The Solution Axiom Portfolios

advertisement

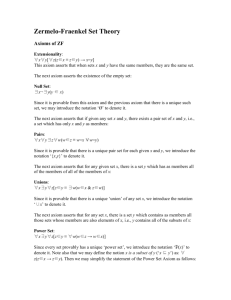

OPEN ARCHITECTURE. SPECIALIZED INVESTMENT EXPERTISE. ONE SIMPLE SOLUTION. Name Date 00, 2014 Contents 1. Investor Challenges 2. The Solution: Axiom Portfolios 3. Axiom Portfolios: The Five Principles of Wealth Investor Challenges Investors are looking for three key things for their investment portfolio: Performance to grow their wealth Lower volatility to protect their wealth Flexibility in pricing and income solutions Investor Challenges The challenge is having the time, knowledge and expertise to: Design a portfolio tailored to unique goals and risk profiles Monitor the portfolio and make day to day investment decisions Do all of this cost-effectively The Solution Axiom Portfolios provide investors with the features and benefits of sophisticated portfolio management, while simplifying the reporting, management and administration of their portfolio Axiom Portfolios An all-in-one portfolio solution that leverages the benefits of: Open Architecture Specialized Investment Expertise Investment Management Research Features: 8 Portfolio Options 3 Flexible Pricing Options 3 T-Class Options Axiom Portfolios: The Five Principles of Wealth Axiom Portfolios are built on the five principles of wealth, a set of beliefs that form the foundation of wealth accumulation and protection over the long term. Principle Benefit Axiom Wisdom Knowledge through experience Global investment managers Peace of Mind Comfort and reliability Investment Manager Research Team, Portfolio design Confidence Ability to reach your goals and satisfy unique needs Tailored investment solutions, pricing and T-class Clarity Freedom from ambiguity and complexity Straightforward portfolios, clear reporting Significance Respect, advice and service Personal service from a dedicated financial advisor The Principle of Wisdom Open Architecture = Choice WISDOM Specialist versus Generalist model Diversification across asset classes, geographic regions and investment styles Specialized investment expertise on each element of the portfolios Specialized Investment Expertise WISDOM The Principle of Peace of Mind Investment Management Research (IMR) PEACE OF MIND Creating value for Clients through the relentless pursuit of Alpha Research NOT Search PEACE OF MIND Research NOT Search PEACE OF MIND Breadth + Flexibility = Risk Adjusted Return Potential Greater exposure across the style spectrum gives more breadth to the portfolio allowing it to be rewarded across the market cycle. Overcomes the challenges of different market environments through a carefully constructed portfolio of complementary managers. The Principle of Confidence The Principle of Confidence CONFIDENCE Flexible pricing, income solutions and tailored portfolio options provide additional value and choice Three Flexible Pricing Options CONFIDENCE Select and Elite Class provides additional value for larger investments Householding CONFIDENCE Build and save through preferred pricing Three Income Solutions: T-Class CONFIDENCE A tax-efficient way to draw regular cash flow from your investments Eight Tailored Portfolio Solutions CONFIDENCE Portfolio solutions cater to diverse investment profiles The Principle of Clarity The Principle of Clarity CLARITY The Principle of Significance The Value of Advice SIGNIFICANCE Did you know? Most investors begin to work with an advisor when they have only modest savings (57% had less than $25K) (Pollara Research) Advised clients maintain a long term strategy and avoid emotional investing habits Axiom Portfolios: Disclaimer Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Axiom Portfolios simplified prospectus before investing. Select and Elite Class: There will be no automatic transfer into the Select Class (including Select-T4 Class, Select-T6 Class, or SelectT8 Class) or Elite Class (including Elite-T4 Class, Elite-T6 Class, or Elite-T8 Class) from other Axiom classes when the minimum investment of the Select classes or Elite classes has been reached. Conversions and switches into the Select classes or Elite classes will be subject to the minimum investment requirements governing each class. As a result, an investor must hold a minimum investment of $250,000 to convert or switch into the Select classes, and $500,000 to convert or switch into the Elite classes. Note: See the simplified prospectus for the tax treatment of conversions and switches. The information presented is accurate at the time this presentation was created, and is subject to change without notice. Management fees for Class A and Class F units are outlined in the Simplified Prospectus of the Portfolios. Management fees for the units of the Select classes and Elite classes will vary but will not exceed the difference between the capped MER for that Class and the Portfolio’s operating expenses. No management fees are payable by the Portfolio that would duplicate a fee payable by the Underlying Pool(s) for the same service. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. This material was prepared for investment professionals only and is not for public distribution. It is for informational purposes only and is not intended to convey investment, legal, or tax advice. The material and/or its contents may not be reproduced without the express written consent of CIBC Asset Management. Renaissance Investments and Axiom Portfolios are offered by CIBC Asset Management Inc. ®Axiom, Axiom Portfolios and ®Renaissance Investments are registered trademarks of CIBC Asset Management Inc.