Micro Ch 20- presentation 3 Explicit and Implicit Costs

advertisement

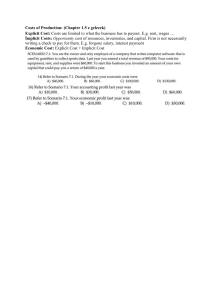

Presentation 3- Cost of Production Cash expenditures a firm makes to those who supply labor services, materials, fuel, transportation etc. Cash payments for the use of resources owned by others ($$ value) Opportunity cost of using self-owned, selfemployed resources Amount of $$ that self-employed resources could have earned in their best alternative use Ex- using a building rather than renting it…the amount of rent you could have made The value or worth the resources used to produce a good would have in its best alternative use Ex- steel in a building could be used for cars Ex- for an assembly line worker making computers, the contribution he could have produced for another good The payments a firm must make, or the incomes it must provide, to attract the resources away from alternative production opportunities. These payments can be explicit or implicit. The minimum payment you must receive for performing entrepreneurial functions for a firm rather than for yourself Included in implicit costs Profit = Total RevenueExplicit Costs Profit = Total Revenue – Economic Costs (Implicit and Explicit Costs) You have been earning $22,000/yr. You decide to open your own T-Shirt company. You invest $20,000 of savings that have earning you $1000/year in interest. Your firm will be in a small store that you own and have been renting out for $5000/year. You also hire a clerk for $18000/year. Calculate Accounting and economic profit Total Sales Revenue………………..120,000 Cost of t-shirts…………40000 Clerk’s salary…………...18000 Utilities…………………...5000 TOTAL COSTS (Explicit)………………………(63,000) ACCOUNTING PROFIT…………………………$57,000 $57,000 accounting profit looks good but doesn’t include implicit costs and overstates the economic success of the company. By providing your own financial capital, building and labor you incur implicit costs (forgone income): Accounting Profit………………………57000 Forgone interest……………………….1000 Forgone rent…………………………...5000 Forgone wages………………………..22000 Forgone entrepreneurial income….5000 TOTAL Implicit Costs…………………………….(33000) Economic Profit……………………………………$24000 ECONOMIC Profit = TR-ECONOMIC COSTS = 120000 – 63000-33000 = $24000 Gomez runs a small pottery firm. He hires one helper at $12,000 per year, pays annual rent of $5,000 for his shop, and spends $20,000 per year on materials. He has $40,000 of his own funds invested in equipment (pottery wheels, kilns, and so forth) that could earn him $4,000 per year if alternatively invested. He has been offered $15,000 per year to work as a potter for a competitor. He estimates his entrepreneurial talents are worth $3,000 per year. Total annual revenue from pottery sales is $72,000. Calculate accounting profits and economic profits for Gomez’s pottery. Explicit costs: $37,000 (= $12,000 for the helper + $5,000 of rent + $20,000 of materials). Implicit costs: $22,000 (= $4,000 of forgone interest + $15,000 of forgone salary + $3,000 of entrepreneurship). Accounting profit = $35,000 (= $72,000 of revenue - $37,000 of explicit costs); Economic profit = $13,000 (= $72,000 $37,000 of explicit costs - $22,000 of implicit costs).