Business Interruption - Institute of Directors

advertisement

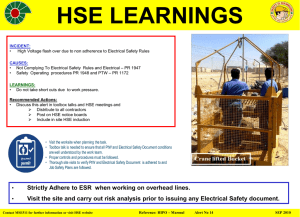

The Reality of Business Risk Friday 14th October 2011 Surrey Welcome and Introduction David Seall Chairman IoD Surrey Agenda • • • • • • • Major Loss Crisis Management Coffee and Refreshments The Future Risk – The Big Picture The Current Political Landscape Panel Q&A’s Major Loss To BI or not to BI The importance of Business Interruption and Sum Insured Neil Hardie Major Loss Manager, Zurich Insurance plc Importance of BI and SI Considerations • Business Interruption – Peril based cover to protect bottom line or additional expenses – May be an individual cover or part of package based business – More complex cover may indemnify against contingent risks • Supply Chain disruption • Loss of orders • Denial of Access • Sums Insured and Indemnity Periods – Business is dynamic and sums insured must be regularly reviewed – For BI, the Indemnity Period (how long the cover will run for) needs to be carefully considered. Under estimation will result in severe difficulties – Have lead times changed since the last review – How has the economic environment affected the business How important is BI cover? Risk landscape is evolving • • • • • • Had business considered the possible effects of the riots What impact might the Olympics have on your risk profile Have you considered location based risks How might you be affected by outsource/contactor risks Legislation landscape When did you last review your Continuity Planning – – – – – Alteration to risk profile Changes in personnel New dependencies Support structures Communication You own the problem You own the solution Crisis Management Practical hints on handling incidents and investigations Helen Devery Partner, Berrymans Lace Mawer LLP It could be you? Case Study 1 Automotive client 6 CID officers 2 HSE Inspectors Call from FD Fork lift truck and stillages Prohibition Notice What happens next? Who attends? Why? What can (and do) they do? What about employees/ witnesses? When? Where can they enter? How do you keep control? Practical Considerations Prohibition Notices Compulsory powers Different Powers of each regulator Claims from employees Business continuity Media interest The company’s response Practical steps? We don’t understand the risks Leave the regulators to it Assume its all done properly Volunteer incriminating evidence Lose all management control Case study 2 Construction site Fall from height Guard rail fails 6 CID officers 2 HSE Inspectors Prohibition notices Internal investigation You will need Work related deaths Police & HSE powers Privilege Ostensible authority A plan! Control of contractors Directors responsibilities What are HSE/Police powers? Privilege Conflict CDM and liability of third parties? Small companies and contractors Designers and clients? Practical tips 1 Manage the injured party Assert privilege Statements from witnesses Plan and practice response in advance Training for the worst case scenario Monitor the regulators’ investigation Rapid response Practical tips 2 Monitor the reports and accuracy The press release Business continuity Early notification to insurers Early legal advice Protection of your employees/ claims Remember Take control and manage It could be you Document everything Think it’s ‘when’ not ‘if’ Control of disclosure The Future What’s on the horizon? Jim Wilkes Casualty Underwriter, Zurich Insurance plc Acronyms • • • • • P.E.B.K.A.C. G-S.I.F.I F.I.F.O. I.F.A. N.U.D.E. Legal Requirements • Represent circa 30% of bodily injury costs • Multiplex • Costs Reviews • Ministry of Justice • Jackson Jackson Review Recommendations To review the rules and principles governing the costs of civil litigation and to make recommendations in order to promote access to justice at proportionate cost Main Recommendations • Irrecoverability of success fees/ATE premiums • Allowing contingency fees • One way costs shifting • Increase in general damages • Extension of fixed costs regime • Scrapping of referral fees Lord Young Review ‘Common sense Common safety’ Mainly about compensation culture Remove burdens – regulation review Lofstedt Review Legislative Pressure • Health and Safety Offences Act 2008 • Regulatory Enforcement and Sanctions Act 2008 • Coroners Rules 2008 • Corporate Manslaughter 2008 • Environmental Damage Regulations 2008 • Regulatory Reform (Fire Safety) Order 2005 • Product Recall (GPSO) Fire Risks • Regulatory Reform (Fire Safety) Order 2005 • Abolishes fire certificates • All organisations to carry out fire risk assessments • Official guidance • Fines Impact of Losses • 5% net profit operation • Needs £3.7m income to cover a claim of £187k Risk management is a systematic way of identifying and analysing potential risks within an organisation and then developing strategies to manage these risks • Risk management should address all risks surrounding the organisation’s past, present and future • Objective is N.U.D.E Risk Management Strategies • Avoid risk • Accept some or all consequences of a risk • Reduce negative effects of a risk • Transfer risk to a third party Corporate Governance • Boards must consider nature and extent of risks/likelihood of risks occurring, acceptable level of risk and costs/benefits of risk control mechanism • Important that Boards put in place mechanisms that give them confidence that risk issues are being identified, monitored and addressed • Boards must understand whether they have in place the right culture and structure to manage liability risk as effectively as possible • Lloyds – Directors in the Dock Corporate Governance • HMG to reinstate OFR (narrative reporting) • ‘Narrative reporting is non financial information to give details of market position, strategy, performance and future prospects, social and environmental issues’ Rating Factors • Business • Claims Experience • Risk Management information Claims Defence Requirements • • • • • • • • • • Effective H&S policy Documented Risk Assessments Training Records Effective SSOW and permits Regular review of RA and SSOW Documented monitoring of use of PPE Effective physical controls in place Effective disciplinary procedure Effective documented accident investigation Documented inspections and audits Precedents • Popplewell • Baker & Quantum The Well Organised Risk • Adoption of management systems approach to H&S • Proactive Board involvement • Managing H&S like quality/environmental issues • OHSAS 18001 – like ISO 9001/14001 • Use of good practice Advice • IoD `Leading H&S at Work` • IOSH website • HSE website (specific topics) • HSE 65 `Successful H&S Management` Food Hygiene Any establishment supplying food direct to consumers Food retailers, Restaurants, Cafes, Takeaways ‘Scores on the doors’ rating system Scores 0 – 5 Effective 01-10-2010 Provides information on hygiene standards (not quality) to consumers Voluntary (initially) Risk – The Big Picture Graeme Leach – Chief Economist of the Institute of Directors The Current Political Landscape The Right Honourable Charles Clarke Panel Q&A