Reverse Mortgage Presentation - Elite Mortgage and Financial

advertisement

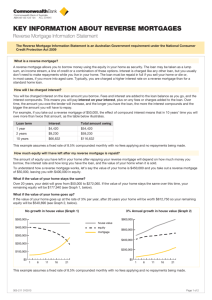

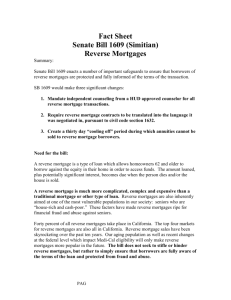

Reverse Mortgage Presentation Presented By: Constance Griggs Elite Mortgage & Financial Services Working In Conjunction With Susan Wang From “2” Questions to ask yourself Are you planning to stay in your home? Would having more money improve your quality of life and give you peace of mind? Today’s Agenda What is a Reverse Mortgage “3” Ways to get money out of your home Issues Seniors Face Today How Reverse Mortgages Work How Safe is a Reverse Mortgage Common uses of a Reverse Mortgage Borrowers Responsibility Why Elite Mortgage Questions & Answers What is a Reverse Mortgage A Reverse Mortgage is a unique loan that enables senior homeowners (62+) to convert part of the equity in their homes into tax free income without having to sell the home, give up title, or take on a new monthly mortgage payment. “3” ways to get money out of your home Sell your home- Requires you to move Take out a forward loan or a line of credit against your home- Requires credit and income qualification and requires monthly payments Get a Reverse Mortgage-You do not have to move, no credit or income qualifications and no repayment required as long as you live in the home Issues Seniors Face Today Fixed Incomes Social Security not enough Fear of outliving their incomes Rising costs of healthcare, & prescriptions Cost of Living (Gas, Groceries, etc.) Unexpected expenses How Reverse Mortgages Work Loan against your home-not paid back until one of the following occurs Move, Sell, or Die No Restrictions on how you use your money Benefit determined by the following 1. Age of youngest borrower on title (minimum of 62 years of age) 2. Appraised value of home or county lending limit 3. Current Index Rate How can you receive your proceeds/benefit 1. Lump sum of cash 2. Monthly payments to you 3. Leave on a Line of Credit 4. Or a combination of the above options How Safe is a Reverse Mortgage The Home Equity Conversion Mortgage (HECM) is the safest HUD Mortgage in the United States You can not outlive the loan You can never be forced out of your home as long as you pay your property taxes, homeowners insurance & maintain the property You cannot be made to make any payments as long as you live in your home Guaranteed by U.S. Department of Housing (HUD) Insured by FHA if Lender Fails 3rd Party Counseling Required/Mandated Asset Protection-Non Recourse Loan Common Uses of a Reverse Mortgage Pay off existing debt (mortgage, credit cards, etc.) Supplement monthly income Healthcare cost and prescriptions Remodeling, home repair, or maintenance Funds for In Home care Recreational trips, cruises, vacations, etc Purchase new vehicle, RV Create cash reserve ( emergencies) Borrower’s Responsibility Keep property taxes current Maintain homeowners insurance Maintain property in good condition Questions & Answers No obligation Benefits Request Form Name_____________________ Date of Birth_______________ Name_____________________ Date of Birth_______________ Property Address:_________________________________________ City:__________________________ Zip:______________________ Phone: (______) ________________ Cell: (____)_______________ Do you have a current Mortgage Yes / No Estimated Value of Home: ___________________ Best time for us to call you AM / PM Your request will be processed with in 48 hours Constance Griggs, VP of Operations (Certified Reverse Mortgage Consultant) Irene Langenberg, Community Outreach (Coordinating Reverse Mortgages) ** See business card for contact information