PPT

advertisement

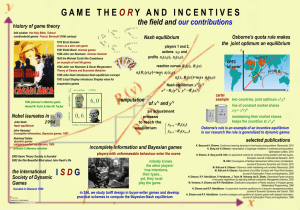

16 CHAPTER DYNAMIC P OWERP OINT™ S LIDES BY S OLINA L INDAHL Competing for Monopoly: The Economics of Network Goods CHAPTER OUTLINE Network Goods Are Usually Sold by Monopolies and Oligopolies The “Best” Products May Not Always Win Standard Wars Are Common Competition Is “For the Market” Instead of “In the Market” Contestable Markets Antitrust and Network Goods Music Is a Network Good For applications, click here To Try it! questions Food for Thought…. Some good blogs and other sites to get the juices flowing: Network Goods A Network Good is a good whose value to one consumer increases the more that other consumers use the good. BACK TO Network Goods Features of network goods: 1. Network goods are usually sold by monopolies or oligopolies; 2. When networks are important the “best” product may not always win; 3. Standard wars are common in establishing network goods; 4. Competition in the market for network goods is for the market instead of in the market. BACK TO Monopolies and Oligopolies Sell Network Goods Network goods typically involve one firm providing a dominant standard at a high price. These markets usually include a number of other firms offering a slightly different product. These firms tend to service niche areas in the market. BACK TO The “Best” Product May Not Always Win It’s possible for the market to “lock in” to the “wrong” product. A Nash Equilibrium is a situation in which no player has an incentive to change their Tyler strategy unilaterally. Alex Apple Microsoft Apple (11, 11) (3, 3) Microsoft (3, 3) (10, 10) Both (Apple, Apple) and (Microsoft, Microsoft) are Nash Equilibria depending on who chooses what first. If Alex chooses Apple, Tyler faces a better payoff if he also chooses Apple (11) or a lower payoff if he chooses Microsoft (3) and vice versa. BACK TO Standard Wars are Common Sony Toshiba HD-DVD Blu-Ray HD-DVD (10, 8) (0, 0) Blu-Ray (0, 0) (8,10) Both companies prefer a standard to none… Two Nash equilibria exist… Postscript: The Sony group won the standard war when Blu-Ray technology was imbedded into the Sony PlayStation 3 and increased the audience for Blu-Ray BACK TO Competition is “For the Market” instead of “In the Market” Once there is a winning standard, the loser can disappear quite rapidly. Winners are not guaranteed their victory for long. 1988: Lotus 1-2-3 dominates the market. 1998? Excel dominates. It’s normal for just a few firms to dominate some markets. Does this make us worse off? BACK TO Nash Equilibrium Cell Phone Duopoly P Q $0 140 5 130 10 120 15 110 20 100 Smalltown’s demand schedule 25 90 Two firms: T-Mobile, Verizon 30 80 35 70 40 60 45 50 Smalltown has 140 residents The “good”: cell phone service with unlimited anytime minutes and free phone (duopoly: an oligopoly with two firms) Each firm’s costs: FC = $0, MC = $10 BACK TO Nash Equilibrium P Q $0 140 5 Revenue Cost Profit $0 $1,400 –1,400 130 650 1,300 –650 10 120 1,200 1,200 0 15 110 1,650 1,100 550 20 100 2,000 1,000 1,000 25 90 2,250 900 1,350 30 80 2,400 800 1,600 35 70 2,450 700 1,750 40 60 2,400 600 1,800 45 50 2,250 500 1,750 Competitive outcome: P = MC = $10 Q = 120 Profit = $0 Monopoly outcome: P = $40 Q = 60 Profit = $1,800 BACK TO Nash Equilibrium T-Mobile and Verizon could agree to each produce half of the monopoly output: For each firm: Q = 30, P = $40, profits = $900 Does anyone have an incentive to cheat? What if Verizon increases Q to 40? Market demand curve now has Q = 70 and P = $35 Verizon profit = Revs – Costs = 40*$35 - ($10* 40) = $1000 T-Mobile profit = (30*$35) – ($10*30) = 750 Verizon gains profit, T-Mobile loses profit BACK TO Nash Equilibrium Will Verizon cheat? Why wouldn’t they? What will T-Mobile do? Will it gain if it cheats? Suppose T-Mobile increases its Q to 40 Now market Q = 80 and market price = $30 What is T-Mobile’s profit? (40*$30) – (40*10) = $800 Will T-Mobile increase its Q? Yes, since its profits increase from $750 to $800 Note that Verizon’s profits fall from $1000 to $800 BACK TO Nash Equilibrium Is there an incentive to cheat at this point? Suppose Verizon increases output to 50 Market Q rises to 90 and market price falls to $25 What is Verizon’s profit? (50 * $25) – (50 * $10) = $750 Does Verizon have any incentive to cheat? No BACK TO Nash Equilibrium Verizon and T-Mobile have arrived at a Nash equilibrium Definition: A Nash equilibrium is a situation in which no player has an incentive to change their strategy unilaterally By cooperating they could have made more profit Note that decreasing production yields no gain So now they are both in a less profitable position BACK TO Try it! Do you use Facebook? a) Yes b) No If so, how much would you REALLY be willing to pay per month for access to Facebook? (if not, use your best guess) a) $0 b) $1.99 c) $4.99 d) $9.99 To next Try it! e) $19.99 Contestable Markets Contestable Market: when a competitor could credibly enter and take away business from the incumbent. Large market share does not necessarily mean the firm’s position is safe… BACK TO Contestable Markets Markets are more contestable when: 1. Fixed costs of market entry are low, relative to potential revenue. 2. There are few or no legal barriers to entry. 3. The incumbent has no unique, hard-toreplicate resource. 4. Consumers are open to the prospect of dealing with a new competitor. BACK TO SEE THE INVISIBLE HAND City water: less contestable Mineral water: more contestable Limiting Contestability with Switching Costs http://awkwardfamilyphotos.com/ Facebook hosts free photos: bad business decision? Or saavy? If you are embedded with Facebook, are you less likely to switch to another network? If switching costs rise, demand will be less elastic (and firms can charge more) BACK TO Antitrust and Network Goods Bill Gates testifies before Congress, 1998. Microsoft intended to “smother” Netscape, went to court on antitrust violations and later settled. List three other web browsers that are now popular. Why and how are they thriving? B A CK T O Try it! Music can be considered a network good in the sense that a) b) c) d) many people today listen to music online and over computer networks. the preferences of individual consumers are independent of what others like. music is produced by large networks of bands, record labels, and music stores. many consumers prefer to purchase music that others purchase as well. To next Try it! Music Is a Network Good An ingenious experiment by Duncan J. Watts (Columbia University) demonstrated that tastes in music have a strong social component. Watts discovered that the more downloads a song had, the more people wanted to download the song. BACK TO Try it! This is the philosopher Rousseau’s “stag hunt game”. He thought many social situations are like going hunting with a friend: If you both agree to hunt for a large male deer (a stag), then you each have to hold your positions near each end of a valley to prevent escape. If one hunter wanders off to hunt the easier-to-find rabbit, then the stag will almost surely get away. What is the Nash equilibrium (or equilibria) of this game? a) (Hunt Stag; Hunt Stag) b) (Hunt Rabbit; Hunt Rabbit) c) (Hunt Stag; Hunt Rabbit) and (Hunt Rabbit; Hunt Stag) d) Both A and B To next Try it! Try it! In a “standard war:” a) b) c) d) there are two good equilibria, but the players differ over which equilibrium is the best. there is only one good equilibrium, but players get locked into the “bad” equilibrium. the Nash equilibrium never dominates. both players would prefer to have no To next standard. Try it! Try it! All cartels and cartel-like behavior are illegal in the United States a) True b) False BACK TO