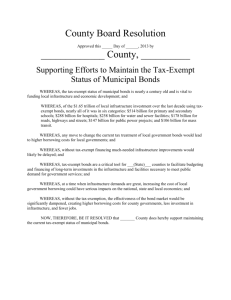

here - Bond Dealers of America

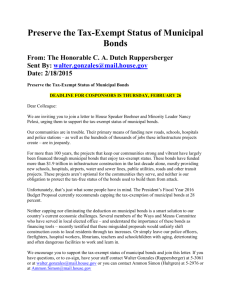

advertisement

The Push for Tax Reform: Will Congress Act in 2013? Panel • Anne Urban, Urban Swirski & Associates, LLC • Sandra Swirski, Urban Swirski & Associates, LLC • Ellen Marshall, Marshall & Company • Moderator – Susan Collet, SVP, Government Relations, Bond Dealers of America Principal Tax Reform Proposals Proposal Intent Obama FY 2014 Budget Limits the value of the tax-exempt for deductions and exclusions – including the federal tax exemption for municipal bonds – to 28%. The cap may apply to currently issued bonds and new issuances. The Administration also released proposal to create a federal infrastructure bank and to create America Fast-Forward bonds, described as direct pay bonds to be used exclusively for financing critical infrastructure projects. House Ways & Means Committee No formal proposal on tax treatment of municipal bonds released to date. March 19, 2013 Committee hearing on state/local taxes produced positive comments from both Republicans and Democrats on the effectiveness of municipal bonds and the muni exemption. Overall goal of Committee tax reform initiative is to reduce individual and corporate tax rates to 25%. Senate Finance Committee No formal proposal on the tax treatment of municipal bonds released to date. However, the Senate Budget Committee’s FY 2014 Budget Proposal includes a provision to cap the value of unspecified deductions and exemptions at 28%. Committee “options paper” also suggests eliminating private activity bonds. Other Legislative/Commission proposals Simpson-Bowles Commission – prospectively eliminates tax-exempt bonds. Also eliminates private activity bonds. Sen. Ron Wyden (D-OR), S. 727 (2011) – replaces tax-exempt bonds with taxcredit bonds with a 25-percent tax-credit to bondholders in lieu of interest. Tax Reform Won’t Be Easy Spending and Tax Revenue as Share of Economy From 2012: assumed sequester took place and tax rates returned to Clinton-era levels Primary House Taxwriters W&M Chairman Dave Camp (R-MI) W&M Subcommittee on Select Revenues Chairman Pat Tiberi (R-OH) W&M Subcommittee on Select Revenues Ranking Member Richard Neal (D-MA) W&M Ranking Member Sandy Levin (D-MI) Bi-partisan Bill? Who is “Gettable”? Rep. Joe Crowley (D-NY) Rep. John Larson (D-CT) Rep. Ron Kind (D-WI) Rep. Mike Thompson (D-CA) Rep. Allyson Schwartz (D-PA) House Process • Small Working Groups (February – May) • 500+ Page Joint Committee on Taxation Options Report (May 7) • Chairman Camp Wants to Pass a Bill Through His Committee by end of 2013 Primary Senate Taxwriters Finance Committee Chairman Max Baucus (D-MT) Senator Ron Wyden (D-OR) Senator Charles Schumer (D-NY) Finance Committee Ranking Member Orrin Hatch (R-UT) Senate Process • Big Announcement • Members-only Briefings Started in February and ended June 20th • Comprehensive “Options Papers” Released to Public After Each Briefing • Chairman Baucus Wants a Markup in Late Fall Joint Efforts • Web Portal for Public Submissions: https://taxreform.gov/ • “Max and Dave” Road Show Beginning in July • Joint Hearings Through Rest of 2013 • Coordinated “Pre-Conference” Approach Debt Ceiling To Hit Later Than Expected The top blue line reflects the path of national debt excluding any payments from Fannie Mae and Freddie Mac. Those agencies are required to pay a portion of the profits they’ve earned on assets since the financial crisis to the Treasury, and those payments are expected to be made before the end of the year. X-Factors • Retirements and Term Limits • Scandals and Distractions • Campaign Season: Mid-Term Elections November 2014