Charity Accounting & Resource Maximisation

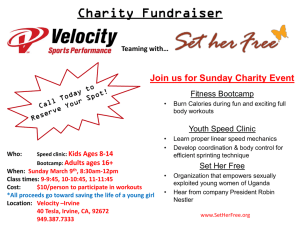

advertisement

Charity Accounting & Resource Maximisation Presentation by Robin Middleton Agenda • Introduction to Charity Commission Requirements for Charities – Below £25,000 – Between £25,001 and £500,000 – Difference between and audit and independent examination • Guidance to good financial information and reporting • Ways to maximise resources in small organisations (pros & cons) of the following areas: – Outsourcing – Group purchasing – Collaboration or services 2 About Charity Business Our mission = To have the maximum positive impact on the charity sector, improving efficiency and effectiveness by reducing administration costs specifically in the area of the finance function. Formed in 1999 by Chief Executive, Mark Freeman Part owned by and work solely with the not for profit sector. Leading provider of outsourced financial back office services 192 clients – 30% of which are small charities 34 staff of which 30 are dedicated to client servicing Streamline processes to improve efficient and ensure resource maximisation Save Clients 40 – 80% on finance costs Saved £10 million over past 11 years 3 Our Services Consultancy Efficiency & effective process reviews Shared Services Strategic financial planning Business planning Full cost recovery Collaborative Services Payroll Purchase Ledger Sales Ledger Debtor Management Treasury Management Credit Card & Debit Card processing Management accounts Direct Debits Annual accounts Feasibility studies Sharing experience through market seminars ACEVO / EPC / A4A / NCVO 4 Commercial in Confidence Transition Management Education & Training Investment Advisory Investment Manager Reviews Performance monitoring and reporting Reserves and Investment policy reviews Tendering Investments Meeting the Charity’s financial aims CASS Business School – guest lecture on Financial Management and Outsourcing Client Views Client Survey 100% of the respondents indicated that we meet or exceed their requirements : Partnership approach / personal touch Individuals that are extremely efficient and deliver quickly and reliably Staff are positive, pleasant and responsive Excellent account managers Payroll is excellent, and queries are raised from our contact if something looks unusual Why Charity Business Specialists in the unique requirements of Charity and Not-for-Profit finance Transparency in all we do Giving back to the sector through knowledge sharing Shared Service efficiencies – Significant cost reduction Focused on supporting our clients to achieve their charitable objectives Owned by the sector & Working for the sector Wholly UK based service teams – accessible / responsive / pro-active 5 Commercial in Confidence Current Pressures on Charities • The triple whammy that has hit: – Recession – 3 years of the belts being tight – Government Grants cut – 5 years to recovery – Trust Funding reduced due to the equity and bond markets being impacted by the global recession • Pressure to merge or work collaboratively • Tough decisions needing to be made in short order Reporting Requirements • All charities must prepare accounts and make them available on request. • The framework for accounting by charities sets out different requirements for different sizes and types of charity. To understand how it applies to your charity, you need to check: – whether or not your charity is also a company; – its income for the current financial year; – the value of its assets; and – whether or not it is required to be registered as a charity. Reporting Requirements Continued • You should then establish: – what type of accounts must be prepared; – what information is needed in the Trustees’ Annual Report; – whether the accounts need an independent examination, or audit; and – what information must be sent to the Charity Commission. Levels of Reporting Revenue Part A – Charity Info Trustee Accts & Report Report’g Financial Standard of Info Info Serious Return Incidents < £10k J £10k – £25k J J £25k - £500k J J J £500k - £1m J J J J >£1m J J J J 9 Min Opinion IE IE IE Audit J Audit Audit vs Independent Examination Audit Independent Examination • Higher level of assurance provided • Auditor has to be registered with the ICAEW • Regulated in how they undertake the work • Undertake more checks and work to provide assurance • Costs more • Provides an external check on the accounts • Can be carried out by any person with the relevant ability and experience • Is a less onerous form of scrutiny • Provides less • Is only required to confirm that no evidence has been found that suggests certain things have not been done by the charity. • Costs less than an audit 10 What goes into the Annual Report? • Reference and administrative details of the charity, its trustees and advisers • Structure, governance and management • Financial Review • Public Benefit Statement • Objectives and Activities • Achievements and Performance • Plans for Future Periods Financial Review • Reserves policy • Investment policy • Risk statement • Analysis of incoming and outgoing resources for the year • Future financial plans Public Benefit Test • 2 stage test • First stage is that your objects are charitable – one of 13 criteria set by the Charity Commission in the 2006 Act • Second stage is that you are operating for the public benefit • What does this all mean to you and your organisation…. The Role of the Treasurer “The Treasurer will ensure that proper accounts are kept, and help set financial and investment policies” Charity Commission What support should the Treasurer be giving the Director/CEO and the finance team? What should he/she expect from them in terms of reports/information. Sample Internal Reports Management reports to the board of trustees should be clear, easy to understand, accurate and useful. We would suggest using a combination of narrative, graph and numbers. • Summary of the period • Quarterly and Monthly Statements • Comparison to budget • Balance Sheet • Cash flow Statement • Project Breakdown • Notes of any unusual transactions Good Practice in Budgeting • Forgotten costs Many a failed project is based on an under-costed budget. Here are some of the most often overlooked costs: – Staff related costs (e.g. recruitment costs, training, benefits and statutory payments) – Start-up costs (e.g. publicity) – Overhead or core costs (e.g. rent, insurance, utilities) – Vehicle running costs – Equipment maintenance (e.g. for photocopiers and computers) – Governance costs (e.g. board meetings, AGM) – Audit fees Cost Control & Assessment Understand the major costs of the charity including salaries and process of increases, recruitment and related staff costs; Look to simplifying the expenditure streams suppliers, cycles of payments; - Reduce numbers of For one-off expenditure understanding how to best ring fence them and how they will be cut at the end of the project; Project budgeting for areas of new expenditure; Understand where you are making an investment and how this is going to be funded; and Understand long term commitments. Cash Flow Management Needs to be detailed not summary; Needs to take account of cyclical factors; Needs to be understood by management - especially the implications of it; Needs to be conservative; and Should not take account of positive items that will improve the bottom line when there are a number of unknowns. Resource management • In public companies finance is based on the assumption of maximising the market value of the company • In the not-for-profit sector the aim is the optimisation of resources to ensure the organisation is delivering as effectively as possible. This means focusing on: – Smoothly financing current operations by making the most efficient use of current and liquid funds – Maximising available and obtaining resources by enhancing the total return on the invested resources – Economising on the use of resources (reducing waste) – Channelling resources to facilitate priority activities Ways of maximising resources • Competitive pricing for all purchases • Assessing the cost of the service being provided to the outcomes and deciding when to stop (80/20 rule) • Benchmarking costs of running functions or processes against peers and third parties • Outsourcing services to a third party 20 Why Outsource to a Third party • Transfer of risk • Cost assurance • Immediate savings or better information for decision making • Partner to assist you in decline and in growth • Provide insight into what others are doing to solve issues and problems 21 Checklist for Outsourcing – Part 1 1. Reason for outsourcing 2. What to outsource 3. Where to outsource (remember the implications this might have on 1 and 2 above) 1. Type of service delivery model 4. Have you secured agreed commitment to the decision making process and timeframes involved 5. Unanimous commitment to proceed if “Why” and “What” are achieved If “NO” at 5 then you are not ready - do not proceed without agreed commitment, if “YES” then continue 6. How to outsource 22 1. Have you defined the why and what 2. Have you defined the decision process and timeframe 3. Is your current finance process and cost understood and defined 4. What is your preferred fee approach Checklist for Outsourcing – Part 2 7. Choosing the right partner 1. Right chemistry 2. Right quality 3. Candid and open/transparent 4. Understand the sector and the pressures it is facing 5. Can offer more at a later stage 6. Understand TUPE (staff transfer and employment) implications 7. Can assist with TUPE 8. Has a dedicated implementation team 8. Implementation considerations 1. TUPE considerations dealt with or there is a process to deal with them 2. Partner has a defined process of implementation 3. Communication plans are understood 4. Responsibilities understood 23 Summary • Financial reporting requirements are becoming more important with the current economic climate • Transparency in what you do and how you set this out is more important than ever • Decisions can only be made by having good and timely information • Maximising resources is critical for Trustees to be considering all the time but even more so than now as questions are being asked and you need to be about to respond to them 24 Thank You Charity Business Suite 37- 40 Cherry Orchard North Kembrey Park Swindon SN2 8UH Email: robin.middleton@charitybusiness.com Website: www.charitybusiness.com Phone: 01793 554204 General Enquiries: marketing@charitybusiness.com Copyright Charity Business 2011 25