Monetary Policy and Recent Economic Developments: Teacher and

advertisement

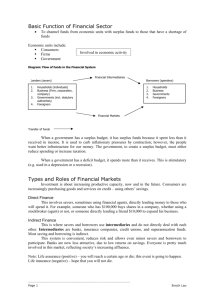

Teacher and Student Guide Our Role The Reserve Bank of Australia Australia’s Central Bank Commenced operations in 1960 • Monetary policy • Market operations • Financial stability • Payments system • Government banking • Banknotes Monetary Policy Our objectives • Stability of the currency • Full employment • Economic prosperity and welfare of the people of Australia Inflation target • Keep inflation at 23 per cent, on average, over the medium term Reserve Bank Board • Governor, Deputy Governor, Treasury Secretary and six external members • Monthly meeting includes a decision about setting the cash rate Monetary Policy • The RBA adjusts the cash rate to try and keep the growth of total spending in line with potential output thereby ensuring that inflation is low and stable Amount of goods and services Total spending Potential output Falling unemployment, rising inflation Rising unemployment, falling inflation Time Monetary Policy • Adjusting the cash rate affects spending and inflation through several channels, such as: Interest rates Spending Cash rate Inflation Exchange rate Import prices Expectations Market Operations • To implement monetary policy, the RBA sets the cash rate • Banks borrow or lend from each other overnight at the cash rate • Open market operations keep the cash rate at target each day Market Operations • The RBA keeps the cash rate at target by setting the supply of funds in exchange settlement accounts so that it is consistent with demand Raises account balances • • • RBA RBA buys government bonds Government makes outlays Banks return banknotes Exchange Settlement Accounts Public Banks Lowers account balances • • • Loans RBA sells government bonds Government receives revenue RBA issues banknotes Deposits Foreign Exchange Reserves • The RBA holds foreign exchange reserves to support monetary policy and Government banking • Income earned on reserves is paid over time to the Australian Government • The RBA only intervenes in foreign exchange markets if: disorderly market conditions clear overshooting (large movement not supported by fundamentals) • The RBA does not target a particular level of the exchange rate Financial Stability • Smooth flow of funds between savers and investors supports economic growth • Safe and robust financial market infrastructure • Coordinate with financial regulators • Crisis management capability, including liquidity support • The RBA monitors financial system health, published in Financial Stability Review Payments System • Allows consumers and businesses to transfer funds to each other Payments System Board • Promotes efficiency and competition in means of payment, including credit and debit cards • Oversees key financial market infrastructure to promote stability in the payments system Reserve Bank Information and Transfer System (RITS) • The RBA runs Australia’s real-time gross settlement system Payments System • RBA at the core, settling all electronic transactions between banks securely Debt securities International & high-value payments RBA Transfers between banks (RITS) Cards, direct entry, cheques Equity securities Government Banking • Banker to the Australian Government, maintaining its core cash accounts • Facilitate government payments to households and businesses, including on behalf of: Centrelink Medicare Australian Taxation Office Banknotes • The RBA manages Australia’s banknotes, including production, issue and distribution • Aim to maintain Australians’ confidence in banknotes as a payment method • Printed on polymer substrate with hard-to-counterfeit security features • Meet the demand of households and businesses for banknotes • Maintain high quality by withdrawing and replacing damaged notes Australia’s Central Bank Our locations • Head Office in Sydney • State Offices in Adelaide, Brisbane, Melbourne and Perth • Branch in Canberra • Overseas offices in Beijing, London and New York For more information Visit the Reserve Bank website: rba.gov.au • Monetary policy • Market operations • Financial stability • Payments system • Government banking • Banknotes