PORTFOLIO SELECTION

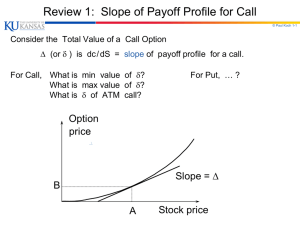

advertisement

THE PORTFOLIO DESIGNER: A basic tool to reduce the markets complexity and make a short list of assets to invest. TARGET USERS: Private Investors Brokerage AXE ,AXEΠΕΥ, ΑΕΠΕΥ BANKS FINANCIAL ORGANIZATIONS MAIN OBJECTIVES To result in to a short list and optimal allocation of assets to invest To Design Hedging with Derivatives BASIC FUNCTIONALITIES Optimal Portfolio Selection Hedge Designer Historic Simulation HUNAM-AND-COMPUTER INTERACTION PRINCIPLES OF QUALITY IN THE DESIGN OF THIS SOFTWARE As few as possible menus and input-and out-put forms As simple and friendly as possible, interface As much as possible hidden automation We keep it intelligent and as simple and selfevident as possible Artificial Intelligence methods INTERNAL STRUCTURE QUALITY OF THE PROGRAM Full use of the most modern design and programming technology Optimal internal structured programming for speed and real-time efficiency Effective both on recent and less recent hardware Full communication with Microsoft Office and other programs MARKOVITZ THEORY OF PORTFOLIO’S RISK AND PROFIT Classification comparison and preference of Portfolios based on risk and profit Profit measures:Average Rate of Return Risk measures: Volatility Elasticity Combinations PORTFOLIOS OF MAXIMUM PROBABILITY OF PROFIT The cut-off-rate technique The Sharp ratio of profit and risk The Treynor ratio of profit and risk Find the portfolio that has the maximum probability to result to a profit above a preset level CONTSTRAINTS ON THE DESIGN OF PORTFOLIO BY THE USERS Constraints on the number of assets Constraints through short listing based on fundamentals Constraints through short list based on news Analysis Constraints through arbitrary short lists Constraints by indexes DEFENSIVE , OFFENSIVE AND NEUTRAL PORTFOLIOS The elasticity of the portfolio relative to the general index Less than 1: Defensive More than 1: Offensive Negative : Opposite to the Market Positive: Parallel to the Market NEUTRAL PORTFOLIOS DESIGNER Find the Portfolio of zero elasticity relative to the market HEDGING A PORTFOLIO WITH DERIVATIVES:HEDGING DESIGNER FOR HEDGE FUNDS After choosing the elasticity, estimation of the required futures or options to hedge the portfolio (Delta neutral hedging ) RISK-AND-PROFIT PORTFOLIO FREE DESIGNER The dependence and changes of risk and profit when the percentages change (for sub optimal design experimentation) A matrix with arrows for sensitivity analysis experimentation HISTORICAL PORTFOLIO SIMULATOR Historical Simulator for testing the Portfolio in the past. User defined transaction costs and Bid-Ask spreads costs CRYSTALL-CLEAR PRINT OUTS OF ALL THE TABLES AND IMAGES Print outs of all the out put tables of the program The print outs admit export in Excel for user defined modifications COMMUNICATION OF THIS PROGRAM WITH ITS ENVIRONMENT AND OTHER PROGRAMS Exporting to Microsoft Office: Excel Access Word Etc. Link and feed of data from other programs. TECHNICAL SPECIFICATIONS Software : Little space to store Hardware:Runs in Pentiums 1,2,3,4 In Windows 98 ,NT etc Communicates, if wanted, with the Internet ADVANTAGES OF THIS PROGRAM Advantages compared to other programs: Supports Historic Simulation Support Hedging with Derivatives It is fast and simple to use