Using a cashflow forecast - St Richard Gwyn Catholic High School

advertisement

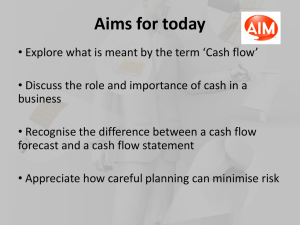

Using a cashflow forecast . 3 20 What is ‘cashflow’? The flows of money into and out of the business Money flows in through revenue from sales of service or product Money flows out when wages and expenses are paid or stocks are purchased. 3.20 Using a cashflow forecast The principle of cashflow 1 More money IN than OUT = cashflow positive. BUT high surplus of cash should be avoided in non-interest bearing account) More money OUT than IN = cashflow negative. Can mean shortage of cash to pay bills AIM is to have a positive cashflow or at least a balance. 3.20 Using a cashflow forecast The principle of cash flow Cash too high Revenue in Cash OK Expenses out Cash too low 3.20 Using a cashflow forecast Inflows Inflows = money received from Customers Local and national government grants Sale of property or equipment Loans 3.20 Using a cashflow forecast Outflows Outflows = money spent by the business on Wages and salaries for staff Raw materials or stock Gas, electricity, water and telephone Rent and business rates Interest on loans VAT Equipment purchases 3.20 Using a cashflow forecast Cashflow forecasts Cashflow forecasts are prepared when: A new product or service is planned New resources (eg new machinery) is being bought A major sales campaign is planned There will be a large increase in existing activities, eg making or selling many more products 3.20 Using a cashflow forecast A basic cashflow diagram Jan Feb Mar Apr May June £ £ £ £ £ £ Opening balance 5,000 7,000 4,000 6,000 12,000 15,000 Add inflows 20,000 22,000 18,000 20,000 23,000 18,000 Total 25,000 29,000 22,000 26,000 35,000 33,000 Less 18,000 25,000 outflows 16,000 14,000 20,000 33,000 Closing balance 6,000 12,000 15,000 0 7,000 4,000 3.20 Using a cashflow forecast A full cashflow forecast See page 341 in Student Handbook. A = sum of numbers under the inflow heading B = sum of numbers under the outflow heading C = difference between A and B, called net cashflow D = balance of money in bank at the start of the month E = adjusted bank balance after adding or subtracting the net cashflow figure 3.20 Using a cashflow forecast Computers and cashflow 1 Spreadsheet packages are ideal for cashflow forecasts because: Once the data and formulae have been entered, the calculations can be done quickly and accurately ‘What if’ calculations can be carried out swiftly Alterations to data can be made quickly and recalculations done automatically 3.20 Using a cashflow forecast Computers and cashflow 2 Potential problems with using a computer are: Incorrect data or formulae will lead to wrong conclusions Spreadsheets take time to set up Computer data can be lost or corrupted 3.20 Using a cashflow forecast