.ac.uk/staff/financia l-accounting/year-end-process.php Not less than £50 per item Consolidate several items Select appropriate form for type of adjustment In same format as Agresso Journal Posting Amounts in one column Form MUST balance to zero with the balancing entry being entered at the pre-printed account code Full description filled in at Narrative Save forms electronically Send to nominated contact in the school/ service area Automatic reversal of same “NIL” returns are required Quarterly charges Pre-payments made in year Estimates (purchases and sales) Internal charges treatment Travel expenses Overtime Goods/services received and booked in Goods/services ordered, but not received Goods/services received but not ordered in Agresso Year-end adjustments to be received by 1 August Collated by nominated person in each school /service area E-mailed to the relevant service accountant with subject “Year-end adjustment” Goods purchased on Agresso must be booked in, if received, by 31 July, 12.30pm. These will be accrued centrally Invoices for goods NOT purchased on Agresso, travel & expenses claims, requests for payments must be in Payments Section by 24 July Don’t rely on internal mail on final day and don’t leave all of these until the final week No further processing in current Financial year Sales Invoices can be raised up to 10.00am on 31 July All income banked daily, 31 July income to be banked on 1 August and the banking sheet sent to Finance also on the 1 August Stock returns to be received by 4 August Equipment returns to be received by 1 August Disclosure of sales and purchases £25K limit before capitalisation First Run – 8 August - will include all year-end adjustments Second Run – 15 August - will include all projects/research/special initiatives closed off Your service accountant (Forms) Angela Grant email (Payments Section) Alice Stewart email (Equipment returns) Fiona Hudson ext. 6195/Derek Stewart ext. 6194 (General queries) School / Service Area Nominated to collate year-end adjustments Service Accountant Morag Crawford Shona Morrison Elizabeth Robertson Shona Morrison Angela Cowan Alison Lindsay Lynn MacGregor Sandie Anderson Mary Frances Kerr Shona Morrison School of Sport Bob Hoolachan Alison Lindsay Stirling Management School Alannaha Young Shona Morrison Estates & Campus Services Lesley Morrison/Alison Lunn Alice Stewart Elaine O'Hare Alice Stewart Mandi Clark Alice Stewart Gail Miller Alice Stewart Rebecca Gilchrist Fiona Hudson Development & External Affairs Pamela Hislop Fiona Hudson Finance Office Lorna Mitchell Fiona Hudson HR & Organisation Development Lesley McEwen Fiona Hudson Information Services Margaret Angell Fiona Hudson Research & Knowledge Transfer Sylvia Barnes Fiona Hudson Secretary/Principals Office Caro McEwen Fiona Hudson School of Applied Social Science School of Arts and Humanities School of Education School of Natural Sciences School of Nursing, Midwifery and Health Commercial Operations & Catering Residential Services Stirling Management Centre Deputy Secretary's Office