Creating a Compelling Scoreboard for our MF Operations

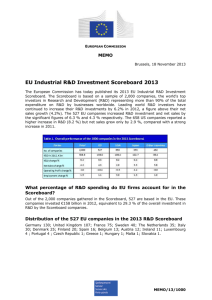

advertisement

Creating a Compelling Scoreboard Microfinance Supervisor’s Forum March 11-12, 2005 Crown Hotel, Naga City Creating a Compelling Scoreboard • A compelling scoreboard starts with clear goals. • It emanates from a shared visionmission of the organization. • The vision-mission of the organization is owned by everyone – from top management to rank and file. Creating a Compelling Scoreboard • As managers and supervisors, yours is the RESPONSIBILITY for “operationalizing” this vision-mission. • “Operationalizing” means translating the vision-mission into objectives and goals. • How do we then “operationalize” the vision-mission? Creating a Compelling Scoreboard • Begin with the End in Mind! (Stephen Covey’s 7 Habits of Highly Effective People) “Create a mental vision for any project, large or small, personal or interpersonal.” “ Don’t just live day-to-day with no clear purpose in mind.” “ Identify and commit yourselves to the principles, relationships and purposes that matter most to you.” A Compelling Scoreboard • The importance of a scoreboard: People play differently when they’re keeping a score. • Without a scoreboard, how does a team determine if it is winning or not. • The benefit of the scoreboard then is that it tells us whether or not we are succeeding in our goals. Strategies and plans are built around the scoreboard. • The scoreboard answers the questions: From what? To what? By when? A Compelling Scoreboard How to create a compelling scoreboard? • Identify top priorities or “wildly important goals*” that the unit must achieve. *WIG – these are goals that when we fail to attain them carries serious consequences and render all other achievements relatively inconsequential. A Compelling Scoreboard How to create a compelling scoreboard? • Create a scoreboard for each one with these elements: - The current result (where we are now) - The target result (where we need to be) - The deadline (by when) • Post the scoreboard and ask people to review it every day, every week, as appropriate. Meet over it, discuss it and resolve issues as they come up. The Microfinance Unit Scoreboard Bangko Pinoy ROXAS BRANCH MFU MONTHLY/W EEKLY LOAN RELEASES Name of Account Officers 1 Juan Dela Cruz 2 Pedro Bayani 3 Maria Liwanag TOTAL 2005 Monthly Loan Actual Week 1 Week 2 Week 3 Week 4 Loan Releases Releases Target Accomplishment 104,167 Target 1/15/2005 312,501 625,002 937,503 1,250,004 5,000,000 416,667 254,167 104,167 150,000 5,000,000 416,667 200,000 100,000 100,000 5,000,000 416,667 300,000 150,000 150,000 15,000,000 1,250,000 754,167 354,167 400,000 The Microfinance Unit Scoreboard Bangko Pinoy ROXAS BRANCH MFU CUMULATIVE LOAN RELEASES Name of Account Officers 1 Juan Dela Cruz 2 Pedro Bayani 3 Maria Liwanag TOTAL 2005 Cumulative Actual % of Loan Releases Monthly Target Accomplishment Accomplishment Target As of Jan. 29, 2005 As of Jan. 29, 2005 As of Jan. 29, 2005 5,000,000 416,667 416,667 8% 5,000,000 416,667 416,667 8% 5,000,000 416,667 416,667 8% 15,000,000 1,250,000 1,250,001 8% The Microfinance Unit Scoreboard Bangko Pinoy ROXAS BRANCH MFU NO. OF ACTIVE BORROWERS For the Month of February Juan Dela Cruz 1 2 3 1 2 3 Performance Indicators Projected Target No. of Active Borrowers No. of New Borrowers No. of Repeat Clients Actual Accomplishment No. of Active Borrowers No. of New Borrowers No. of Repeat Clients Name of Account Officers Pedro Bayani Maria Liwanag TOTAL 150 0 25 100 10 10 130 5 20 380 15 55 150 0 25 100 10 10 130 5 20 380 15 55 The Microfinance Unit Scoreboard Bangko Pinoy ROXAS BRANCH MFU PORTFOLIO QUALITY As of February 4, 2005 Name of Account Officers Juan Dela Cruz Pedro Bayani Maria Liwanag Performance Indicators 1 Loan Balance 2 PAR Amount over 7 Days 3 PAR Ratio over 7 Days 4 PAR Amount over 30 Days 5 PAR Ratio over 30 Days 2,575,000 75,000 3% 5,000 0.2% 1,800,034 50,000 3% 2,000 0.1% MFU TOTAL 2,200,689 6,575,723 20,000 145,000 1% 2% 7,000 0.0% 0.1% The Microfinance Unit Scoreboard Bangko Pinoy ROXAS BRANCH MFU Monitoring of MFU Activities For Week 2: February 7-11, 2005 Name of Account Officers 1 Juan Dela Cruz 2 Pedro Bayani 3 Maria Liwanag TOTAL For Processing For Crecom Approval For Loan Disbursement New Loans Repeat Loans Assumptions • • • • • Microfinance Loan Budget Performance Standards Adequate MIS Staff Training Program Effective Communication System