slide deck - Shale Gas Consortium

advertisement

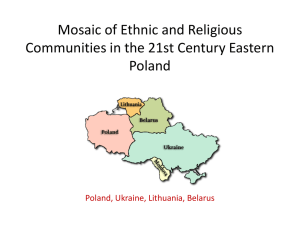

Shale Gas Consortium Idea brief Situation in Europe • Europe – is one of 3 most promising regions (next to US and China) for shale gas production: – Developed industries and large population, strong deficit of its own energy resources – 500+ bln. cub. m consumption, gas prices are at all times high (3-4 times higher than in US) – Dependent on two politically unstable regions: Middle East (Qatar, 40% of supplies) and Russia (30%) – Large undeveloped shale gas reserves, primarily in Poland, Ukraine, Romania, Bulgaria • • • • Poland alone est. recoverable shale gas reserves ca. 146 Tcf (EIA) Ukraine 128 Tcf Romania 51 Tcf Energy independence proclaimed as a strategy by European Commission Shale gas basins in Europe Poland • Most active country • Players like Chevron, Exxon and Marathon present • A lot of locals • None has produced any success – Insufficient geological expertise – Inconsistent GR strategy Ukraine • Two separate basins • Eastern is more promising and was focus for Shell – War disrupted exploration drilling in the area • Government is ready to give full support for newcomers Romania and Bulgaria • Romania – old oil producing region • Shale gas prospects are spread between two countries • Bulgaria hopes to have South Stream pipeline and suspended shale gas, but is under pressure from EC – Prime-minister just resigned, more pro-Western government is being set up • Romania is generally Chevron domain, but its exploration activities met with ecologists protests Recent developments War in Ukraine is disruptive for major gas pipelines from Russia to EU (2/3 of total supply) Russia has cancelled his new pipeline – South Stream – to bypass Ukraine thru Bulgaria, EC is in search for new sources Russia’s is actively using natural gas supplies as its political weapon and leverage on Germany and other European nations To prevent developing alternative energy sources Russia’s Gazprom and government agencies are financing ecological and political groups in EU and US First attempts by international oil and gas players (Chevron – Poland, Romania, Bulgaria; Shell – Ukraine) to enter Europe were not fully successful and met civil groups and political resistance Europe’s dependence on Russian gas Limits to success • Major oil companies: – Lack geological expertise for unconventional gas properties – Enjoy too much of attention from local governments and miss necessity for in-depth PR and GR efforts in selected countries • Independent oil companies: – Have limited international experience – Under pressure from their shareholders who tell them to focus on their core domestic properties and don’t take any new risks Key for success in Europe To be successful in Europe one has to implement a thoughtful GR and PR strategy: 1. Secure majority at national parliaments and governments at Eastern Europe in favor to shale gas production 2. Prepare public opinion that shale gas is an important issue to the national security and economic prosperity of involved countries 3. Ensure tax and other incentives at the EC level to support E&P activities in Eastern Europe and apply pressure on behalf of Western European nations towards their Eastern counterparts to start activities Solution: Shale Gas Consortium SGC will be the organizer of gas properties development in Eastern Europe: • Secure the acreage together with industry professionals • Do the matchmaking for local investors and US oil & gas companies • Raise money for E&P activities • Implement adequate PR strategy • Lobby unconventional gas industry interests on national and EC level Formation of SGC • SGC is a Delaware-based Operations Company – SGC recruits local specialists and organize initial market entry, PR and GR efforts, as well as fundraising activities • For each property SGC will set up a local SPV with participation of investors and oil & gas operator company – SGC will hold 20% interest in the SPV, the rest will be divided proportionally between the investors – SPV will be financed in three stages: • First stage – to obtain the license • Second stage – to finance exploration • Third stage – to finance production • Thus, SGC will finance initial entry risks and retain 20% interest of potential upside SGC Legal structure Partners and Investors 80% 20% 100% SGC Poland SGC Poland Field1 (Cyprus) Field1 (Poland) SGC Poland SGC Poland Field2 (Cyprus) 100% Field2 (Poland) SGC (DE) 20% SGC Ukraine SGC Ukraine Field1 (Cyprus) 100% Field1 (Ukraine) 80% Partners and Investors SGC value proposition • SGC for its oil & gas partners: – takes away significant portion of investment risks at the initial stage – outsource non-core business activities like GR and PR to the top-notch SGC’s GR team • SGC for its investors: – Leverages on geological competence of selected partners to enter promising EE gas market – Significantly decreases amount of investment required to enter rapidly growing energy business in Europe SGC team • SGC is supported and endorsed by reputable US foreign relation and energy professionals: Secr. Spencer Abraham, Hon. Dave McCurdy, Amb. Thomas Pickering, Hon. Ed Verona • SGC has a dynamic and young entrepreneurial founders team: Hon. Ilya Ponomarev, Zachary Todd, Saumitra Thakur • SGC relies on first class specialists on the ground: Stanislav Belkovsky (PR), Ariel Cohen (GR), Thomas Gallagher (IR) Why now Falling oil prices make European market even more attractive as before compared to United States. It is time to diversify The strategy to diversify energy sources at the EU level is being designed right now; new team at EC is being put in place after recent EU elections Political leadership in Poland and Ukraine is being changed Anger against Russia and desire to cut the connecting ties are at all times high Local investors are looking for new opportunities in energy sector as well