The Value Circle & Evolving Market Structures

advertisement

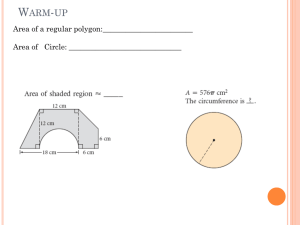

Jonathan Sallet O’Melveny & Myers Washington D.C. The Value Circle & Evolving Market Structures How Do Internet Markets Work? And Why Should Lawyers Care? • As legal counselors, business strategy • As antitrust lawyers, measuring the current and prospective evolution of markets (e.g., price, quantity, output, innovation) • As regulatory attorneys, the use of rulemaking v. adjudication 2 Traditional Value Chain: Mobile Internet Stuck in the middle? Search & Content Operating Systems Device Networks Manufacturers Providers 3 2007 iPhone Changes It All 4 2008: Introducing The “Apps” Store 5 Value Circle & “Markets of Origin” (connectivity) (computer hardware) (mobile device) (computer software) (mobile device) (search) (retail & e-commerce) Multiple players from distinct “markets of origin” can approach the consumer directly, creating economic surplus to be divided with partners 6 Free Cash Flow Analysis • Free Cash Flow is an accounting metric that analysts use to measure the health of a business. It is calculated as income from operations minus capital expenditures. • Some analysts prefer it to earnings, on the basis that it provides a more transparent view of the ability to create profits. • FCF has two big limitations here: – For multi-product, multi-geographic companies, U.S. wireless Internet is only a portion of the FCF – Investments are treated the same as ordinary expenses, despite their potential to generate future innovation and profits • Even so, the FCF analysis is very consistent with the outcomes that the Value Circle predicts. 7 On the Circle 8 Off the Circle 9 Tenets of the Value Circle • Many companies offering competing combinations of value; • Companies play multiple roles with each other, simultaneously (competitor, collaborator, supplier, distributor); • Bargaining among companies divides new consumer surplus; • The market is dynamic and swift; • The purchaser/creator at the center of the circle plays a fundamental role; • Strategic decisions made amid conditions of deep uncertainty; and • Consumers benefit directly from new forms of value, embodied in additional choices in the marketplace. 10 Economics of the Value Circle • Independence of “Elements” – E.g., modularity • Inter-Dependence “Elements” – E.g., “virtual” network effects • Bargaining Power – E.g., multi-sided markets • Consumers – Supplying & Demanding – E.g., Facebook 11 The Mobile Internet Value Circle (broadband) (computing) (electronics and computing) (search) (retail) Whispernet 12 12 Change & Continuity in Video? • The Content “Product” • The Evolution of Internet Distribution • The Commoditization of and Challenge To Television Sets • Cable Business Model is Strong….and Premium Content Has Yet to Make a Big Dent in That Model 13 Video FCF – Little Evidence of Disruption 14 “Google and the mystery device: Spirit and body unite” Puneet Mehrotra February 10, 2012 Google is venturing into hardware. Apple has it. Microsoft has it. Facebook doesn't have it, yet. These are some of the closest competitors of Google. And yes, Google now has it now. Hardware, that is. As competition heats up and the world's biggest technology giants are trying to be one up each other, it's no longer about being just online on the cyberspace, as Google started and where Facebook is right now. 15 If Video Became a Value Circle…. • Devices Would Bring Differentiated Value and Challenge the TV/Remote Control/Set-Top Box – Differentiated TV (Apple, with Siri, or Google or ?) • Differentiated by Design • Differentiated by Content Access and Accessibility – Different Connection to TV (Windows Kinect?) – Different Device (Tablet for Remote or TV?) – Over The Top from Someone In An Adjacent Market • Premium Content Would Be Untethered from Cable – Netflix “Lilyhammer” and other original programming – Google - $100 million for YouTube programming • Consumers “Design” Packages They Want – Cable TV package without sports? – Cable TV package with only news and sports? – “Virtual packages” or single channels over the Internet without cable connection? 16 Value Circle Business Strategy The path to success seems to favor a firm that can: (i) directly approach consumers; (ii) with a “natural” connection to the market of origin, and (iii) a winning “package,” with partners who are often competitors, that delivers new value to customers; while it (iv) “bargains” for a bigger percentage of the new economic value that it has created for itself and its partners. 17 So What? • Business strategy favors experimentation, flexibility and variety, • Antitrust analysis should expressly include potential “disciplining” impact from other markets as important ingredient, • Regulatory processes should favor overarching principles and a “common law” approach to adjudication instead of detailed, prescriptive regulation. 18